Introduction

Bitcoin’s price changes based on how much money is flowing into the market. Two big factors that could help Bitcoin go up are stablecoins and Bitcoin ETFs. Stablecoins help bring more money into the crypto market, while Bitcoin ETFs allow large investors to buy Bitcoin easily. Recently, the stablecoin market has grown again, meaning more money is available for people to invest in BTC. At the same time, Bitcoin ETFs are buying more BTC, which shows that big investors still believe in BTC’s future.

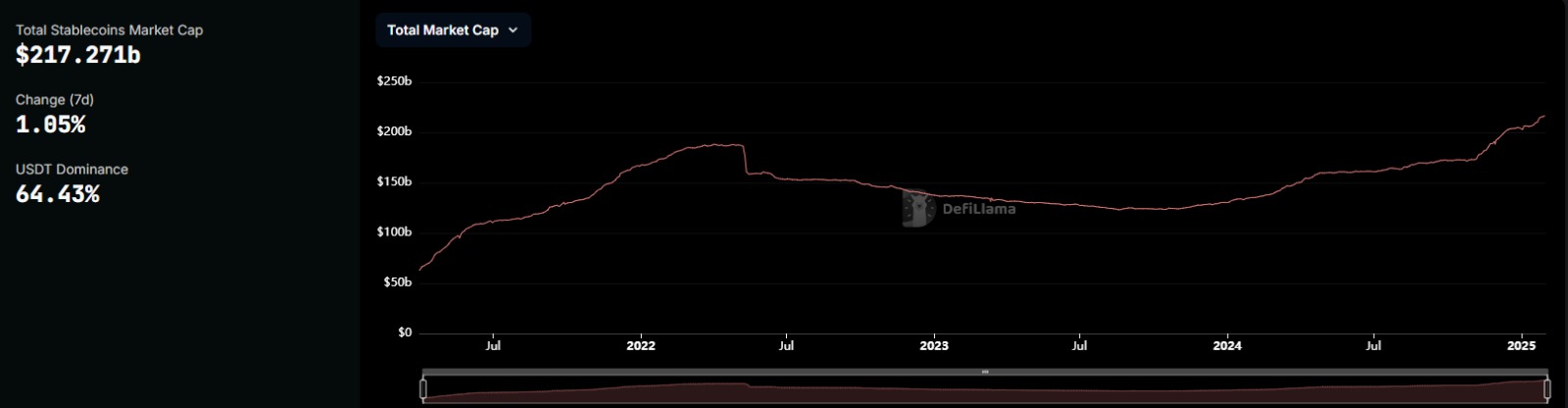

Stablecoins Are Bringing More Money Into Crypto

Stablecoins are a type of cryptocurrency that have a steady value. People use them to buy BTC and other digital assets. When more stablecoins are in the market, it usually means more money is available to invest in Bitcoin. Recently, USDT’s market cap dropped by 2% over 30 days, but it quickly went back up before the month ended. Meanwhile, USDC grew by 20%, which is the fastest increase in a year.

This is important because in the past, when stablecoins grew, BTC price also went up. When people move their money into stablecoins, they often use them later to buy BTC, which can drive the price higher.

Even other stablecoins like DAI have been expanding, adding more money to the market. If this pattern continues, BTC and other cryptocurrencies might see another big rise in price soon.

How Borrowing Money Affects Bitcoin Price

Many traders borrow stablecoins like USDT to buy Bitcoin, hoping the price will go up. This is called margin trading, and it can cause big price swings. Recently, when BTC price started dropping, traders borrowed more USDT, expecting BTC to go back up. But instead of rising, BTCkept falling, leaving traders with too much borrowed money. When traders couldn’t afford to pay back what they borrowed, they had to sell their BTC, which made the price drop even more.

However, after this big sell-off, the market recovered, and BTC price started to rise again at the end of January. This pattern shows that too much borrowing can cause sudden price drops, but it also creates opportunities for people to buy BTC at a lower price before it goes up again.

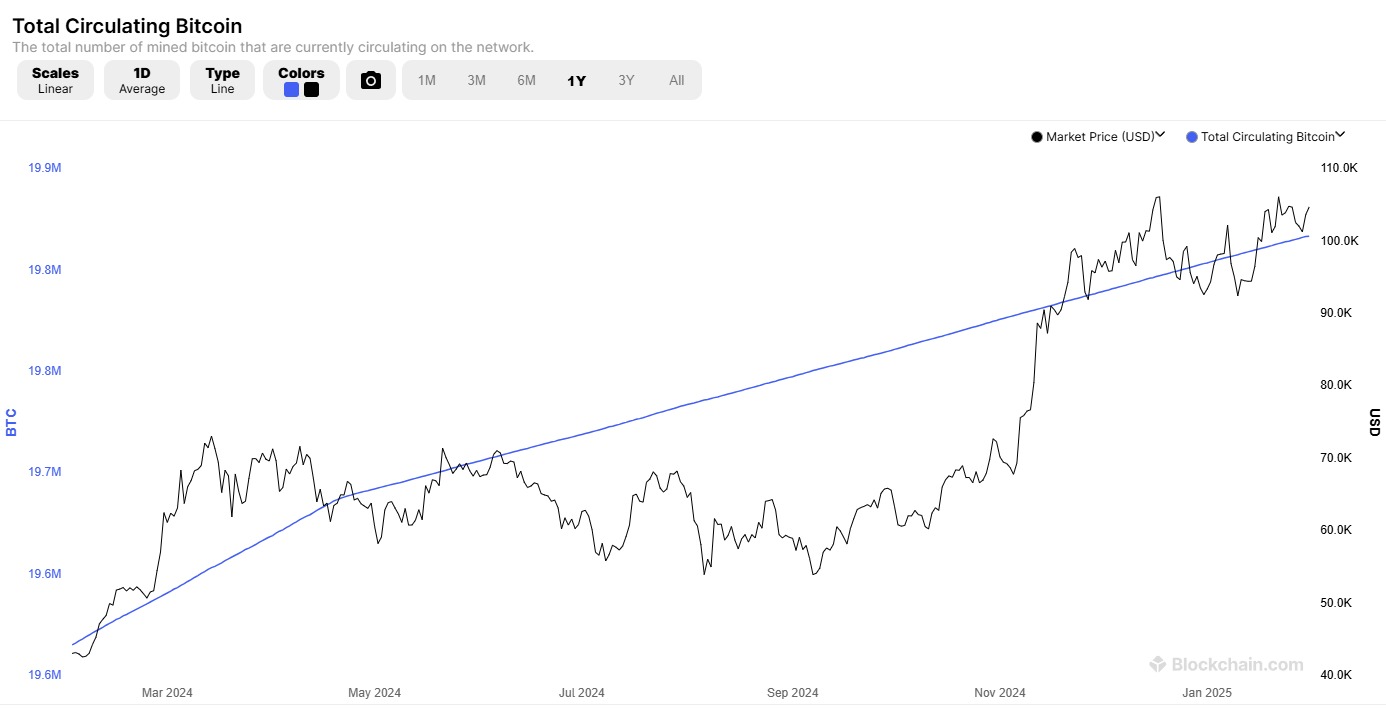

Bitcoin ETFs Are Bringing in More Investors

Bitcoin ETFs are funds that allow big investors to buy BTC without having to hold it themselves. This makes it easier for large companies and financial firms to invest in BTC. Recently, Bitcoin ETFs have collected 1,163,377 BTC, which equals 5.87% of all BTC in circulation. Even though some investors sold their BTC when the price hit $100,000, ETF holdings remain strong, showing that many investors are still confident in BTC.

This means that more people are using ETFs to invest in BTC, which helps keep demand high. If Bitcoin ETFs keep growing, they could help push BTC’s price even higher in the future.

Conclusion

Bitcoin’s price depends on many factors, but stablecoins and ETFs play a big role in keeping the market strong. If stablecoins continue growing, they will bring more liquidity, which helps BTC rise. At the same time, BTC ETFs are bringing in more investors, which helps keep demand steady. However, borrowing too much money to buy BTC can cause market drops, so traders need to be careful. If these trends continue, BTC could be on its way to another major rally in the coming months.