Bitcoin ETF Outflows Continue

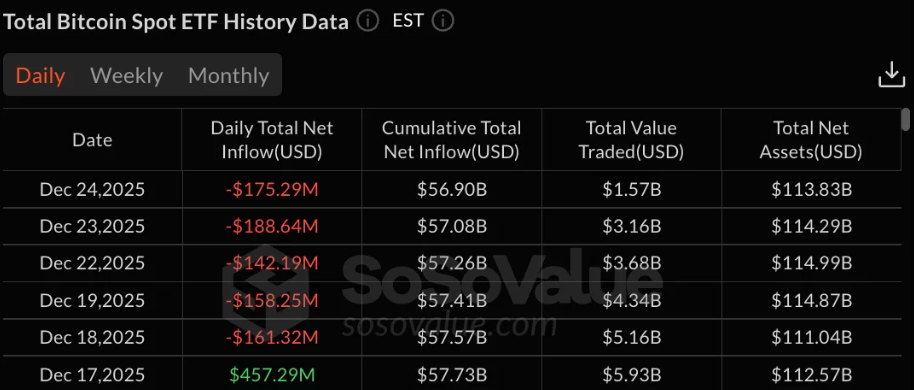

Spot Bitcoin exchange-traded funds posted another day of net redemptions on December 26, extending a five-session withdrawal streak as Bitcoin remained capped below key resistance levels. Net outflows for the day totaled about $83 million, bringing cumulative redemptions during the streak to more than $750 million.

Fidelity’s FBTC led withdrawals with approximately $74 million in net outflows. Grayscale’s GBTC followed with around $9 million in redemptions. Other spot Bitcoin ETFs recorded little to no flow activity during the session, while BlackRock’s IBIT figures were not updated at the time of reporting.

Total assets under management across U.S. spot Bitcoin ETFs slipped to roughly $114 billion. Although cumulative inflows since launch remain above $56 billion, the sustained outflows signal rising caution among institutional investors as Bitcoin struggles to hold higher price levels.

Price Weakness Pressures Institutional Products

Bitcoin continued trading below $88,000, failing to reclaim the $90,000 threshold that previously supported inflows into ETF products. The recent weakness has coincided with lower trading volumes and fading short-term momentum.

ETF turnover has dropped sharply from mid-December peaks, reflecting reduced participation from both institutional and retail market participants. Market analysts note that ETF flow patterns have become increasingly sensitive to price action near major resistance zones.

Ethereum ETFs Mirror Trend

Ethereum-based ETFs have shown similar behavior. ETH products recorded additional net redemptions in late December, reducing total assets under management to under $18 billion. The parallel movement suggests a broader cooling across major crypto-linked investment vehicles rather than asset-specific pressure.

What to Watch Next

Market participants are now monitoring whether Bitcoin can reclaim levels above $90,000 to restore confidence and attract fresh institutional inflows. Until stronger upward momentum returns, ETF activity is expected to remain volatile and closely tied to short-term price movements.