Bitcoin remained stable around $110,000 on October 24 even after U.S. inflation data came in slightly higher than expected, suggesting investors now view the asset as a macro hedge rather than a high-risk trade.

Inflation Driven by Fuel, Not Broad Price Pressures

The latest Consumer Price Index (CPI) report showed a 3.0% year-over-year increase in inflation for September, up marginally from August’s 2.9%. Core inflation, which excludes volatile food and energy prices, rose only 0.2% month-over-month, a slower pace than earlier this year. Gasoline costs were the main driver of the headline rise, indicating underlying inflation continues to cool.

Bitcoin Holds Ground Through Inflation Data

Historically, Bitcoin tends to weaken ahead of CPI announcements as traders hedge macroeconomic risk. This time, however, BTC held firm through the report, signaling that inflation concerns were already priced in.

Options data showed traders positioned defensively, hedging between $109,000 and $115,000 rather than making aggressive directional bets. The lack of volatility reinforced confidence that markets view current inflation levels as manageable.

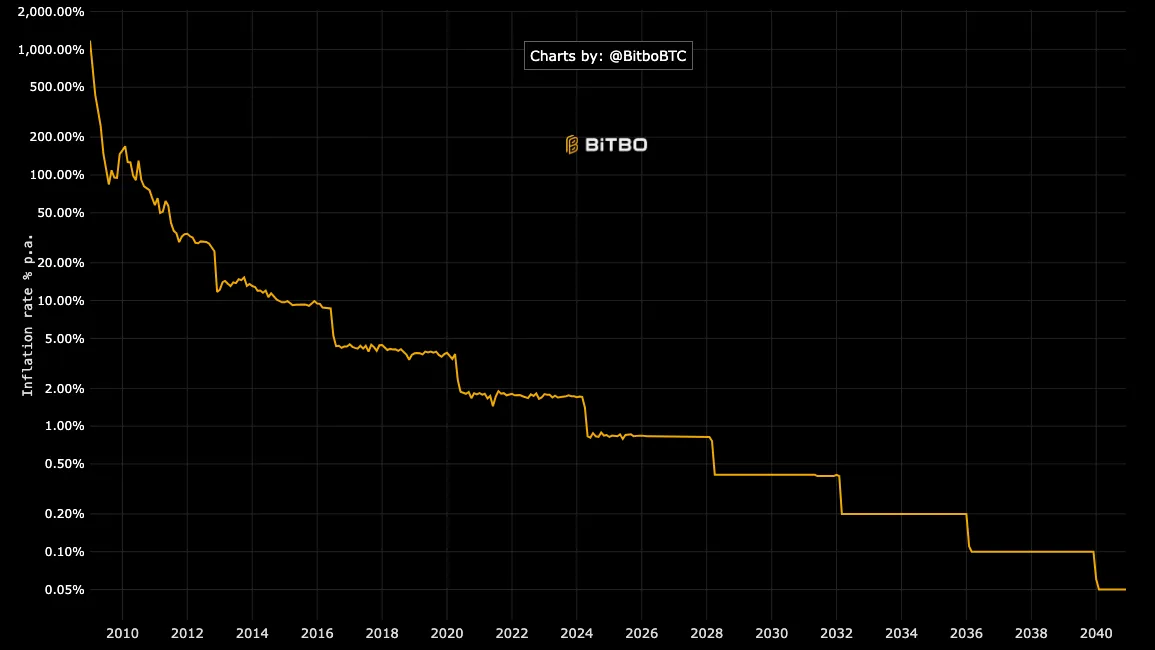

BTC’s Correlation Shifts Toward Gold-Like Behavior

Bitcoin’s muted response mirrored gold’s stability following the inflation release, suggesting both assets are being treated as hedges against monetary uncertainty. The pattern marks a shift away from the days when Bitcoin traded like a high-beta tech stock sensitive to rate expectations.

Broader Implications for Crypto Markets

The CPI data supports a narrative of cooling inflation and a gradual path toward monetary easing by the Federal Reserve. Since most of the increase stemmed from fuel prices, rather than core components, policymakers are unlikely to reverse their current stance.

For crypto, this translates into a supportive environment, stable liquidity, fewer macro shocks, and reduced fear of aggressive tightening. Bitcoin’s steady performance through the CPI release reflects growing market maturity and confidence in its role as a long-term hedge.