Amidst the broader market sell-off, Cardano’s native cryptocurrency ADA has also been encountering robust selling pressure, correcting over 11% on the weekly chart. As of press time, the Cardano (ADA) price is trading 0.36% lower at a price of $0.4536 and a market cap of $16.16 billion.

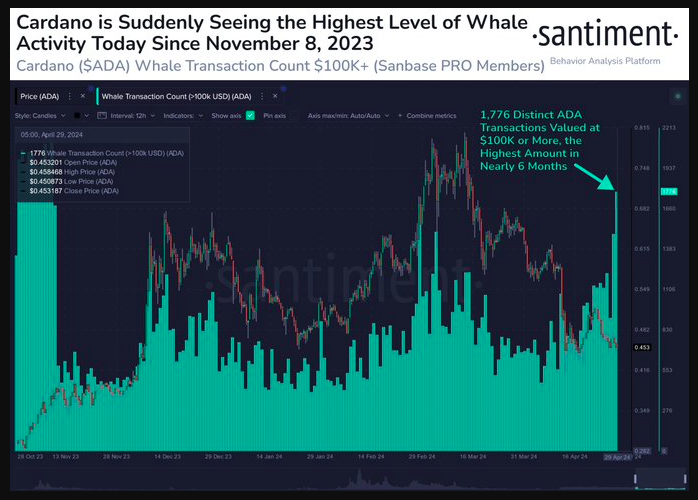

Cardano Whale Transactions Surge

According to recent discoveries by on-chain data provider Santiment, transactions involving substantial sums of Cardano (ADA) tokens, surpassing $100,000 in value, have spiked to their highest level since November 8th.

This noteworthy surge in Cardano whale activity has historically coincided with instances of potential price reversals in ADA’s market trajectory. Notably, the market capitalization of ADA has undergone a significant decline, dropping by 43% since March 13th, indicating a period of considerable volatility and market adjustments for the cryptocurrency.

ADA Price Forcast

Last week, the Cardano (ADA) price lost its major support at $0.50 levels sliding all the way to $0.45, which is the crucial support zone for the altcoin. Should ADA’s price encounter a decisive decline below its current level, it could potentially trigger additional bearish momentum, with the next significant support anticipated at $0.42.

On the other hand, ADA’s immediate resistance is identified at $0.4920, followed by the psychological barrier of $0.500. A definitive breakthrough above this level might ignite a rally, potentially propelling ADA towards $0.5250, and even up to $0.5650 in the event of prevailing bullish sentiment. Despite the broader market’s bearish trend, ADA hasn’t been immune, undergoing a decline in global market cap, reflecting its subdued Year-to-Date (YTD) performance with a -23.69% contraction. Santiment’s data indicates a slight decrease in active ADA wallets over the past three months, contrasting with signs of market recovery. This anomaly may imply either an undervaluation of ADA or a decline in interest among investors and users.

Data sourced from Santiment reveals a minor decrease of 0.13% in the total number of active Cardano (ADA) wallets over the past three months. This trend distinguishes ADA as one of the few networks witnessing a reduction in wallet activity during this timeframe.

Data sourced from Santiment reveals a minor decrease of 0.13% in the total number of active Cardano (ADA) wallets over the past three months. This trend distinguishes ADA as one of the few networks witnessing a reduction in wallet activity during this timeframe.