Avalanche (AVAX) price is expected to remain consolidated owing to the lack of substantial growth expected from the altcoin. The currency holders also exhibit a selling sentiment since short-term investors dominate the supply.

Avalanche Investors Wants to Sell

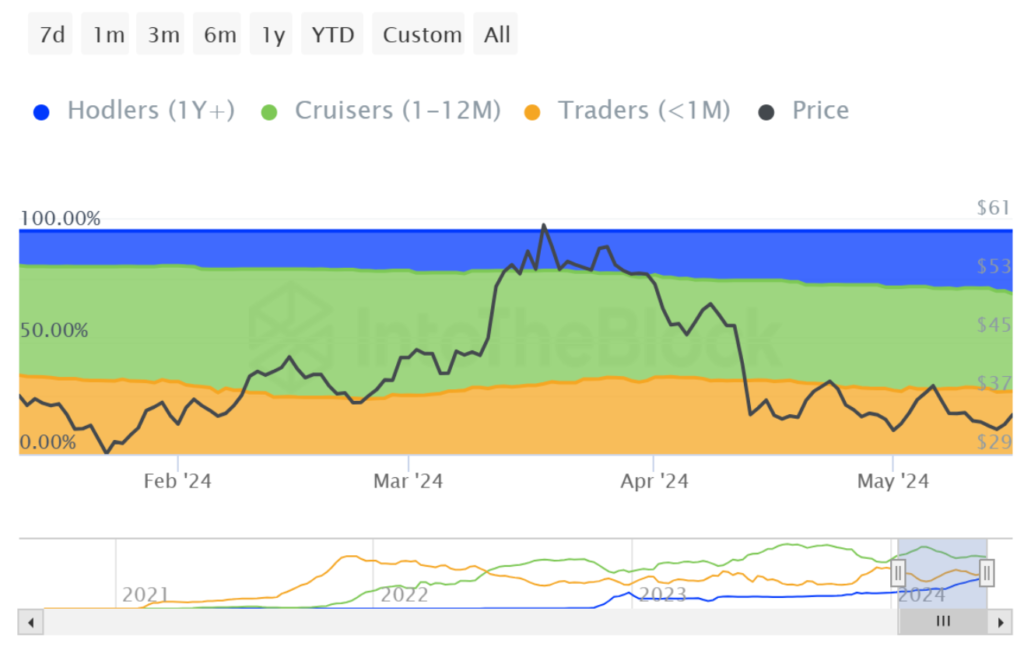

Avalanche’s price could soon observe the impact of investors’ behavior; the supply is dominated by short-term holders known to hold their supply for one month or less.

This makes their holdings susceptible to selling. In the case of AVAX, nearly 28% of all circulating AVAX is in their hands. Forty percent of the coin is still held by mid-term investors who hold their assets for over a month and less than a year. However, 28% still makes up for over 107 million AVAX, making these investors a major threat to Avalanche’s price.

Secondly, Avalanche’s price will face significant resistance owing to a massive demand barrier. According to the Global In/Out of the Money indicator (GIOM), about 12.47 million AVAX await profits. This supply was bought at an average price of $38, making it worth over $473 million.

This would require strong bullish cues, as AVAX would have to push to $42 to ascertain absolute and complete profits. However, considering the market conditions, this may not happen. As a result, Avalanche’s price will fall back down.

AVAX Price Prediction: Consolidation Ahead

Avalanche’s price, $37.5, has rallied 15% in the past three days, pulling it up from $31. The latter marked the lower limit of the consolidation range AVAX has been stuck in for a month. The upper limit stands at $39.

The altcoin has attempted to break out of this consolidation nearly three times in the last month but has failed each time. Even during this week’s rally, AVAX only made it halfway. Furthermore, the cryptocurrency has been unable to invalidate the death cross that occurred over six weeks ago.

The bearish influence will continue until the 50-day Exponential Moving Average (EMA) crosses over the 200-day EMA. As a result, Avalanche’s price will likely remain consolidated until the end of the month.

However, the bullish thesis could be invalidated if the winds shift and AVAX investors opt not to sell but push forward instead. AVAX would need to break out of the consolidation and flip $39 into support.