Introduction

It finally happened. Bitcoin flew past the $100,000 mark like a crypto-powered rocket ship, lighting a fire under the meme coin sector. Dogecoin barked. Shiba Inu wagged. PEPE ribbited with excitement. Prices soared—only to wobble a little the next day, because of course they did. Welcome back to Meme Coin Land, where nothing is ever boring.

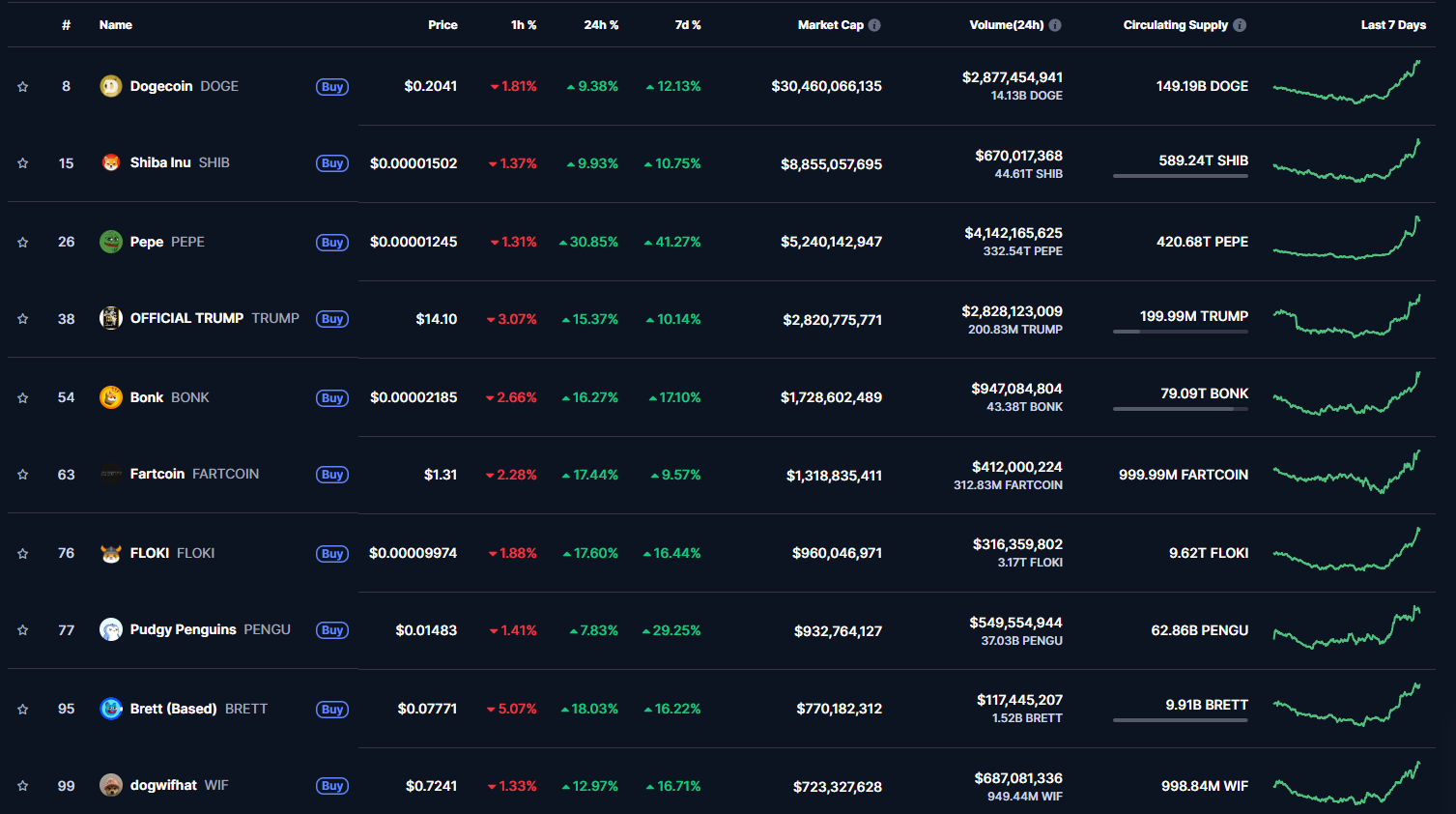

On Thursday, DOGE jumped 10%, SHIB rose 9%, and PEPE croaked out an impressive 30% rally. But by Friday morning, all three were already pulling back, down between 1.6% and 3.5%. Classic meme coin behavior: up like a balloon, down like your mood after checking the chart too late.

MELANIA Meme Coin: The First Lady of Pump-and-Dumps?

In an unexpected twist straight out of a reality show, the MELANIA token—yes, that Melania—made headlines for all the wrong reasons. A Fortune report revealed that savvy (or shady?) traders bought millions in MELANIA tokens before launch, dumped them at peak hype, and walked away with nearly $100 million.

Meanwhile, Financial Times chimed in with claims of insider action. Most of the profits were swapped for USDC, leaving MELANIA’s price down 97% from its high and currently lounging at $0.3437. If you blinked, you missed it. If you bought it, we’re sorry.

Meme Coin Forecast: Who’s Ready for Another Leg Up?

Despite the Friday dip, there’s still bullish momentum in the air. Dogecoin is sniffing toward resistance at $0.21465 and could stretch further to $0.24040. The RSI and MACD indicators are both looking perky, with green bars and upward slopes—exactly what you want if you’re hoping for another moonshot.

Shiba Inu is eyeing a 10% lift, with key resistance levels at $0.00001532 and $0.00001688. It’s already bouncing off support at $0.00001215, and with RSI and MACD on its side, SHIB fans have reason to wag their tails.

But the real scene-stealer? PEPE. Our favorite frog is leaping toward a 27% gain if it can breach resistance at $0.00001206 and $0.00001336. Even if things cool off, there’s strong support near $0.00000828. With RSI at a red-hot 72 and MACD flashing green, PEPE may just be the meme coin to watch.

Beyond the Big Three: New Frogs, Dogs, and… Penguins In the Meme Market?

The meme-coin multiverse is expanding. Alongside the usual suspects, new names are fighting for attention. Trump Coin, Bonk, Fartcoin (yes, really), Pudgy Penguins, and FLOKI are all showing double-digit gains and meme magic potential.

These tokens—many built on Solana and Base chains—are catching fire thanks to Bitcoin’s rally and social media buzz. But keep your helmets on: if Bitcoin sneezes, the meme sector usually gets the flu. Volatility is part of the game, and in memecoin land, it’s always just a tweet away.

Final Thoughts: HODL, Laugh, Repeat?

As Bitcoin teases another run toward its all-time high of $109,000, meme coins are riding the hype train. But remember: what goes up in the world of internet frogs and cartoon dogs often comes down just as fast. Still, for those chasing fun, chaos, and the occasional moonshot, the meme coin market might be the wildest ride in crypto—just don’t forget to buckle up.