As recession fears pushed stock markets and cryptocurrencies to two-year lows last week, things are looking better this Juneteenth, as a federal holiday observes the end of slavery in the United States. Stock markets are closed today, which provides an extra day for cryptocurrencies to show bullish momentum and regain some of their prices. However, as the stock market opens on Tuesday, chances are the continuing decline will push crypto prices further down causing additional selloffs.

Bitcoin Price Hovers Above $20k

After bottoming out at $17.7k on June 18th, Bitcoin price managed a spectacular recovery back above the $20k levels, currently trading at $20.4k at writing. The inflation narrative continues as CPI numbers last week showed a substantial increase in inflation. UK CPI data is scheduled to release on Wednesday (June 22nd), which could push the market to further lows if it signals an increase in inflation.

The good news is, according to a report from glassnode, shared by Bitcoin Archive on Twitter, Bitcoin miners have stopped selling and started their accumulation phase, which could signal a potential trend reversal in the next couple of months:

💥JUST IN: #Bitcoin Miners have stopped selling

Accumulation has re-started.🙌 pic.twitter.com/5q13bQXUDt— Bitcoin Archive (@BTC_Archive) June 20, 2022

With the current prices, it’s no longer profitable for miners to sell their earnings, so miners have effectively turned into investors. This should help curb the immense selloff for Bitcoin.

Ethereum Price Bounces Above $1.1k

After dipping to a low of $906, the Ethereum price managed to bounce back above the $1k level, currently trading at $1.1k. As Ethereum continues to follow Bitcoin’s price movements, all eyes are on BTC when it comes to directing Ethereum’s price.

One factor that’s causing Ethereum’s significant volatility is the massive amount of liquidation that’s occurring to ETH traders.

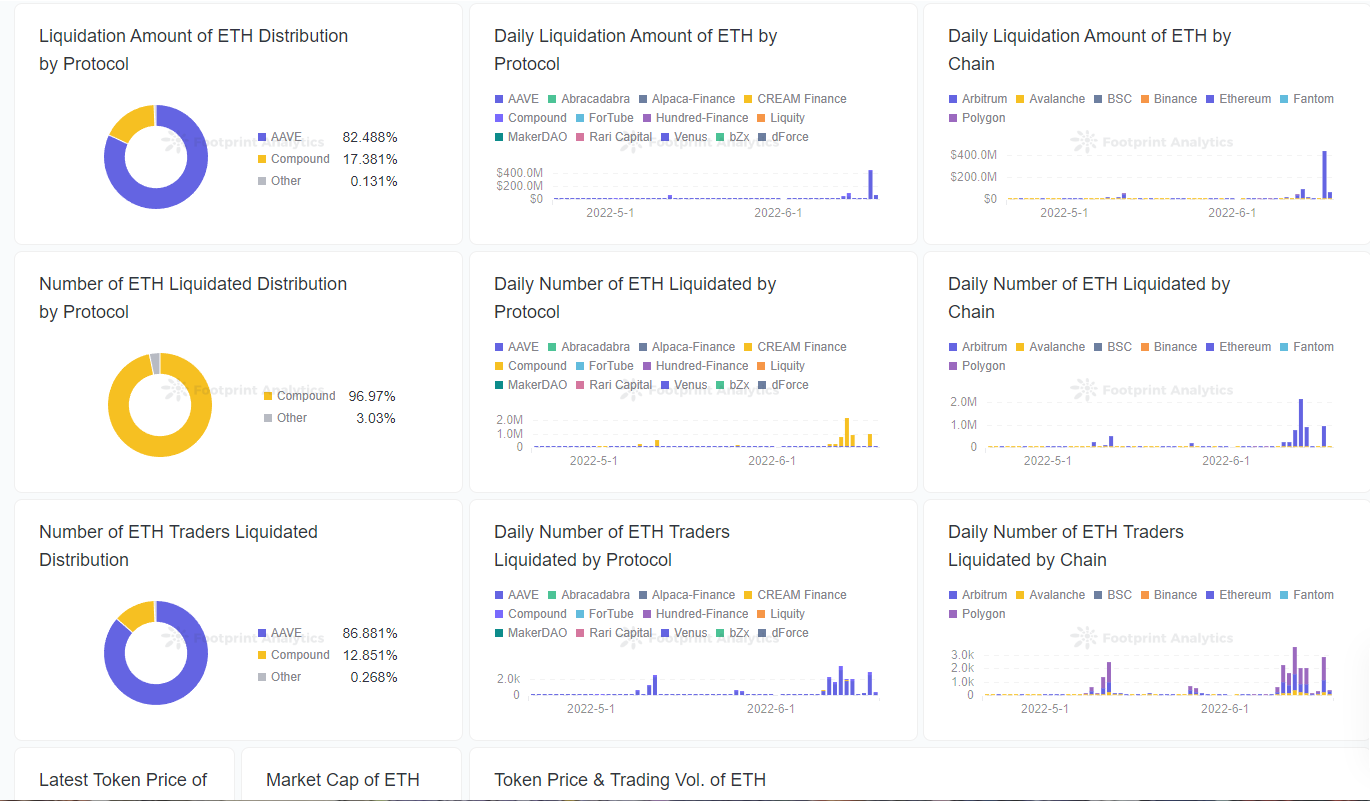

The leading protocol for liquidation when it comes to ETH is AAVE, followed by Compound. There have been over $400 million in liquidations this weekend, with over 1,700 traders liquidated on June 18th.

The good news is, that liquidation seemed to have slowed down which will provide the Ethereum price with a chance of recovery, assuming Bitcoin stays above the $20k level.

XRP and Solana Prices Remain Bullish

Today, XRP is up over 3.45% while Solana is up over 11.71%. Solana has been particularly resilient this week as it managed to gain over 35% in the past seven days.

One reason for Solana’s spectacular price action is the community’s vote to temporarily control the largest whale’s wallet to mitigate liquidation and selloff risks.

Governance proposal SLND2 has passed.

SLND1 has been invalidated and governance voting time has been increased from 6 hours to 1 day. pic.twitter.com/z0agJV9pOz

— Solend (@solendprotocol) June 20, 2022

Solend, a Solana-based protocol passed a proposal that will enable over $20 million in Solana to be sold over OTC rather than on exchanges, which will significantly curb bearish momentum for the markets.

The proposal was passed with over 99.8% voting Yes with over 1.4 million votes. Only 3,535 wallets voted No, comprising 0.2% of the total votes.

Selling such a massive number of tokens OTC will create much-needed breathing room for Solana markets to continue their recovery and bullish momentum amid the crypto selloffs.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any project.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: peshkov/123RF