BlackRock Bitcoin ETFs holding rose to 196,065 BTC’s, surpassing MicroStrategy by 3,065 coins. Meanwhile, analysts expect strong demand for ETFs to push Bitcoin towards $100,000.

BlackRock holds more Bitcoin than MicroStrategy

BlackRock’s bitcoin accumulation rate has significantly outpaced MicroStrategy, which began acquiring BTC in 2020. IBIT’s rapid asset growth underscores the growing demand for spot BTC ETFs since their introduction in January.

In a recent interview, Grayscale CEO Michael Sonnenschein said “pent-up demand” for ETFs was one of the main reasons for the surge in enthusiasm among market participants.

“We are seeing huge flows of funds and increased demand from investors, which is outpacing the supply of Bitcoin entering the market every day and increasing its price,” he said.

iShares Bitcoin ETF has eclipsed $10bil net inflows…

That’s net inflows in 40 days.

Pulling down avg of $250mil/day.

Now at $13.6bil AUM.

For context, ARK Invest has about $16.5bil total assets. Firm launched in 2014. https://t.co/yLM7N0Xncm

— Nate Geraci (@NateGeraci) March 9, 2024

ETF expert Nate Geraci echoed this sentiment, highlighting that inflows into nine spot BTC ETFs over the past two months have exceeded the total inflows into all physical gold ETFs over the past five years. The total trading volume of BTC ETFs, meanwhile, exceeded $100 billion.

Bitcoin road to $100,000

The surge in interest in spot BTC ETFs comes amid favorable market conditions and growing recognition of the potential of the major cryptocurrency.

Some analysts suggest that a combination of persistently high interest in ETFs, positive market fundamentals and pending regulatory approval for trading options on BTC funds could push the price of the asset towards the long-awaited $100,000 mark. Technical, on-chain and fundamental factors will contribute to this growth.

What’s Happening to Spot Bitcoin ETFs?

Almost two months have passed since the long-awaited approval of spot BTC ETFs in the United States. During this time, the trading volume of the instrument reached $10 billion, and BTC updated its absolute maximum value.

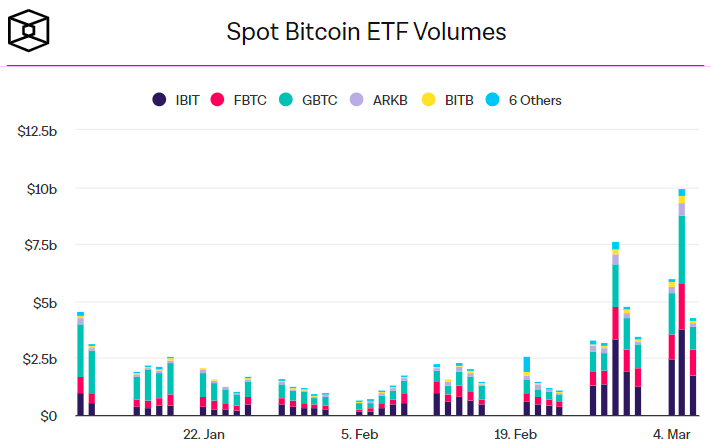

Trading volume in the spot BTC ETF market continues to grow. On March 5, the maximum was set at $9.93 billion, and the previous peak, $7.64 billion, was recorded on February 28. By comparison, trading volume for spot Bitcoin ETFs on the first trading day was $4.54 billion.

Blackrock’s IBIT share increased from 22% recorded on the first day to 40%. The share of GBTC from Grayscale, the sale of which was one of the reasons for the fall of BTC at the beginning of the year, decreased significantly – from 58% to 23%. The third-largest spot Bitcoin ETF, Fidelity’s FBTC, also rose. On the first day of trading, the instrument occupied 15% of the market. As of the time of writing, FBTC’s share has grown to 26%. The share of spot instruments in the Bitcoin ETF market is consistently around 80%.

According to bitcointreasuries, a total of 4.6% of the cryptocurrency issue was purchased under Bitcoin-based ETFs. The leader is GBTC, this fund controls almost 2% of the total BTC in circulation.