Introduction

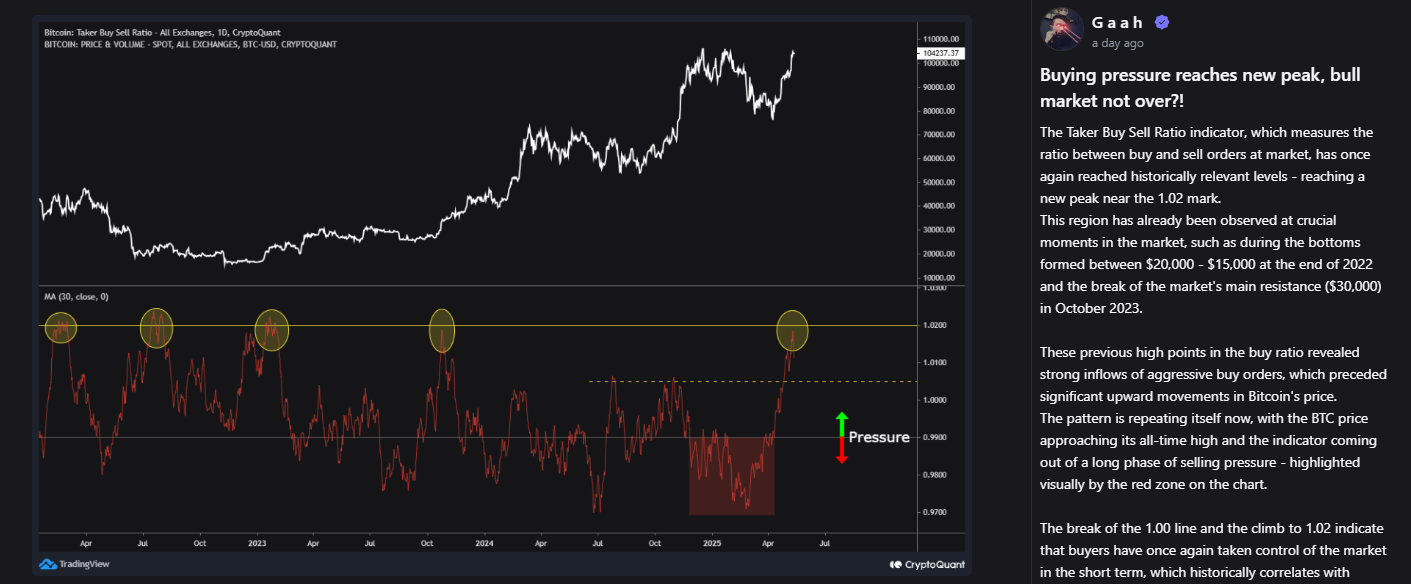

Bitcoin is looking spicy again, and no—it’s not just Twitter hype. The Taker Buy/Sell Ratio just popped off to 1.02, a level we’ve only seen before some of BTC’s biggest “hold-my-beer” breakouts. Translation: buyers are getting gutsy.

For those new to the party, when this ratio climbs above 1.0, it means people are slamming the buy button way harder than the sell. According to CryptoQuant, the last time we saw this level was before Bitcoin’s $30K explosion in late 2023—and before that, back when it rose from the ashes of $15K like a golden phoenix.

Right now, BTC is flirting with its previous highs, trading just above $103,800. And with the market mood going full FOMO, the question is obvious: is the next all-time high around the corner, or are we just getting teased?

The Big Fish Are Suspiciously Quiet

Let’s get into whale talk—because what the ocean giants do always makes waves. Wallets holding over 10,000 BTC? They’ve hit the pause button. According to Glassnode, their accumulation score is chilling around 0.5. Not bearish, not bullish—just… meh.

On the other hand, mid-tier whales (1,000–10,000 BTC) are still partying like it’s 2021. These folks are scooping up coins left and right with an accumulation score near 0.9. Even the mini-whales (think hedge funds, not Shamu) are still in the game. Retail traders, however, continue to offload—probably to pay rent or buy another memecoin.

So, while the mega-whales might be keeping their powder dry, the middle class of crypto is holding the line. For now.

Is Bitcoin Running Out of Breath Near the Finish Line?

Now for the “but”—because no rally comes without a little drama. Bitcoin’s been rejected at $105K more than once, and price action is starting to look… tired. The RSI is clocking in at 70.68, which is essentially your chart’s way of saying, “Overcooked!”

Yes, the MACD is still technically bullish (MACD line is above the signal line), but the momentum? It’s kind of doing that awkward sideways shuffle, not really dancing anymore.

BTC has been stuck in a tight range for a few sessions now, hinting that bulls might be losing steam—at least for the moment. And if it can’t break above that $105K ceiling soon, we might see a dip back to $100K or even a bit lower to catch a breath before charging up again.

Final Thoughts: A Bitcoin Breakout or Fake Out?

Bitcoin’s current setup is like a movie trailer for a sequel—big energy, a couple of familiar signs, and some serious suspense. The buy-side pressure is real, mid-tier whales are marching, and sentiment is heating up faster than a meme coin pump.

But the big wallets are on the sidelines, and technical indicators are starting to sweat. So if BTC doesn’t smash through $105K soon, we might be in for a pit stop before the next moon mission.

One thing’s clear: buckle up. Whether it’s liftoff or cooldown, this chart’s got popcorn-worthy moves ahead.