With only one day left before the Bitcoin halving event, miners and investors are getting their expectations of profit in the market as the Bitcoin halving event is right round the corner. A clear decrease in miner flows to centralized crypto exchanges, which is interpreted as a tactic by the miners to reduce the selling pressure ahead of the halving, and this will play a massive role in the price of BTC.

Bitcoin: Reduced Miner Flows to Exchanges

The data from CryptoQuant shows a big fall in miner flows to exchanges, last month’s total being 374 BTC as opposed to the following month’s 1388 BTC. Generally, inflows of money from miners and whales to exchanges usually suggest extra selling pressure which may result in the asset’s price dropping. However, in contrast, the market is often observed to gain a positive sentiment and upward momentum when assets are taken out of exchanges or there is a decline in miners inflows.

Mining Strategies Amid Bitcoin Halving Hype

Miners are eyeing on the opportunity to exploit the Bitcoin halving hype, which is normally associated with the bullish market. The bear market in 2022 has caused miners to be in the red for the most part because of the depreciation in asset prices. While the ETF approval gave rise to renewed activity, including miners selling reserves to recover their losses and to improve their operations, it also put pressure on the Bitcoin price. Interestingly, just as the ETF approval was announced, $1 billion worth of miner reserves were transferred into the exchanges, which, in turn, impacted the market dynamics.

Historical Precedents and Market Sentiment

Analyzing historical trends preceding Bitcoin halving occasions suggests that miners, who are the main producers of the cryptocurrency, rationalize their operations in preparation for the potential price surge before the revenue reduction that follows immediately after halving.

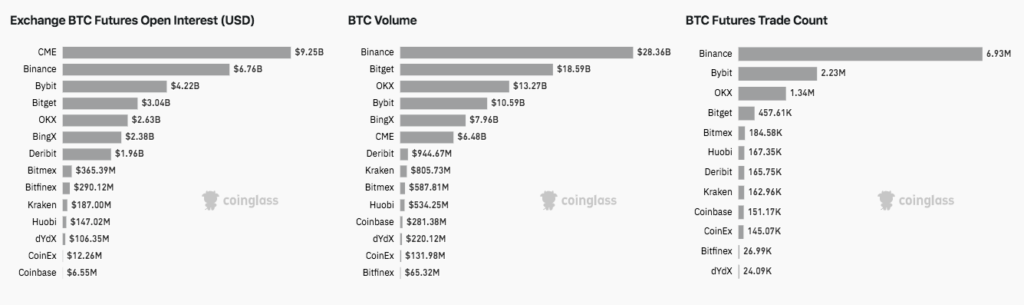

The recent data trend is indicating that selling pressure from miners is on the way down, with analysts talking about the price rebound as a result. The selling pressure that has been observed in the past few months is probably already priced into the market, thus there is a better chance that the current short-term outlook will be positive, especially in the current risk aversion sentiment. Furthermore, Coinglass data reveals a large withdrawal of 4800 BTC from exchanges in the last 24 hours which is the largest outflow since January 2023. These withdrawals result in the change of investors’ behavior and the possible accumulation phase, laying a solid foundation for the Bitcoin market to rise after halving.