The memecoin market has once again shown how volatile it can be by showing it on Dogecoin. After gaining around $10 billion in market value at the start of 2026, the sector quickly lost most of those gains within days. This sharp reversal highlights the high-risk nature of memecoins.

Dogecoin has followed the same pattern. The token is down about 14 percent from its yearly high near $0.15, wiping roughly $5 billion from its market value. The recent drop raises an important question: is this just part of a broader market pullback, or are larger investors starting to exit?

Key Dogecoin Resistance Keeps Holding

From a technical point of view, Dogecoin has struggled to move higher. The $0.15 level has acted as strong resistance. Since losing that level in mid-November 2025, DOGE has failed to break above it four separate times.

The most recent attempt happened about ten days ago. After that rejection, the price fell for six straight days, dropping close to 15 percent. DOGE later bounced around 9 percent, bringing attention back to the $0.13 area.

This rebound has led traders to watch whether $0.13 can act as a reliable support level or if it is only a temporary pause.

Whale Transfer Raises Questions

Dogecoin’s latest move has put large investors under the spotlight. On January 14, DOGE briefly tested the $0.15 resistance before falling back to $0.13.

Normally, strong conviction from large holders could show up as buying during these pullbacks. However, on-chain data suggests a different story.

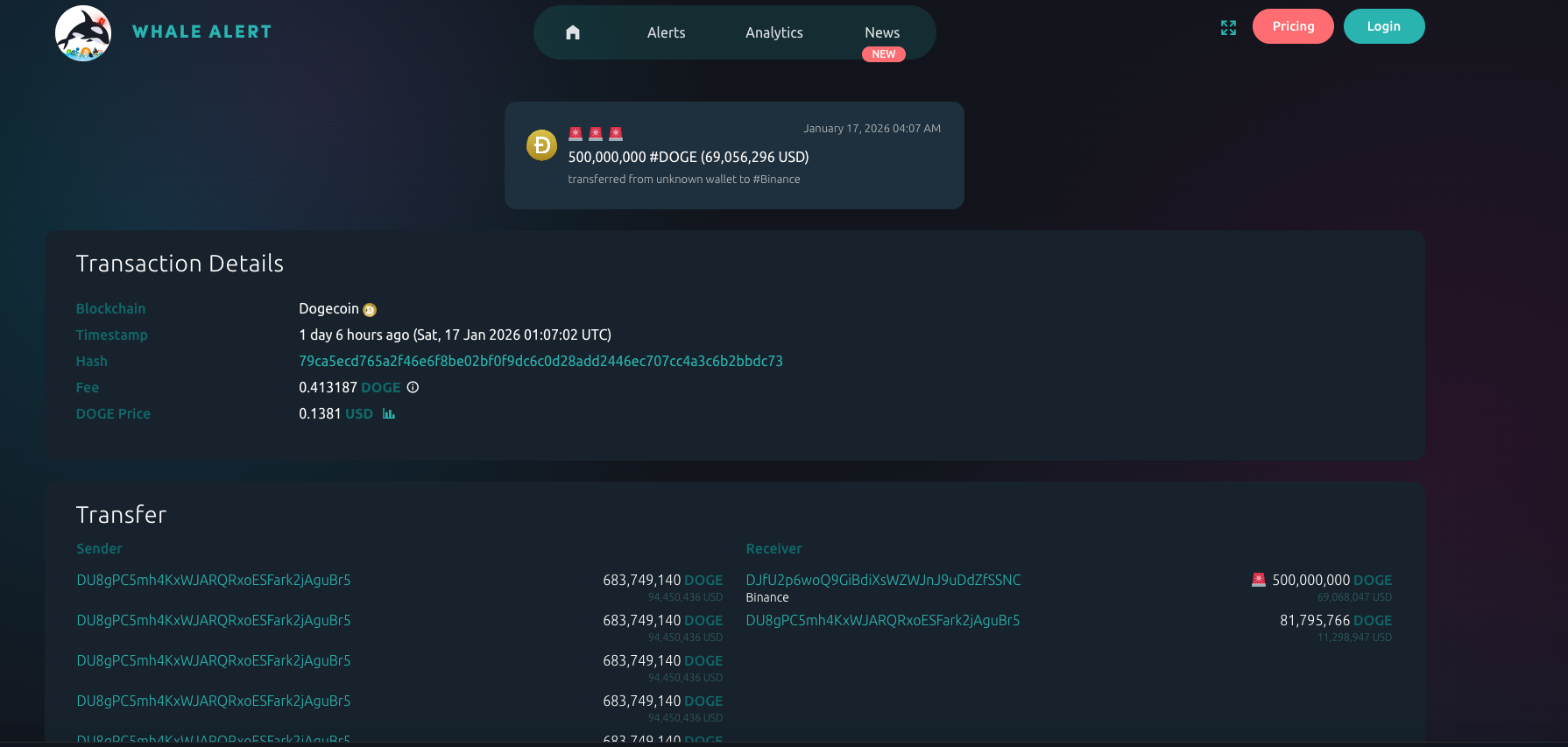

According to Whale Alert, a wallet transferred 500 million DOGE to Binance. Such a large transfer to an exchange is often interpreted as preparation to sell, not accumulate.

This move suggests that some large holders may lack confidence in an immediate breakout.

Sideways Trading Continues for Dogecoin

Dogecoin has remained stuck in a sideways range since mid-November, even after an early January rally that briefly pushed the price up by about 20 percent. Each attempt to break higher has failed, keeping the price locked between support and resistance.

In this context, the recent whale outflow does not appear random. Instead, it fits a pattern where large holders sell near resistance while the market remains uncertain.

Unless buyers step in with stronger conviction and push DOGE above key resistance levels, the price is likely to remain range bound in the near term.