As Bitcoin approaches the 2026 cycle, market conditions point to a growing divergence in sentiment and positioning. While price action remains subdued, underlying supply dynamics suggest that recent weakness may be driven more by structural pressure than broad market fear.

Bitcoin has yet to recover levels seen before the October sell-off. The share of supply in profit has declined sharply, falling from roughly 98 percent before the drop to about 63 percent. This shift has compressed margins across the market and pushed Bitcoin’s Net Unrealized Profit and Loss metric deeper into negative territory, a zone historically associated with late-stage drawdowns.

Despite these conditions, not all signals point to sustained bearish momentum. Instead, a closer look at mining activity and regional flows reveals a more complex picture.

Bitcoin Mining Disruptions Add Pressure to Supply

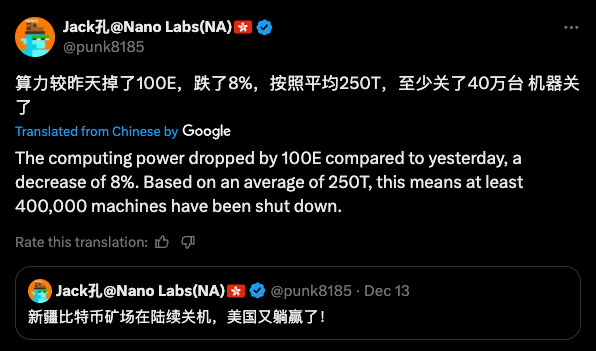

A major source of recent weakness stems from renewed mining restrictions in China. Authorities in Xinjiang have reportedly shut down approximately 1.3 gigawatts of mining capacity, forcing around 400,000 mining rigs offline.

This development has had a measurable impact on the network. Bitcoin’s hashrate dropped by roughly 8 percent within a short period, declining from about 1.12 billion terahashes per second to nearly 1.07 billion. With China estimated to account for around 14 percent of global hashpower, regional policy shifts continue to influence network stability and short-term supply behavior.

Lower hashrate levels place additional strain on miners, particularly those operating with thin margins. As operational costs rise relative to output, selling pressure increases as miners seek to manage cash flow and offset losses.

Bitcoin Long Term Holders and Asian Flows Contribute to Weakness

On-chain data indicates that selling pressure is not limited to miners. Asian exchanges have recorded consistent net spot selling throughout the fourth quarter, reinforcing the regional nature of the current drawdown.

At the same time, long term holders have begun reducing exposure. Selling activity among this group has increased over the past several weeks, suggesting that prolonged price stagnation is testing conviction even among historically resilient investors.

These combined factors help explain Bitcoin’s recent underperformance. However, they also highlight that selling is concentrated among specific cohorts rather than spread evenly across the market.

Bitcoin Institutional Demand Tells a Different Story

While Asia-driven flows and mining disruptions weigh on price, institutional demand in the United States has moved in the opposite direction. Spot Bitcoin exchange traded funds recently recorded their largest single-day inflow in more than a month, signaling continued interest from long-term capital allocators.

This contrast between regional selling and institutional accumulation suggests that the current drawdown may reflect forced supply rather than panic-driven exits. Miner net position change data supports this view, showing increased distribution tied to operational pressure rather than speculative fear.

A Supply Reset Heading Into 2026

Bitcoin’s setup heading into 2026 appears increasingly defined by a rebalancing of supply. Mining disruptions, margin compression, and selective long term holder selling have capped short-term momentum. At the same time, steady ETF inflows indicate that demand from larger players remains intact.

Rather than signaling a breakdown, current conditions resemble a transitional phase where weaker hands are pressured to sell while longer-term capital quietly absorbs supply. How this dynamic evolves may play a central role in shaping Bitcoin’s next major cycle.