Introduction

Solana (SOL) is one of the biggest names in cryptocurrency, but right now, its price is facing a big test. A huge amount of Solana has been moved around by a company called Pump.fun, and this is making traders nervous. Some believe these large transactions could help push SOL’s price higher, while others worry they might cause it to drop.

Massive Whale Transfers Shake Solana Market

A company called Pump.fun has been moving huge amounts of Solana. Recently, it sent 90,000 SOL, worth about $20.5 million, to the crypto exchange Kraken. In total, the company has transferred nearly 2 million SOL, which is valued at $407 million. So far, 264,373 SOL have already been sold, bringing in $41.64 million USDC. Altogether, Pump.fun has earned 2.57 million SOL, worth about $588.6 million, from these transactions. These massive movements are causing traders to ask an important question: Will Solana keep going up, or will these big trades cause its price to drop?

Solana Stablecoin Market Is Getting Stronger

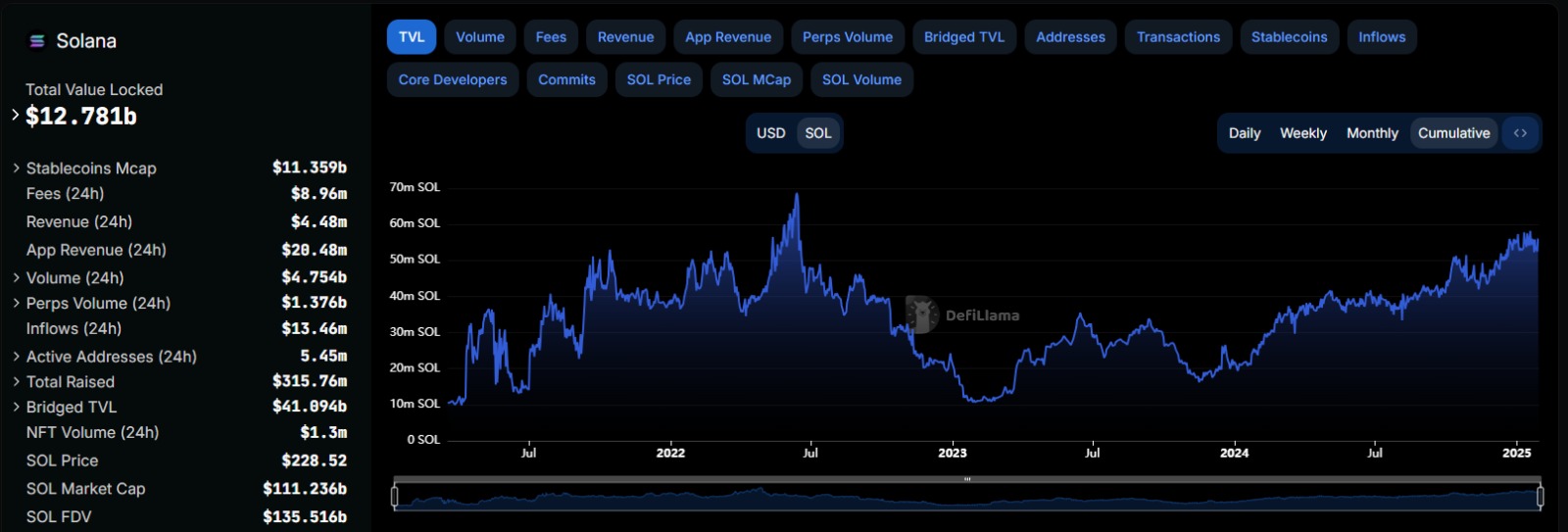

Even with all the whale activity (large transactions from big investors), SOL’s stablecoin market is doing well. Right now, the total amount of stablecoins on Solana has reached $12.78 billion, which is the highest ever.

The most dominant stablecoin on Solana is USDC, making up 77.9% of all stablecoins on the network. USDT, another stablecoin, holds less than $2 billion. This is a big deal because stablecoins help power DeFi (Decentralized Finance) on SOL, making it a strong competitor to Ethereum and Tron. But the question remains—is this growth permanent, or is it just because of short-term traders?

Solana Price Is Struggling to Break $250

Solana’s price has been going up and down, showing signs of strength but also uncertainty. Recently, it bounced off a key trendline, which suggests that it still has a chance to climb higher. It even reached $270, but then dropped back down to $227.30, which is still a 1.82% increase.

However, there’s a huge problem—$250 is a big resistance point. If SOL can break above this level, it might keep rising. But if it fails, there could be a wave of selling that sends the price lower. Whale activity from Pump.fun could make this movement even more unpredictable, meaning traders need to be extra careful.

Derivatives Market Stays Neutral, But Risks Loom

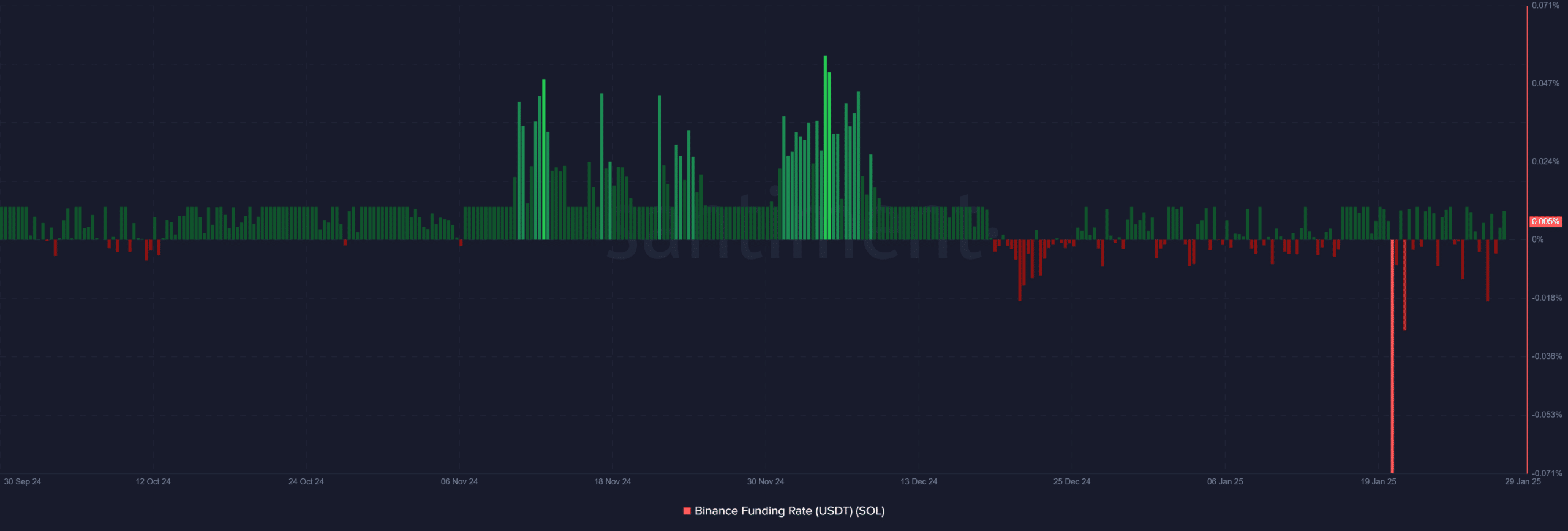

One way to measure market conditions is by looking at funding rates. Right now, SOL’s funding rate on Binance is at 0.005%, meaning the market is balanced—neither buyers nor sellers have complete control.

This is a good sign because it means there is no immediate risk of forced liquidations. However, shifts in funding rates could signal incoming volatility. If aggressive changes occur, SOL may see sudden price fluctuations, making it essential for traders to remain cautious. Another concern is Pump.fun’s frequent transactions, which might make the market unstable and unpredictable.

Conclusion

Right now, SOL still has a bullish structure, meaning its price could continue rising. However, Pump.fun’s transactions add uncertainty to the market. If buyers can absorb the large sell-offs, SOL could break past $250, leading to more gains. But if sellers take control, the price could start falling, making things very unpredictable. SOL is at a make-or-break moment, and what happens next depends on whether buyers or sellers win this battle.