The recent surge in Bitcoin’s long-term holder supply to an all-time high of 14.59 million BTC, accounting for 75% of the circulating supply, reflects a growing trend of investors opting to hold onto their assets for extended periods. This long-term holding behavior can signify increased confidence in Bitcoin’s potential as a store of value and a hedge against traditional financial uncertainties.

Bitcoin Post-Bear Re-Accumulation Phase

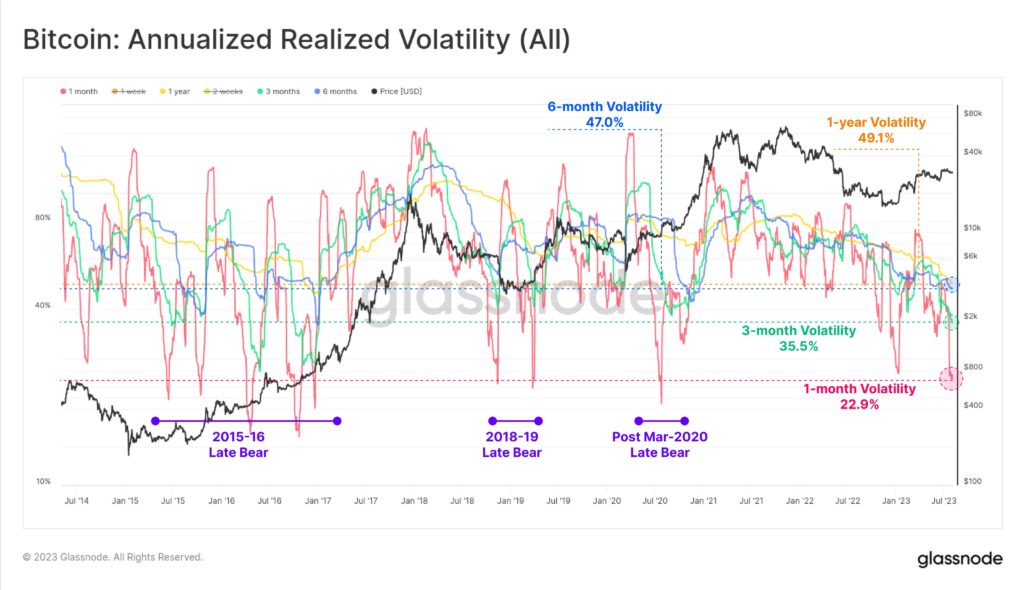

Simultaneously, the collapse of realized volatility for Bitcoin to historical lows over various timeframes, ranging from one month to one year, indicates a remarkably stable market environment. Such tranquil conditions have historically been observed after periods of intense market turbulence, like the aftermath of the bear market that followed the pandemic-induced crash in March 2020. This low volatility scenario often aligns with phases of re-accumulation, where savvy investors gradually accumulate assets as they anticipate future price appreciation.

Potential Post-Bear-Market Hangover

The convergence of these factors suggests a potential post-bear-market hangover period for Bitcoin. This phase typically involves price stabilization and consolidation, as the market adjusts to new investor sentiment and long-term holders accumulate assets at relatively stable prices. This process can precede a renewed upward trajectory as Bitcoin transitions from the re-accumulation phase to the next phase of significant price growth.

Conclusion

In essence, the surge in long-term holder supply and the historic lows in realized volatility hint at Bitcoin’s ongoing maturation as an asset class. This is characterized by a more resilient investor base, reduced speculative fervor, and the establishment of a foundation for future growth. However, it’s important to note that while historical patterns provide insights, they don’t guarantee future outcomes in the ever-evolving landscape of cryptocurrency markets.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: parilovv/123RF// Image Effects by Colorcinch