Recent data shows that Bitcoin might face a big price drop soon. Some experts believe it could even lose half of its value. Certain patterns in trading activity are raising concerns about what could happen next.

What Is Open Interest Delta?

Open Interest Delta tracks changes in the number of Bitcoin trading contracts over time. Additionally, it helps experts see if more people are entering or leaving the market. For example, a growing delta means more people are trading, which can push prices up. But when the delta drops, it can signal that traders are pulling back, and prices might fall.

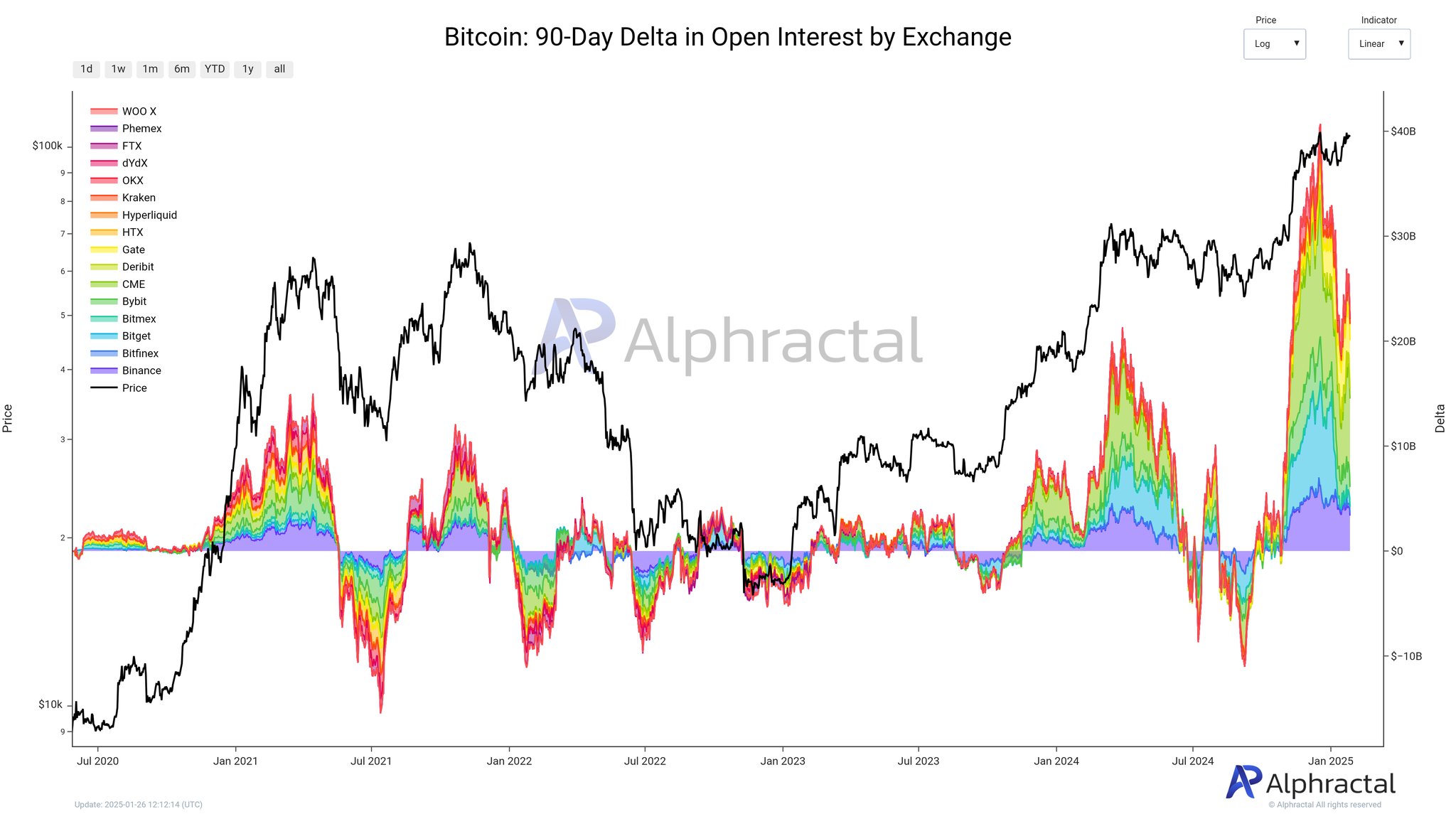

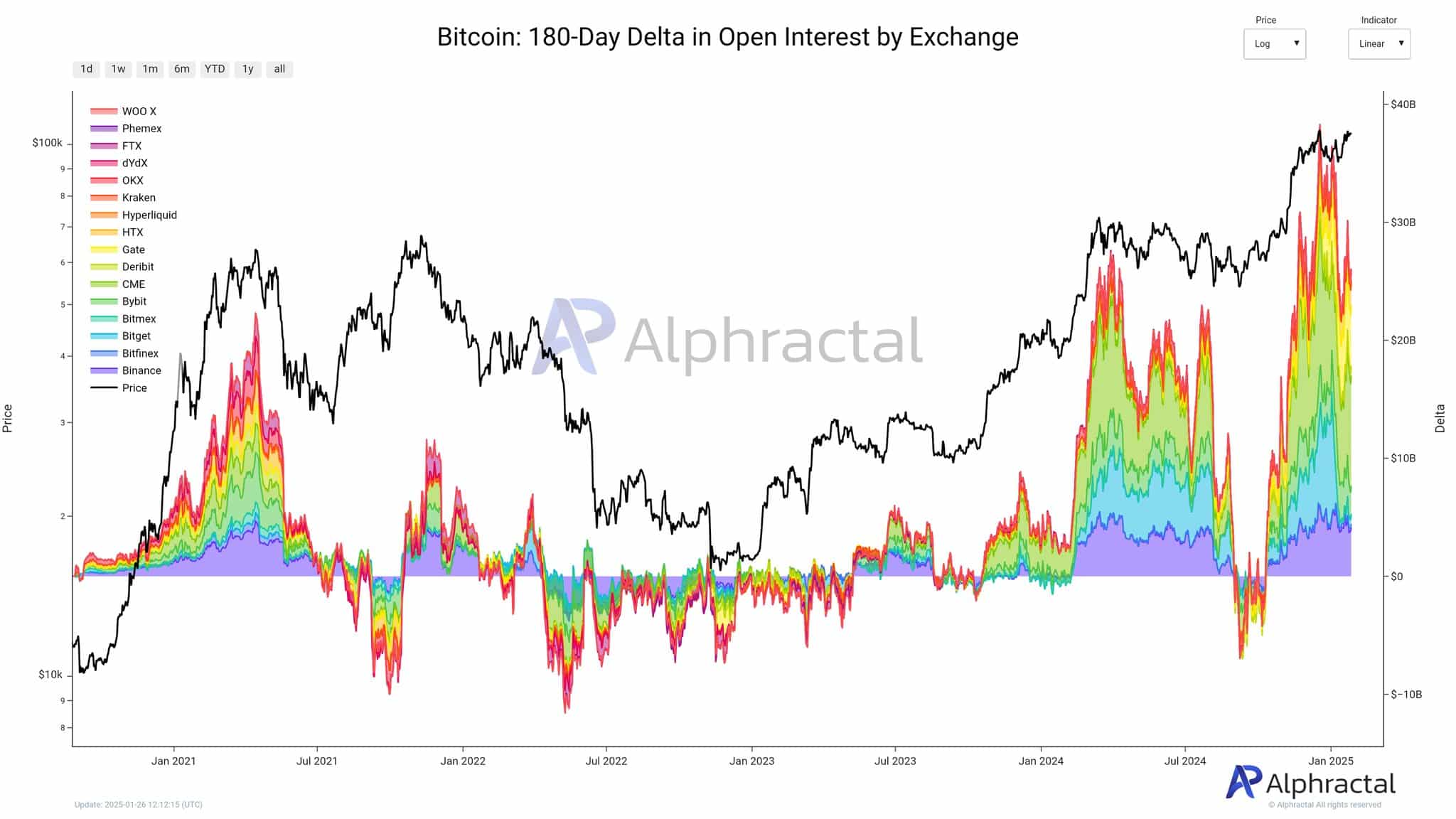

The 90- and 180-day Open Interest Delta is showing signs of weakness, suggesting the closure of institutional positions.

In the past, after a significant rise in these deltas followed by a weakening, Bitcoin’s price has dropped by up to -50% from its peak within a few weeks.

It… pic.twitter.com/txIErtijXi

— Alphractal (@Alphractal) January 26, 2025

The 90-Day Open Interest Delta

The 90-day Open Interest Delta looks at trading activity over three months. Right now, it is going down, which shows fewer people are holding or trading Bitcoin contracts. This change suggests that many traders may be taking profits or losing interest in trading. When this happens, the market often becomes weaker.

For example, in 2021 and 2023, the 90-day delta dropped just before Bitcoin prices fell sharply. This pattern could happen again if traders continue to leave the market.

The 180-Day Open Interest Delta

The 180-day Open Interest Delta looks at trading activity over six months. Like the 90-day delta, it is also showing a decline. This means fewer contracts are active, especially on big platforms like Binance and CME. Experts believe this could be a sign that institutions or big-money investors are closing their positions to lock in profits.

When institutions pull out of the market, it can lead to less liquidity and more price swings. This could make the market more unstable in the coming months.

Why This Matters for Bitcoin

When both the 90-day and 180-day Open Interest Deltas drop, it often means trouble for Bitcoin. Big investors play a key role in keeping the market steady. If they step back, the market can lose strength, and prices may drop. This has happened before. In late 2021, institutional profit-taking caused Bitcoin prices to fall. The same thing occurred in mid-2023, when large investors sold their positions, leading to a sharp price correction.

What Could Happen Next To Bitcoin?

If traders and investors keep pulling out of the market, Bitcoin could lose a lot of value. Some experts say it might drop as much as 50% from its recent high. This would test important support levels, which are prices where Bitcoin usually bounces back. However, there’s also a chance that traders will hold onto their Bitcoin, keeping prices stable. If this happens, the market could recover, especially if new buyers step in.

Final Thoughts

The current trends in Open Interest Deltas suggest that Bitcoin’s price might face challenges soon. While this could lead to a big drop, it might also create opportunities for long-term investors. For now, all eyes are on how the market reacts in the coming weeks.