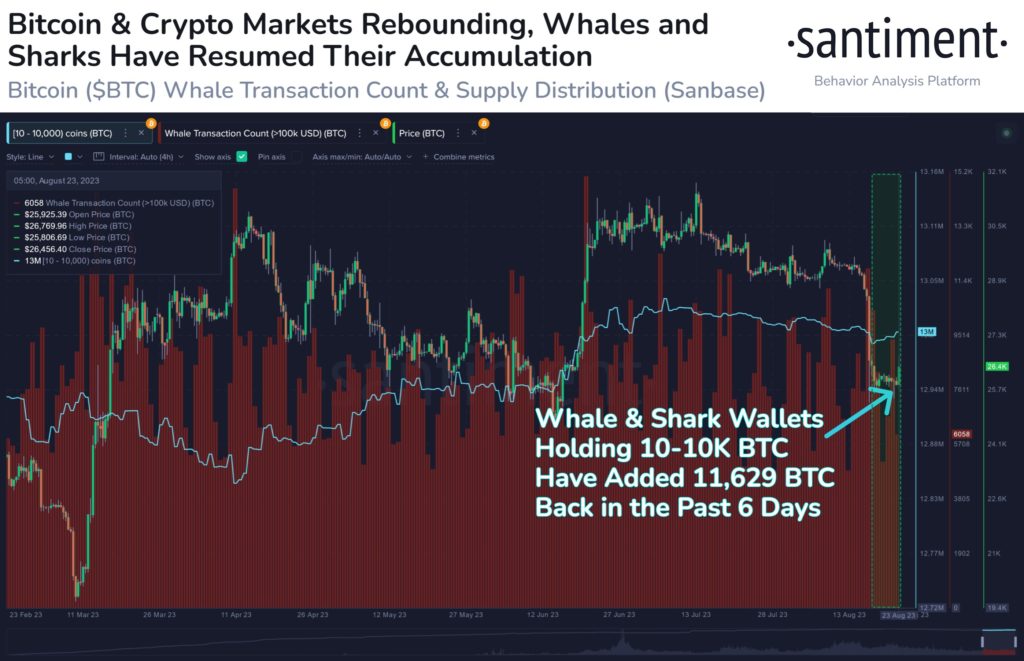

The recent resurgence in Bitcoin’s price to $26.8K on Wednesday has drawn attention to the activity of significant holders, often referred to as “whales” and “sharks,” who possess substantial amounts of the cryptocurrency. These entities hold the power to influence market sentiment due to their ability to execute large transactions, potentially impacting Bitcoin’s value.

$308.6M Accumulation

The accumulation of $308.6M by 156,660 wallets holding 10 to 10,000 BTC since August 17th indicates renewed interest among these substantial holders. Such collective action could be driven by various factors, including macroeconomic trends, regulatory developments, or the anticipation of future price movements. However, determining the precise motives behind these accumulations requires a deeper understanding of market dynamics and the intentions of these individual holders.

Broader Market Trends

It’s important to recognize that while whale and shark activity can offer insights into market sentiment, it’s not always indicative of broader trends. The cryptocurrency market is notorious for its volatility, often influenced by speculative trading, news events, and external factors. Therefore, interpreting the actions of these large holders requires caution and a broader contextual analysis.

Final Thoughts

Overall, the rebound in Bitcoin’s price and the accumulation of holdings by significant addresses signal evolving dynamics within the cryptocurrency landscape. However, drawing definitive conclusions about the market’s direction solely based on these actions would be oversimplifying a complex and multifaceted ecosystem. As always, market participants and analysts should consider a range of factors before making predictions or investment decisions in the highly dynamic realm of cryptocurrencies.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Image Source: vectorup/123RF// Image Effects by Colorcinch