Introduction

BONK memecoin struggles to recover after a sharp drop. The $0.00004 resistance level blocks its progress. This key level, seen on the daily chart, shows strong selling pressure. A bounce to this level might happen soon, but a true bullish shift needs more capital inflow.

BONK Losses and Downtrend

Between November 20 and December 20, BONK dropped by 59%. The steady fall included heavy selling days, like December 9. On that day, Bitcoin failed to break the $100,000 mark, which affected BONK’s price. After this, BONK failed to hold support levels. The latest Bitcoin correction pushed BONK to $0.0000265, a critical support zone. BONK has tried to recover since then but has yet to reach a strong bullish position.

Bulls Aim for $0.0000338 Resistance

The daily RSI for BONK is 44, below the neutral 50 level. This shows bearish pressure in the market. OBV data confirms this with lower highs and lower lows over the past month. Both indicators show sellers still lead the market. Recently, BONK retested the 78.6% Fibonacci retracement level at $0.0000264. It did not close below this level. After hitting a low of $0.0000248 on Friday, BONK rebounded by 39%. Even so, the $0.00004 resistance remains strong. To turn bullish, BONK must close above $0.0000394 on the daily chart.

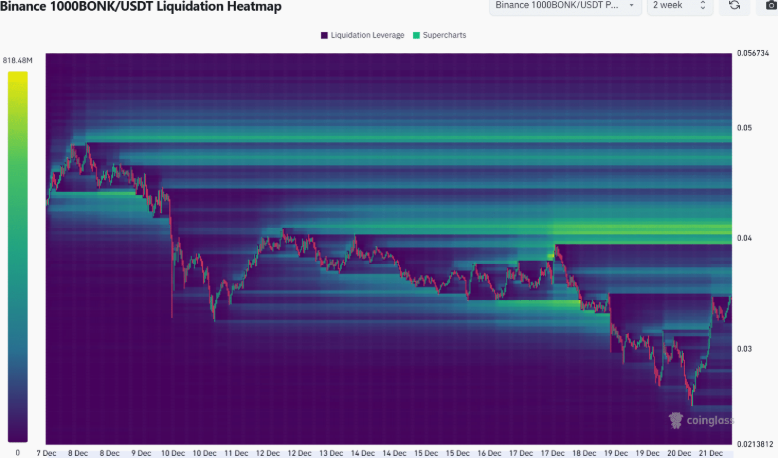

Liquidation Data Shows Challenges

The $0.00004 resistance matches high liquidation levels, as seen on a 2-week heatmap. This data highlights the strong selling interest at this level. Liquidity below the current price is sparse, making a big drop less likely soon.

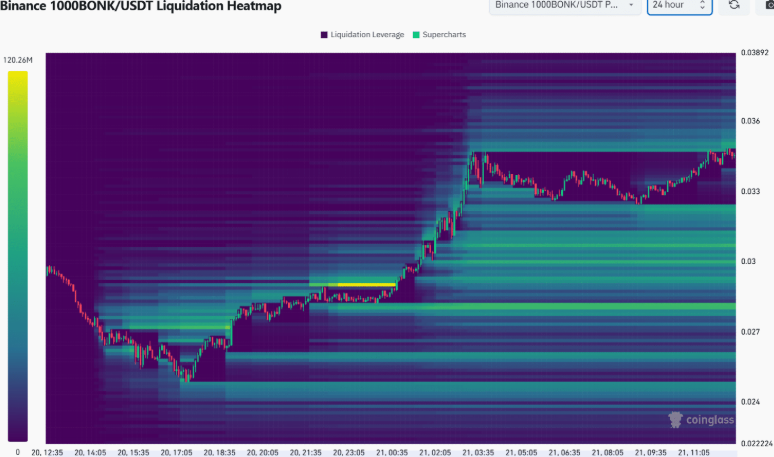

The 24-hour heatmap shows a trading range between $0.0000322 and $0.000035. Liquidity around $0.000035 could trigger a short-term bearish reversal if sellers act fast. These conditions suggest BONK’s price may stay volatile.

Key Factors for a Bullish Shift for BONK

For BONK to turn bullish, it needs to break $0.00004 and hold above it. Bulls must bring strong buying pressure and capital inflow to achieve this. Without these, sellers will stay in control. Traders should watch the price near $0.00004. A breakout above this level signals a bullish move. If BONK fails to hold support, the price may drop further.

Risks and Potential For BONK

BONK’s struggles show the risks of memecoins. The token gained quick attention but lost value fast. Traders should stay cautious, as bearish signals still dominate. At the same time, BONK’s 39% rebound shows it has potential. If bulls can break $0.00004, BONK could recover further. For now, the market is uncertain, and all eyes are on this key level.