The past weekend has been quite volatile for Bitcoin (BTC), with the coin hitting $68,641 on July 21 amid a number of macroeconomic news. Despite Bitcoin’s pullback to $67,218, on-chain analysis suggests that BTC could retest a major barrier that the price has avoided for nearly two months.

Bitcoin is getting ready to go

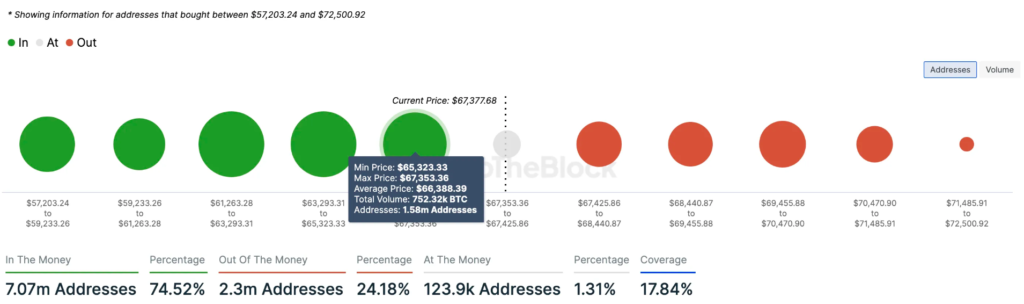

Bitcoin’s performance over the past seven days has improved significantly compared to the past month, as indicated by the on-chain In/Out of Money Around Price (IOMAP).

The metric groups current holders of an asset according to their entry levels (buy prices) relative to the current price. It identifies those who are currently in profit, in the breakeven zone, and those who are losing money. The resulting groups help identify significant buy zones that are expected to act as support or resistance levels.

The more addresses are in a given price range, the stronger the level. A large number of profitable addresses in the “in the money” position shows that Bitcoin is receiving support and the price may rise. The opposite situation indicates that this is resistance and BTC may fall in price.

According to IntoTheBlock, 1.58 million addresses purchased BTC between $65,323 and $67,353. This number is much higher than the number of addresses that accumulated between $69,425 and $72,500.

Thus, Bitcoin support is around $66,388. If it holds, the price may overcome the resistance of $69,455.

Another factor that could push the price up is the upcoming BTC conference, which will be held from July 25 to 27. The fact is that the event is expected to feature US presidential candidate Donald Trump.

The war between Biden and Trump

Yesterday, July 21, the elections took an interesting turn. Incumbent President Joe Biden withdrew his candidacy, refusing to participate in the election race. In response to the news, Bitcoin fell sharply below $67,000. However, according to Santiment, the choice of Kamala Harris as Biden’s replacement triggered a price rebound. As a result, the coin again reached $68,400. In general, this was similar to the dynamics of BTC after the assassination attempt on Trump.

Donald Trump is an active supporter of the development of the crypto industry in the United States. If he wins the election, the politician promised to protect the rights of digital asset investors. He has repeatedly stated that he will ease Biden’s war on the industry. If he confirms his intentions again, the chances of Bitcoin accelerating to $70,000 may increase.

Bitcoin BTC Forecast: New Monthly High Is Getting Closer

Despite a small pullback, BTC is trading above key support levels. This indicates that there are still chances for growth. However, some indicators on the daily chart are giving mixed signals.

For example, the Money Flow Index (MFI) is currently at 79.52. A rise in the indicator indicates buying interest, while a fall indicates increased selling. Values below 20 indicate that the asset is oversold, while values above 80 indicate that it is overbought. In this case, the MFI indicates that Bitcoin has approached the overbought area. This may make it difficult to reach the $68,030 mark.

However, the Awesome Oscillator (AO) is showing positive values. This is a signal of increasing upward momentum. This suggests that Bitcoin may approach or exceed the $70,000 mark. If the current situation continues, the coin may overcome the $68,030 mark. The next target will be around $71,982.

However, Bitcoin also faces downside risks, especially with bankrupt exchange Mt. Gox seemingly ready to pay off its creditors, according to Spot On Chain. Once the payments start, BTC may have a hard time getting above $70,000. In that case, the next step could be a decline to $64,928.