Bitcoin [BTC] recently slid 12.8% from its all-time high, but before the bears start celebrating, context matters. Pullbacks in the range of –10% to –18% are textbook bull market behavior. They usually represent consolidation phases rather than collapse, while true corrections often stretch closer to –30%.

With BTC trading around $110K, this looks more like a breather than a breakdown. Think of it as Bitcoin pausing at a water station during a marathon, still on track, just refueling.

The current BTC drawdown is −12.8% from the ATH.

In this bull cycle, pullbacks after local peaks have mostly clustered in the −10% to −18% range, while deeper corrections have typically extended to −20% to −30%. At −12.8%, we’re closer to the moderate zone, consistent… pic.twitter.com/Z2deM91HRp

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 2, 2025

Bitcoin charts hint at higher ground

On the daily chart, Bitcoin continues to hug the lower edge of its ascending channel, with a notable bounce from the $107K zone. This keeps the structure intact, with upside projections pointing first to $123K, and possibly $150K if Fibonacci extensions play out.

Momentum is improving too. The Relative Strength Index (RSI) sits at 42.8, weak, but far from exhausted. That gives bulls space to build pressure. Of course, a breakdown below support could drag BTC toward $93K, but for now, the bias remains tilted upward.

NVT ratio says “don’t panic”

On-chain data brings more reassurance. The Network Value to Transaction (NVT) ratio slipped 17.35% to 32.6, suggesting Bitcoin’s valuation is syncing more cleanly with actual network activity. Historically, declining NVT readings have aligned with healthier, sustainable phases in bull cycles.

It’s a promising signal, but the caveat is clear: if transaction volumes dry up, this positive indicator could quickly lose relevance.

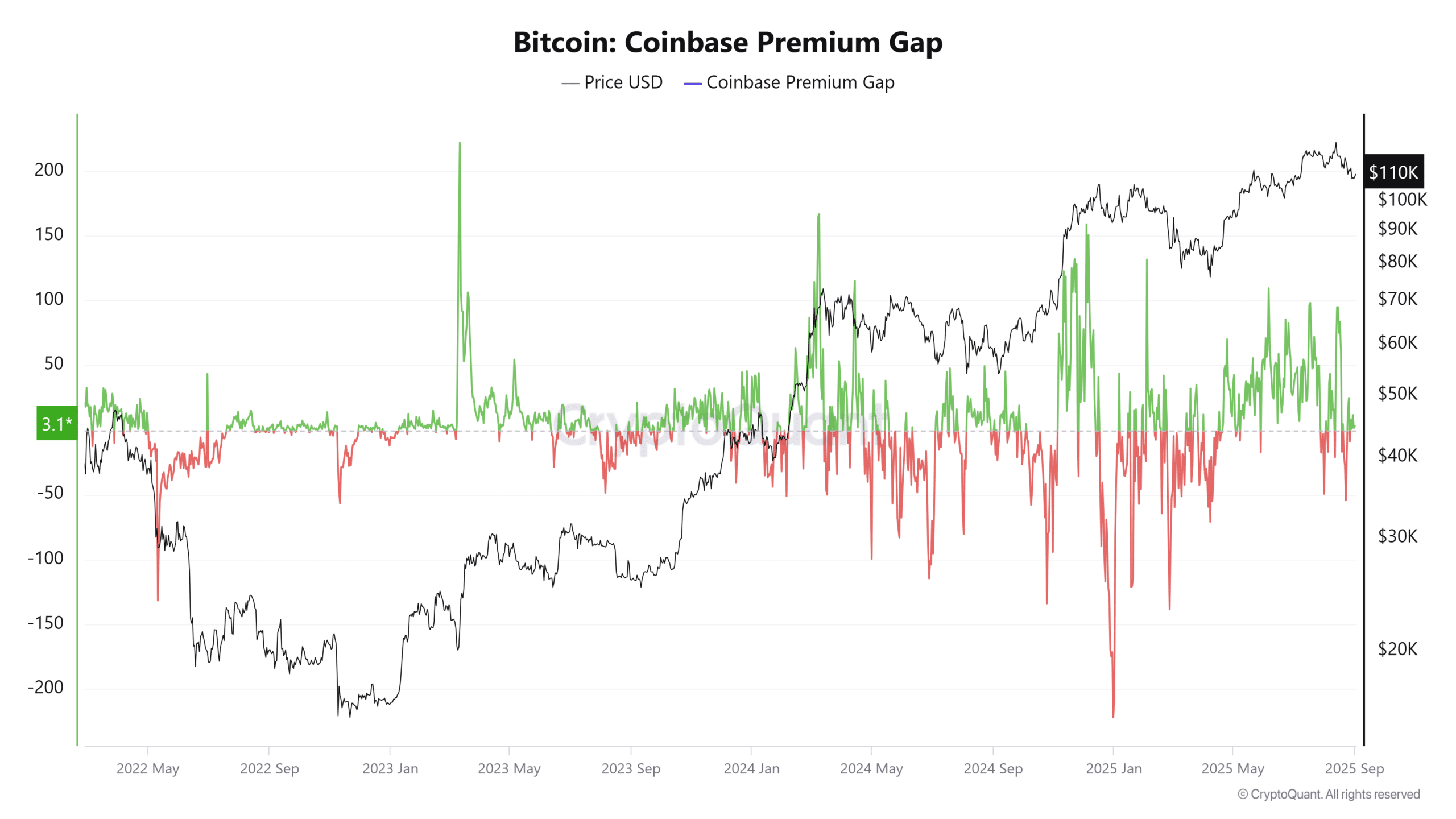

U.S. appetite grows with Coinbase Premium spike

One of the more telling metrics is the Coinbase Premium Gap, which shot up 128% to 2.56. In plain English, American traders are paying more than their global counterparts for BTC. Premiums like this typically hint at institutional accumulation and have historically preceded sustained rallies.

But, as with all signals, this knife cuts both ways. If the premium fades, it could mark waning demand stateside.

Bitcoin Shorts take a beating

Liquidation data tilts the scale in the bulls’ favor. Over $13.3 million in shorts were wiped out versus just $379K in longs. Most of that pain came from Bybit, Binance, and Hyperliquid, showing bearish traders got caught leaning too hard against Bitcoin’s rebound.

When shorts are forced to cover, rallies often accelerate as their exits fuel upward momentum. For now, the imbalance suggests further upside, but overleveraged longs should tread carefully.

The bigger picture: resilience, not weakness

Pull everything together, the 12.8% drawdown, the intact ascending channel, the healthier NVT ratio, U.S. buying premiums, and the squeeze on shorts, and the story is clear: Bitcoin isn’t breaking, it’s consolidating.

The next leg higher, whether to $123K or $150K, is still firmly on the table. Until proven otherwise, this dip looks like strength disguised as weakness.