The crypto market is seeing a sharp correction in the prices of most cryptocurrencies, but a strange thing is happening – major investors are apparently attracted to Dogecoin, the biggest memecoin by market cap. Interestingly, like how the broader crypto market’s trend is going down now, DOGE price went under $0.18 in the past 24 hours, which is similar to the crypto market crash today.

A sharp drop in the price of this crypto asset with the dramatic whale movement, which involves more than 324 million DOGE traded over the last 24 hours, has stirred up massive interest in the global crypto market. This instantly sparked speculations by crypto traders and investors as to what kind of price action the DOGE might take in the future.

Whale Activity: What Does It Mean?

Whale Alert, a tracking tool that operates on the blockchain, has issued reports that three large whale transactions have moved 324 million coins in the last day. The first transaction showed that the amount of 100 million DOGE, which was equivalent to 17.32 million USD, was sent to the exchange called Robinhood, an American exchange.

On the contrary, the second operation revealed a whale who had collected 150 million DOGE, which can be converted to $26.03 million, from the same exchange. On the other hand, the third transfer revealed 74.02 million Doge worth $12.58 million was transferred to Robinhood, a digital currency exchange, which consequently sparked a frenzy among crypto market traders as a sign of mixed feelings for the asset among whales.

The whales are kicking some out of DOGE while others are accumulating it in the run-up to the pre-halving crash; therefore, crypto market insiders attempt to predict Dogecoin’s price movement. For now, on-chain indicators for the dog-based meme token have been downgraded in line with the coin’s bearish mode today.

Dogecoin (DOGE) Price Plunges

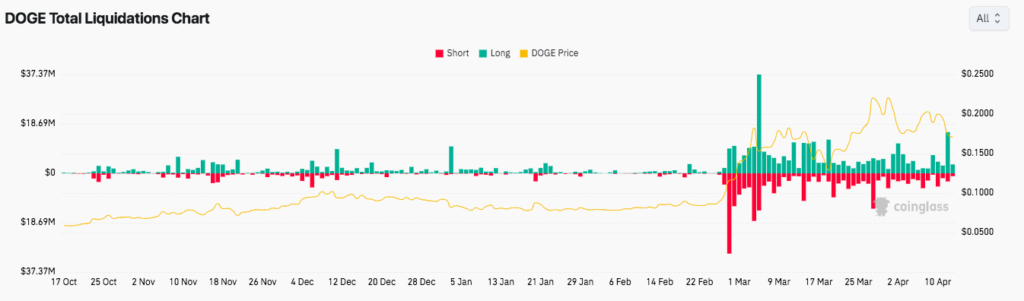

At the moment of writing the DOGE token’s price is down 13.24% from the last day and is now traded at $0.1721. First of all, this decrease is largely attributed to a couple of on-chain factors, including DOGE liquidations and open interest.

According to the data provided by Coinglass, liquidations of DOGE amounted to $21.38 million in the past 24 hours. Long positions accounted for $18.30 million, and short positions accounted for $13.08 million. Such a case, therefore, amplifies DOGE’s price drop by creating a higher selling stress in the market. Although the price of Dogecoin went up, the open interest of the token decreased by 22.43%, which added to the bearish sentiment as investors appear to be losing interest in the token.

This data altogether creates a picture that is too uncertain to define the future of DOGE’s price action, as whales exhibit mixed sentiment, the on-chain data also contributes to the bearish thoughts of Dogecoin. Moreover, the DOGE could as well be pushed to a considerable height following the BTC halving event because the past records suggest that the altcoins are known to mimic the BTC’s price movements after the halving.