Bitcoin and Ethereum ETFs Rebound as Institutional Confidence Returns

After several days of heavy outflows, Bitcoin and Ethereum exchange-traded funds have shown signs of recovery, attracting $339 million in new inflows. The renewed activity suggests that institutional investors are regaining confidence following a volatile week across the digital asset market.

According to data from SoSoValue, Bitcoin ETFs recorded $102.6 million in net inflows on October 14. Fidelity’s FBTC led the charge with about $133 million, followed by Bitwise’s BITB with $8 million and ARK & 21Shares’ ARKB with $6.8 million. Offsetting these gains were withdrawals totaling $44.85 million from BlackRock’s IBIT and Valkyrie’s BRRR.

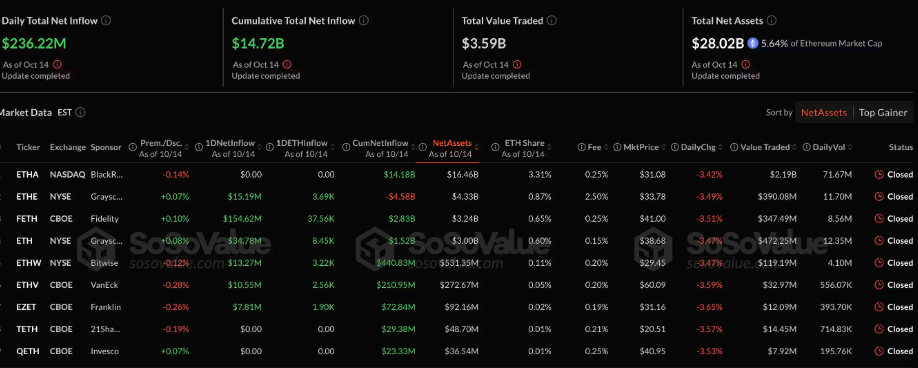

Meanwhile, Ethereum ETFs saw an even stronger rebound, adding $236.2 million in total inflows. Fidelity’s FETH attracted the majority with $154.6 million, while Grayscale’s ETHE brought in $50 million. Other funds, including Bitwise’s ETHW and VanEck’s ETHV, reported smaller but steady gains.

Market Rebounds After Major Outflows

This turnaround follows a turbulent period for crypto ETFs earlier in the week. On October 13, Bitcoin-tracking funds recorded $326.5 million in outflows, while Ethereum ETFs lost $428.5 million, adding to earlier selloffs. The renewed inflows now bring both BTC and ETH funds back into positive territory for the month, highlighting a potential shift in sentiment among institutional investors.

Bitcoin’s price has also shown signs of stability, climbing 0.34% in the past 24 hours to trade near $112,431, recovering from lows around $105,000. Although BTC remains below its previous peak of $125,000, analysts see resistance in the $115,000–$120,000 range as a key area to watch.

Ethereum has mirrored this recovery, rising more than 20% from its post-crash low to trade around $4,116. After briefly dipping to $3,435, ETH quickly regained key support levels, with $4,250 now seen as the next resistance point.

Sentiment Slowly Turns Positive

Market sentiment appears to be improving, though many traders remain cautious after the recent volatility. The Crypto Fear and Greed Index has moved closer to neutral levels, suggesting a gradual return of optimism. Analysts note that sustained ETF inflows, especially from large institutions, could mark the start of renewed stability in the broader crypto market.

With total crypto ETF assets nearing the $1 trillion milestone, the sector’s recovery reflects both a recalibration of risk appetite and a broader belief in the long-term potential of Bitcoin and Ethereum as institutional-grade assets.