Introduction

Bitcoin is once again capturing market attention, with key metrics signaling a potential move higher. As of April 29, BTC’s Realized Capitalization reached $882.2 billion—an encouraging sign that capital is flowing into the network with conviction. While the price slightly dipped to $94,664, sentiment remains broadly positive, underpinned by technical and social indicators that favor the bulls.

More than just price, the broader engagement around Bitcoin is also gaining steam. Social dominance is on the rise, and other data points hint that BTC might still be trading below its fair value.

Social Metrics Suggest the Crowd Is Warming Up

A notable development in the current cycle is the increase in Bitcoin-related chatter. Social Dominance reached 25.81%, reflecting a surge in online mentions and engagement. When interest in Bitcoin spikes across platforms, it’s often followed by inflows from retail and institutional investors alike.

The recent uptick in Social Volume confirms that conversations around Bitcoin are heating up. Historically, this type of attention can precede price rallies as fresh capital pours in from both seasoned traders and newcomers responding to market momentum.

On-Chain Signals Reinforce Bullish Bias For Bitcoin

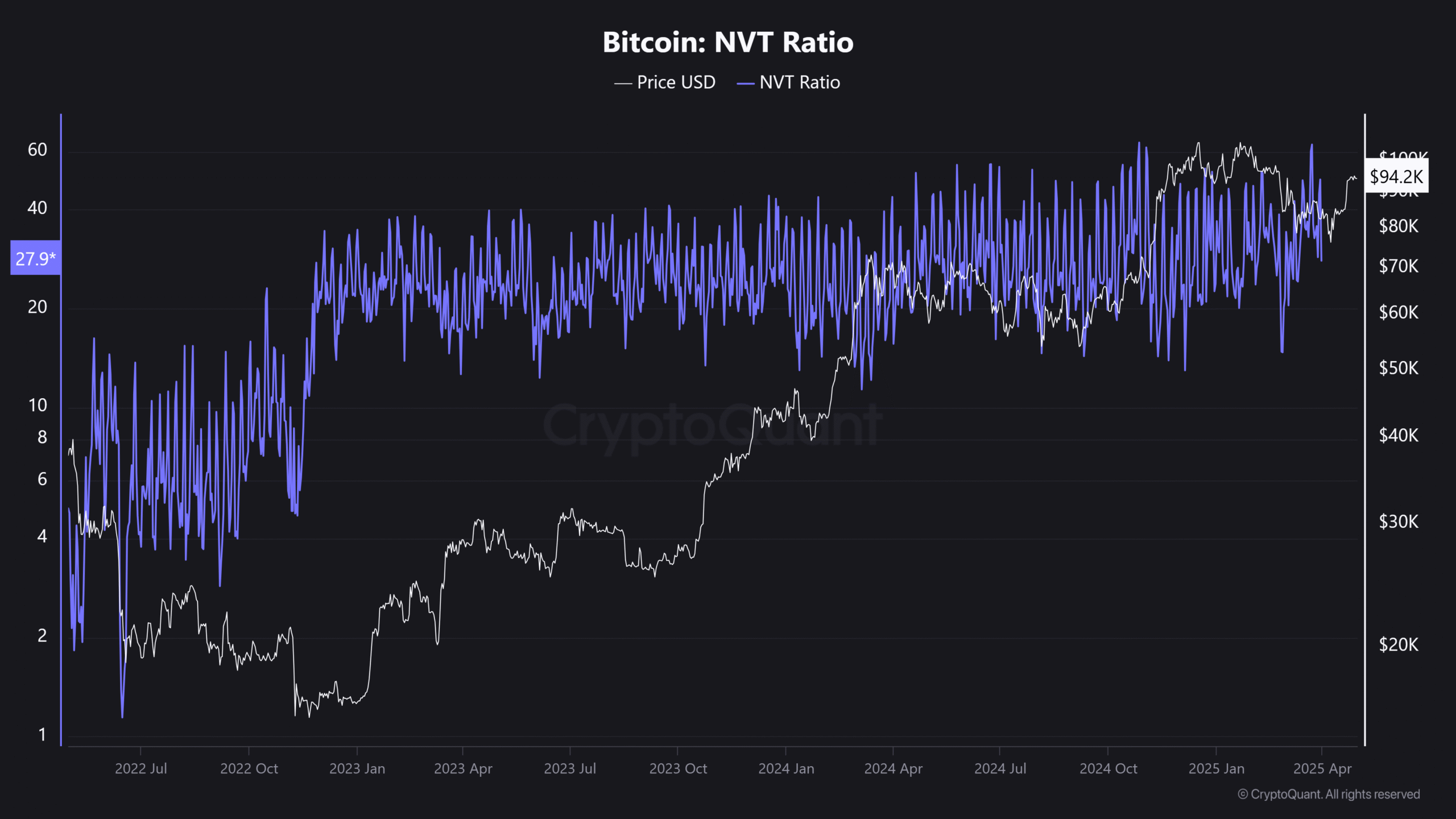

Looking beyond the hype, several on-chain indicators paint a compelling picture. Bitcoin’s NVT (Network Value to Transactions) ratio currently sits at 460.14. This figure suggests BTC may be undervalued relative to the volume of transactions being processed on the network. When transaction activity is high and prices lag behind, it often indicates room for upward movement.

Meanwhile, Price-DAA (Daily Active Addresses) Divergence remains steep at -217.59%. This imbalance shows that price increases have outpaced user activity, which can seem worrying at first—but historically, this divergence has often aligned with bullish continuation trends. Active wallet growth continues to be healthy, supporting this thesis.

Bitcoin Liquidation Zones Hint at What’s Next

While the long-term trend looks favorable, short-term volatility can’t be ignored. Binance’s BTC/USDT Liquidation Heatmap shows significant long liquidations clustered around the $94K mark. This could pressure the market in the short term if bulls overextend.

However, if short positions begin to unwind instead, we could see a sudden upside burst. Traders should watch for shifts in the liquidation pattern as potential indicators of the next big move.

Technical Indicators Align With Bitcoin Bullish Continuation

Bitcoin now sits near two crucial resistance levels—$95,709 and $98,666. These barriers, if broken, could open the door to the next phase of upward momentum. BTC is also pressing against its upper Bollinger Band, a technical position that often leads to a breakout when pressure builds.

Conclusion: Momentum and Fundamentals Align for a Push Higher

While volatility and liquidations may challenge Bitcoin’s short-term stability, all signs point to strong undercurrents of growth. With Realized Cap hitting new highs and NVT suggesting BTC remains undervalued, the market appears poised for continuation.

If Bitcoin manages to breach $95,709 convincingly, $98,666 could be the next checkpoint. For now, the bullish case remains intact—driven by solid metrics, strong sentiment, and renewed optimism across the board.