Chainlink (LINK) price is poised for a significant correction in the near future. A bearish reversal pattern warns of this. Chainlink (LINK) is preparing for an imminent correction. However, sellers should exercise caution. The expected decline may encounter resistance, potentially limiting the magnitude of the correction.

Chainlink investors are retreating

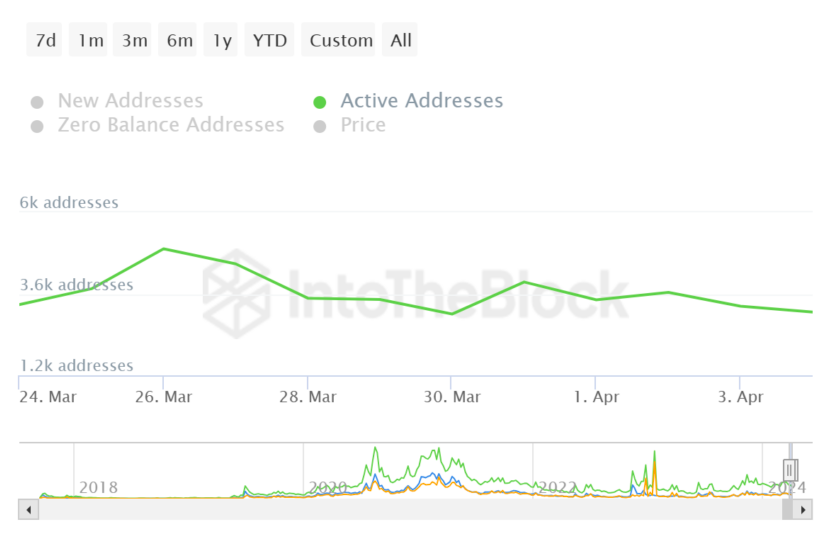

The coin’s price has been adjusting over the past few days, resulting in the token trading around $17.2 at the time of writing. This drawdown is expected to continue further due to a variety of factors, including reduced investor participation. Over the past two weeks, the number of addresses transacting on the network has dropped by almost 45%, from 5,560 to 3,070. On the other hand, the decline in network activity indicates a decline in investor interest.

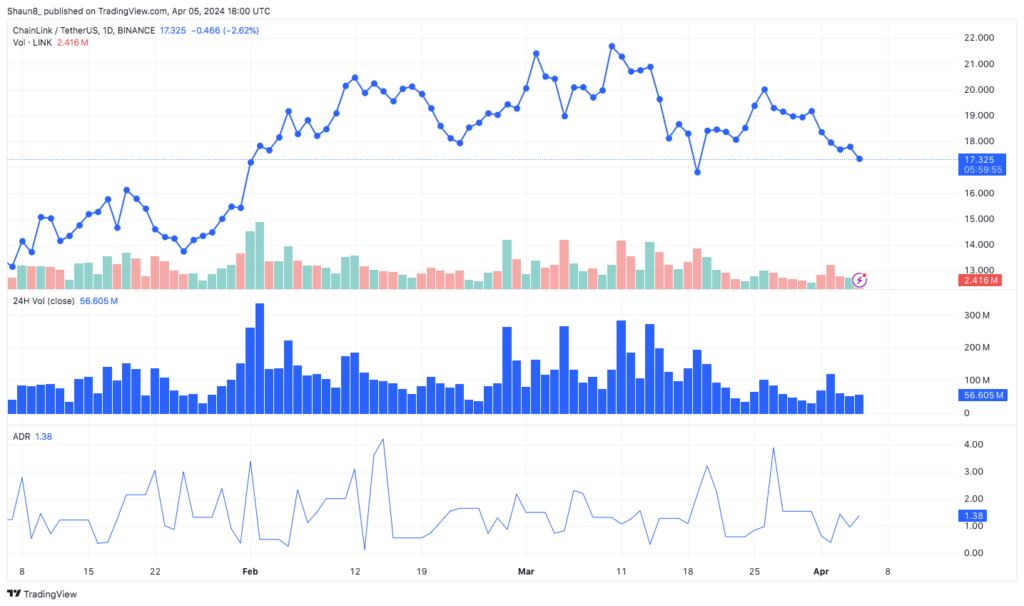

Additionally, the Relative Strength Index (RSI) is currently in a bearish zone below the 40 levels. However, this momentum oscillator suggests that the price is highly susceptible to a sharp correction.

LINK forecast: 21% drop

From a technical point of view, Chainlink is preparing for another correction. A head and shoulders pattern is developing on the daily chart, which is considered a bearish reversal formation. The pattern’s neckline is at $17.85, providing support for the price, but a sustained close below this level could trigger a correction to $14.02, which would represent a 21% drop.

However, a large accumulation of LINK tokens purchased between $15.56 and $17.48 could stop the decline. As investors refrain from selling assets at a loss, this level could provide support for Chainlink. However, the coin will need to consolidate above the $17.85 level to refute the bearish scenario.

About Chainlink (LINK)

The Chainlink network was designed as the first decentralized oracle that aims to provide external data for smart contracts. With its help, you can connect smart contracts with real information – payments or events. Chainlink gives the smart contract access to any external API you want to connect it to. In this way, you can make a payment through a contract to any payment system or banking network. The protocol provides a secure connection to smart contracts on any blockchain. Allows you to receive a variety of types of data: market rates, results of sports competitions, weather, etc.

The LINK token follows the ERC677 standard but runs on top of ERC20 and inherits its functionality. Its main purpose is to pay node operators to obtain data for smart contracts, that is, to extract off-network information flows. Tokens are generated in blockchain-readable formats. In order for a smart contract from an external network to interact with ChainLink, it is necessary to pay a certain amount to the node operator. In addition, the LINK token is used to conduct transactions within the network.