Bitcoin [BTC] has charged past its all-time highs, hitting a jaw-dropping $118,000, with cheers echoing across crypto Twitter. That momentum didn’t appear out of thin air, Binance’s Net Taker Volume just crossed $200 million, marking the most aggressive buyer activity since February 2025.

Now, here’s the kicker: these spikes in taker volume often ignite fresh rallies. But history also tells us they can signal the end of the party just as quickly. Is this the start of another leg up, or are we dancing dangerously close to a cliff?

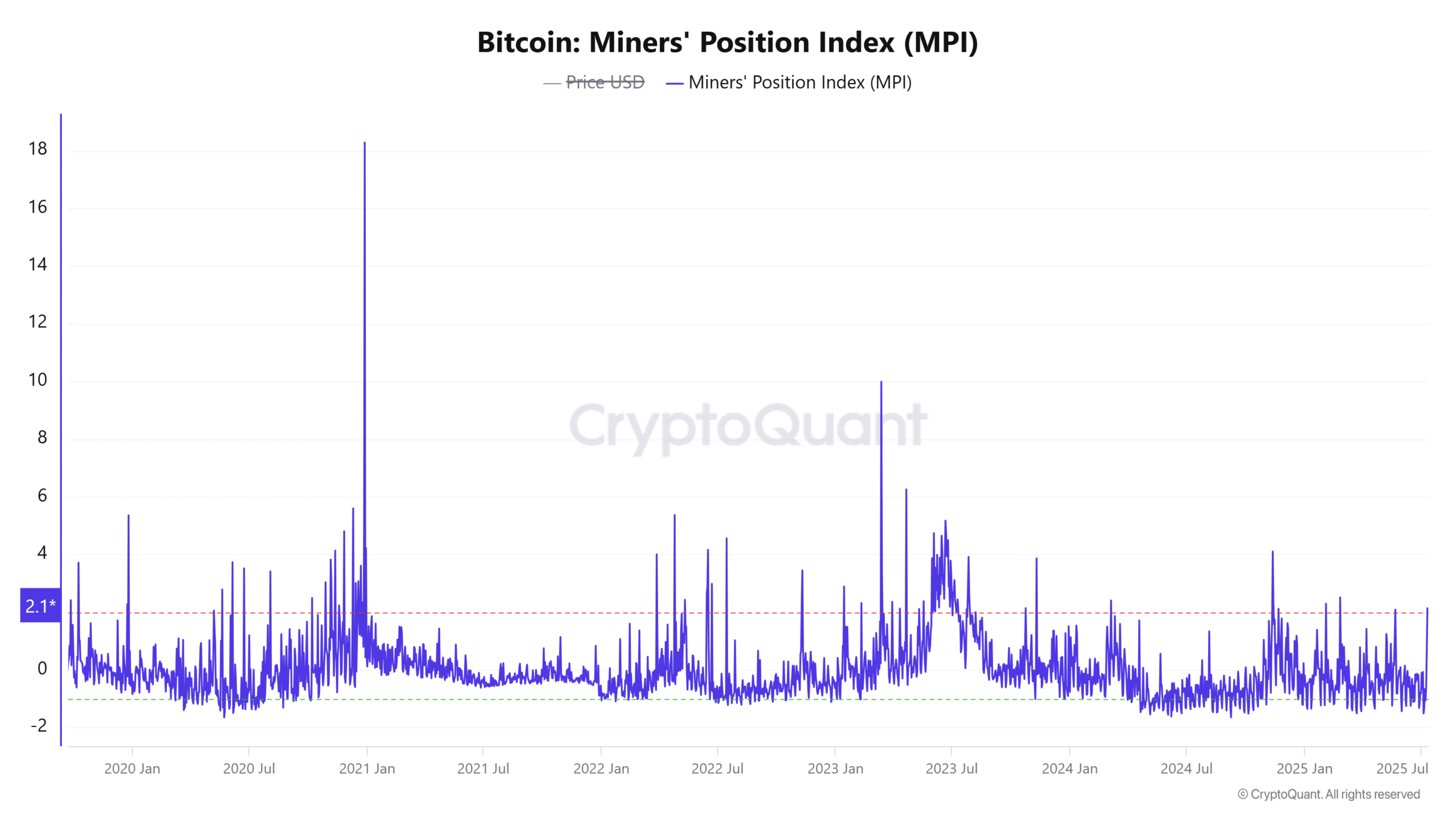

Bitcoin Miners Are Warming Up Their Sell Buttons

As Bitcoin pumped, the Miners’ Position Index (MPI) quietly crept up to 2.13, representing a 153% spike in miner activity. Translation? Miners are now moving more BTC out of their wallets, likely to cash in while the price is sizzling.

This doesn’t automatically mean the top is in, but seasoned traders know this is usually the phase where miners begin securing profits. If the trend accelerates, their selling could pour cold water on BTC’s recent fireworks.

Spot Demand Strong, But Exchange Outflows Stay Muted

Despite BTC’s pump, exchange netflows tell a more cautious tale. On July 12th, Bitcoin’s netflow was just – $9.22 million, negative, yes, but not dramatically so.

This shows us that while people are still withdrawing BTC (which is generally bullish), it’s not happening at the “fear-of-missing-out” scale seen in earlier bull phases. Could this be confidence? Maybe. Could it be hesitation? Also maybe.

Short Squeeze Showdown at $118K For Bitcoin?

The Liquidation Map is looking juicy. There’s a heavy cluster of high-leverage short positions above the $118,000 mark, think 50x to 100x bets.

At the time of writing, BTC was hovering near $117,809. If the bulls push just a little more, they could trigger a chain reaction of liquidations, sending bears scrambling and fueling a rapid price surge through a classic short squeeze.

The Final Word: Rally or Rug Pull?

Bitcoin’s latest run is supported by real network activity, confirmed by a 31% drop in the NVT Ratio, a signal that transactions are booming relative to BTC’s market cap. That’s a green flag for organic strength.

Still, with miners possibly prepping to sell, cautious exchange flows, and a minefield of short positions above, we’re approaching a tug-of-war moment. Will BTC crush resistance and zoom into uncharted territory? Or will it meet the usual fate of euphoric rallies: a quick dip as profits are locked in?

For now, the charts look bullish, but traders would be wise to keep one hand on the throttle and one on the brakes. The next move could come fast, and it might not wait for confirmation.Bitcoin’s rally ignites optimism, but miners and leveraged shorts could pull the rug.