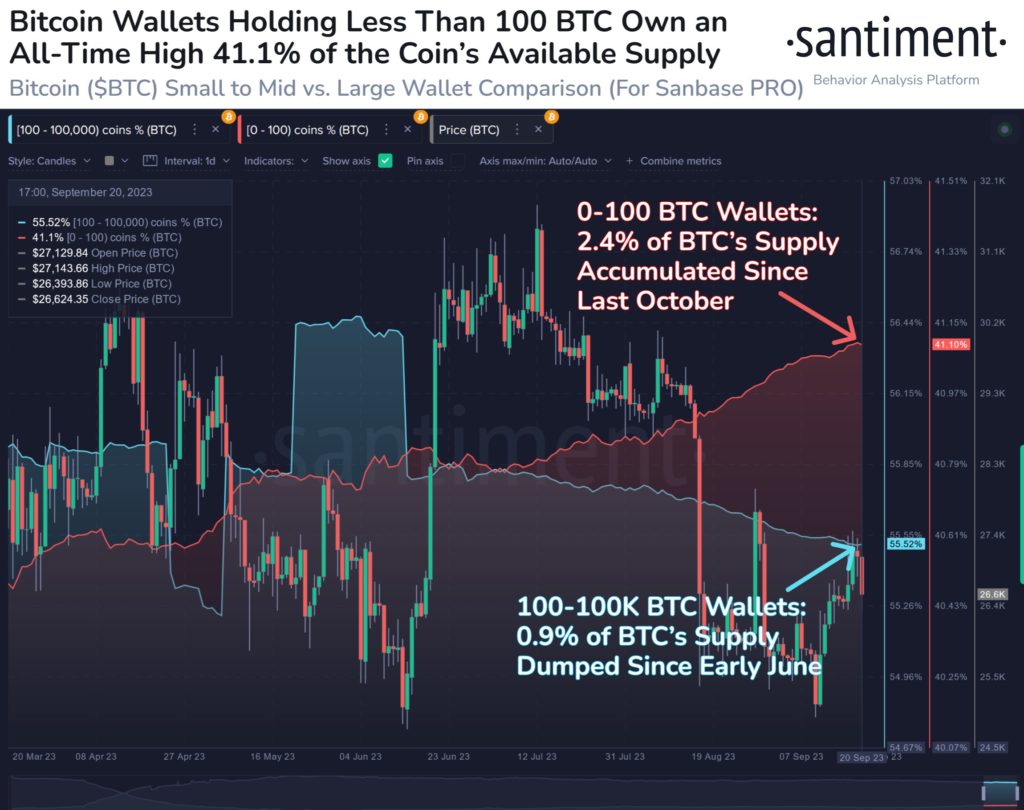

Recent data shows a significant shift in the ownership landscape of Bitcoin, with non-whale wallets – those holding less than 100 BTC – reaching a new all-time high. These wallets now command 41.1% of the total available Bitcoin supply. Simultaneously, the share held by larger whales, possessing 100 to 100,000 BTC, has dipped to its lowest point since May, accounting for 55.5% of the supply. This shift underscores a broader trend in Bitcoin’s decentralization.

Increased Retail Participation Is Noted

The rise of non-whale wallets is indicative of increased retail participation in Bitcoin. Small investors are accumulating Bitcoin at an unprecedented rate, with wallet addresses holding 0-100 BTC accumulating over 2.4% of the supply since late October. This surge in small-scale ownership suggests growing interest and adoption among individual investors who may see Bitcoin as a store of value or a long-term investment.

Potential Redistribution Of Wealth

On the flip side, the declining share of larger whales indicates a potential redistribution of wealth within the cryptocurrency ecosystem. While whales still maintain significant influence, their reduced ownership might indicate a broader dispersion of power, aligning with the original ethos of decentralization in cryptocurrencies.

Other Factors To Note

It’s worth noting that this data reflects a dynamic landscape, and trends can change rapidly in the crypto space. Factors like market sentiment, regulatory developments, and macroeconomic conditions can all influence ownership patterns. Moreover, the level of decentralization in Bitcoin remains a subject of debate, as some argue that mining and development centralization still exist.

Final Thoughts

In conclusion, Bitcoin’s evolving ownership landscape is a testament to the cryptocurrency’s resilience and adaptability. The increasing prominence of non-whale wallets suggests that Bitcoin is gaining wider acceptance among retail investors. As the crypto ecosystem continues to evolve, monitoring these ownership trends will be crucial in understanding Bitcoin’s trajectory and its role in the future of finance.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: peshkova/123RF // Image Effects by Colorcinch