Introduction

Bitcoin miners are starting to recover, and this could mean a big change for Bitcoin’s price. The Hash Ribbon indicator, which tracks miner activity, suggests that the hard times for miners are ending. In the past, when this happened, BTC’s price went up. Right now, BTC is trading close to $100,000, and experts believe that if miners keep recovering, Bitcoin’s price could rise even higher.

What Is the Hash Ribbon Indicator?

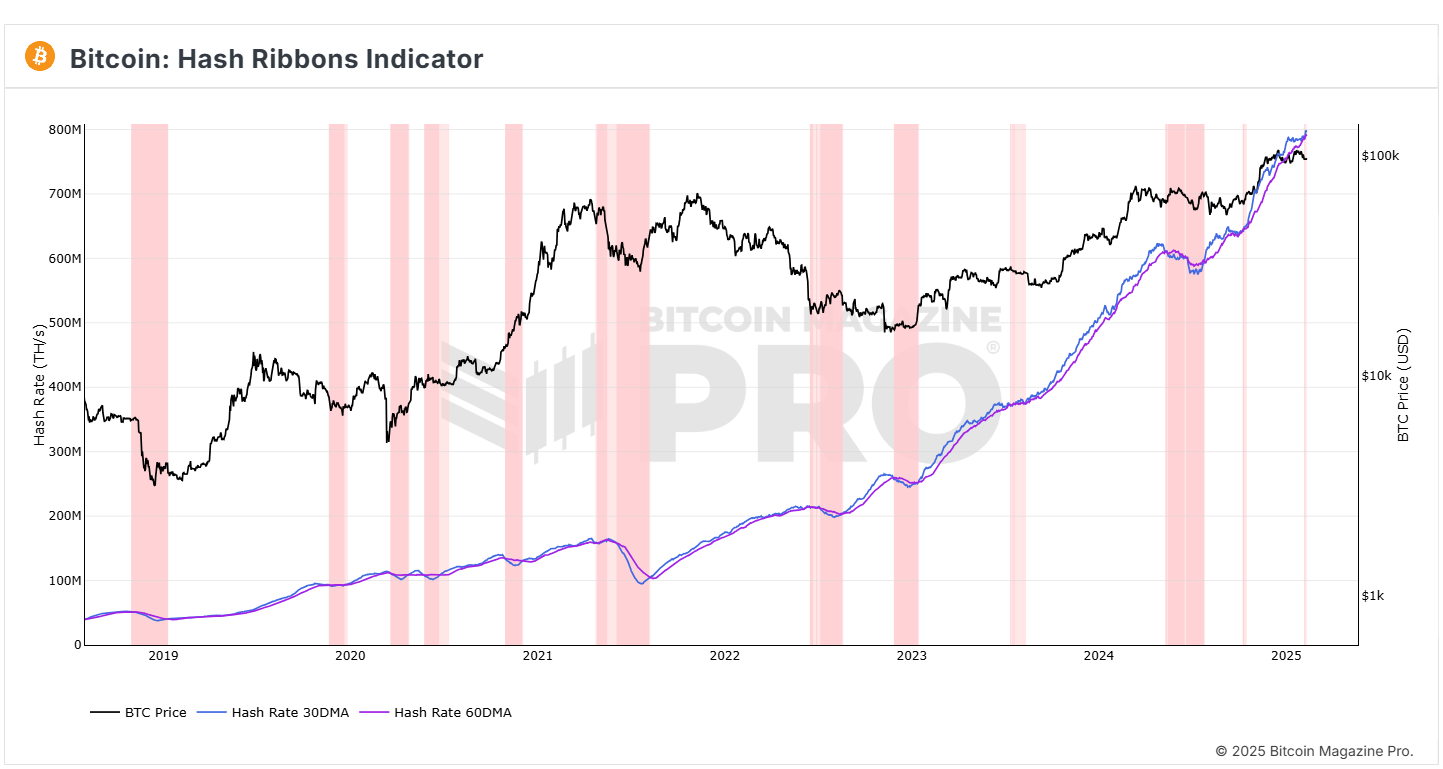

The Hash Ribbon indicator is a tool that helps track how BTC miners are doing. It looks at two important numbers: the 30-day and 60-day Moving Averages (MA) of Bitcoin’s hash rate. The hash rate measures how much computing power miners are using to create new BTC. If the 30-day MA drops below the 60-day MA, it means that mining has become too expensive, and many miners are shutting down their machines. This is called miner capitulation, and it usually happens when Bitcoin’s price is too low for miners to make a profit.

But when the 30-day MA moves back above the 60-day MA, it signals that miners are recovering. In the past, this has happened right before Bitcoin’s price goes up. For example, in 2021, BTC’s price jumped to $64,000 after miners started recovering. In 2023, a similar event helped BTC reach $30,000. Now in 2025, BTC is at a key moment, and experts think that another price surge could be coming.

Are Bitcoin Miners Recovering Now?

Recent data shows that the 30-day and 60-day hash rate numbers are getting closer together, which could mean that miners are coming out of the tough phase. This is important because BTC’s network hash rate is at an all-time high, showing that miners are adjusting to the rising costs and challenges of mining. When miners recover, they usually stop selling their BTC and hold onto it instead. This means less BTC is available for sale, making it more valuable. If miners continue to recover, BTC’s price could start rising as demand stays strong but supply slows down.

How This Affects Bitcoin’s Price

The Hash Ribbon indicator suggests that Bitcoin is entering a bullish phase, which means its price could go up. If BTC follows the same pattern as before, it could break through $100,000 and hit new record prices. But BTC’s price doesn’t just depend on miners. Other factors, like how many people are buying and selling BTC, economic events, and interest from big investors, will also affect its price. If BTC gets strong buying support, its price could rise even higher. However, if investors become unsure about the market, BTC’s growth could slow down.

What Experts Are Saying

Crypto expert Ali Martinez believes that the Hash Ribbon indicator is useful but shouldn’t be the only thing investors look at. The market in 2025 is different from past years because there are more big companies and institutions involved in BTC . This means investors should also consider other signals before making decisions about Bitcoin’s future.

Conclusion: Is Bitcoin Ready for a Big Move?

Bitcoin’s Hash Ribbon indicator suggests that miners are getting back on their feet, which in the past has led to big price increases. With BTC already near $100,000, this could be the start of another rally. If miners continue recovering and investors remain confident, BTC could break past its current price and reach new highs. However, other factors like the economy and market trends will also play a role in what happens next. For now, BTC is at a turning point, and many traders are watching closely to see if this recovery will lead to another major price surge.