One of the most popular memecoins in the Solana ecosystem, BONK, is moving within a bullish pattern, showing signs of an imminent resumption of the rally. Meanwhile, KangaMoon (KANG) is currently in phase 5 of the presale, with the aim to continue its bullish journey as one of the leading memecoins in the favorable market.

BONK is preparing for a new rally

Currently, the Bonk price is showing bullish signs, indicating a possible recovery. The main obstacle to growth in the price of memecoins is usually the decline in traders’ enthusiasm after a correction, as many market participants switch to other assets.

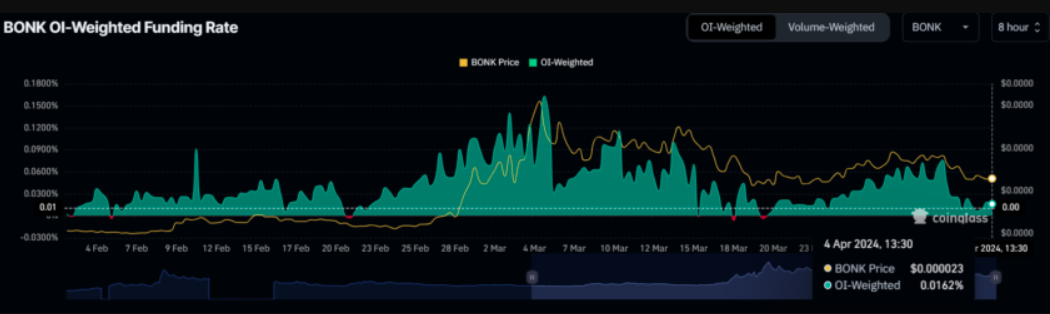

However, BONK traders are currently optimistic, as evidenced by the positive funding ratio. It indicates that the number of long positions in the futures market significantly exceeds short positions.

Additionally, the moving average divergence indicator, used to determine trend direction, signals bullish momentum. Currently, the MACD is hinting at a bullish crossover, marked by a green bar on the histogram, which also indicates potential price growth.

BONK price forecast: 60% increase

Bonk is currently moving within a descending triangle. A successful breakout from this pattern would result in a 62% rise to $0.00004188, provided several resistance levels are cleared.

However, a sharp decrease in traders’ interest in memecoin may provoke a continuation of the correction. If BONK falls below the key support level of $0.00002157, the bullish scenario will be nullified.

KangaMoon transitions to stage 5

With Chainlink and Mantle making progress ahead of the altcoin season, KangaMoon is expanding rapidly as it approaches listing. As a meme token, KangaMoon relies on real utility, which has been the constraint of many meme tokens. It incorporates aspects of play-to-earn and SocialFi functionalities, cultivating a community for gaming enthusiasts.

The platform has available slots for players to exhibit their gaming prowess and earn substantial rewards on a weekly, monthly, and quarterly basis. Observers are not excluded from KangaMoon’s generosity as they also benefit from betting and game predictions. KANG is currently in phase 5 of its crypto ICO campaign with the platform having raised $4M thus far.

KangaMoon (KANG) Eyes Huge Gains Before Exchange Listing

The native token of the platform (KANG) is priced at just $0.0196. Having moved from a minimum price of $0.0050 in phase 1 to the current price, it signifies that early investors now have 290% returns. At the current trajectory, analysts predict over 50x returns when it lists on exchanges in Q2 of 2024. Additionally, token holders can enhance their portfolio by participating in promoting the project on social media.

Recognizing the substantial potential of KangaMoon, buyers have flocked to accumulate KANG. Already, the platform has 20k subscribers with approximately 5800 token holders. Specifically, KangaMoon is one of the meme token giants penetrating the $200B NFT market. Therefore, now is the optimal time to invest in the presale of the new memecoin.