Introduction

Bitcoin isn’t having the easiest week. After teasing a high of $108,000, the world’s favorite crypto slipped and slid its way down to $102,000, scaring off some overconfident long traders in the process. But this latest stumble might not be the meltdown it looks like. In fact, it could be the setup for something much bigger, and more bullish.

Longs Get Liquidated, But Bears Shouldn’t Celebrate Yet

Over the past seven days, Bitcoin’s long liquidation dominance shot up to 10%, according to CryptoQuant’s Axel Adler. What does that mean in plain English? Basically, a lot of traders who bet on Bitcoin going up got wrecked. More specifically, 2,200 BTC worth of long positions were wiped out in one day. Ouch.

In the last week, the long liquidation dominance metric has grown from 0% to +10%, while BTC has held within a narrow range of $103K–$106K without significant price corrections. The increase in long position liquidation share without a sharp price crash indicates sustained buyer… pic.twitter.com/dFra1pLV1s

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) June 21, 2025

Normally, such a spike would hint at a deep price crash. But interestingly, BTC stayed mostly within a tight range between $103K and $106K. That’s a hint that buyers aren’t completely giving up just yet.

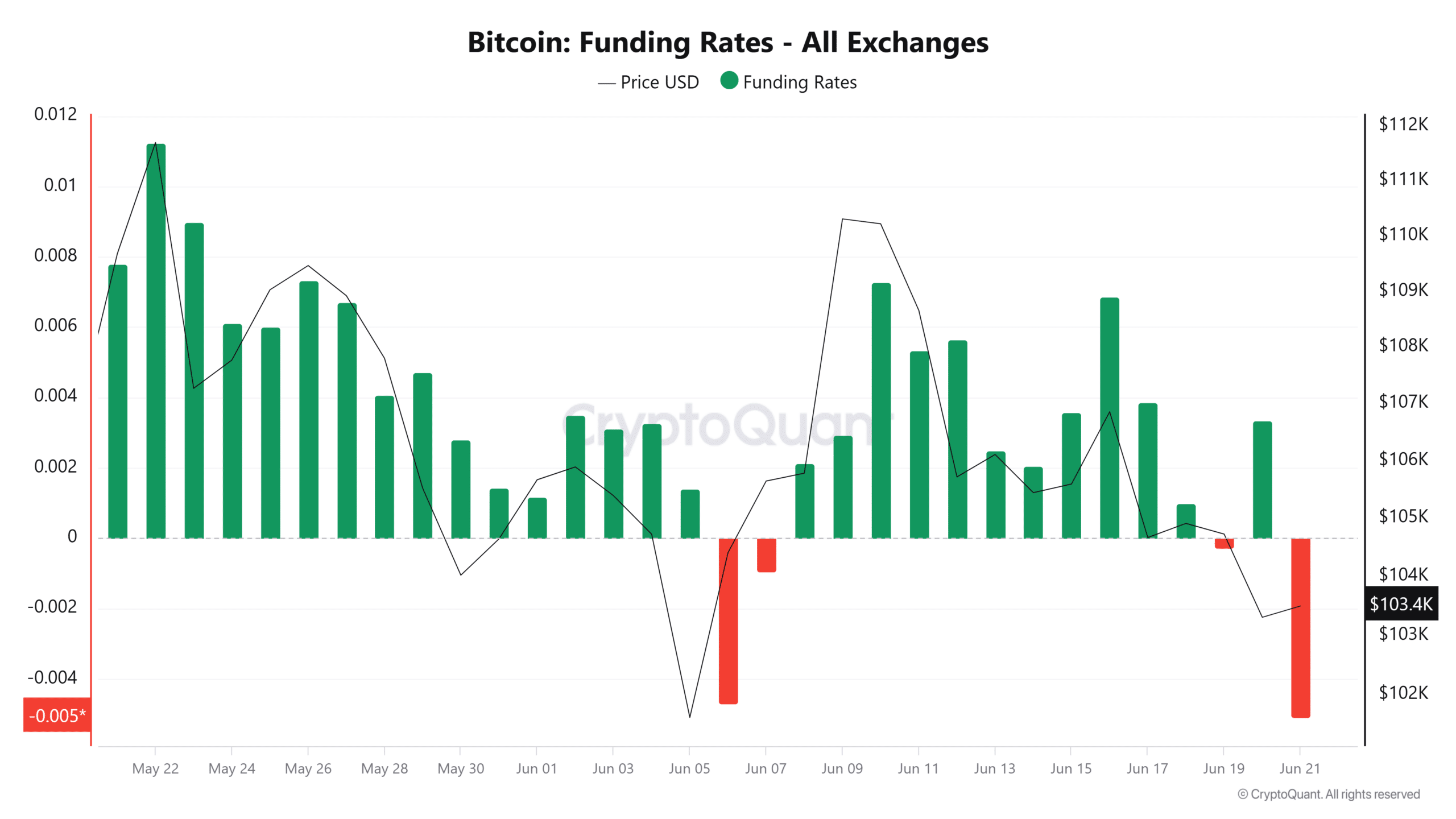

Bitcoin Funding Rates Flip Bearish, But That’s Not the Whole Story

When long positions start vanishing, it opens the door for shorts to take over, and that’s exactly what happened. Negative funding rates have returned, meaning more traders are piling in expecting BTC to fall. But before you join the bear parade, take a moment. This type of lopsided sentiment has a habit of flipping violently.

Why? Because too many people betting on one outcome often sets the stage for the opposite. And this time, the pieces are falling into place for a potential short squeeze.

Bitcoin Buyers Tiptoe Back In, Is $104.5K the Next Target?

While Bitcoin bounced between fear and confusion, some savvy bulls have quietly started creeping back in. One key metric, the Taker Buy/Sell Ratio, has turned positive, signaling rising demand for Bitcoin even as shorts increase. That rising short interest is like kindling for a fire. If BTC turns upward, those same short sellers could get squeezed into buying back at higher prices.

If that happens, Bitcoin could break above $104,500. It’s not exactly moon levels, but it’s enough to shift market mood and force the bears to reconsider their life choices.

So… Are We Headed Up or Down From Here?

Right now, BTC sits near $103,763, seemingly bored and indecisive. But that calm could be deceptive. If long liquidations rise another 5–7%, we could be looking at a major reset of bearish positions. That might sound painful, but it’s often what sparks a strong reversal.

Of course, it’s not all sunshine and up-only dreams. If sellers regain the upper hand, Bitcoin might revisit $102K, or worse. But as it stands, momentum seems to be quietly building in the bulls’ corner.

Conclusion: What’s Next For Bitcoin?

Bitcoin’s recent stumble might look like weakness on the surface, but under the hood, things are brewing. With short interest growing, buyer demand sneaking in, and liquidation data flashing contrarian signals, we might be on the verge of a dramatic flip. Whether you’re team bull or team bear, one thing’s for sure: it’s about to get interesting.