Introduction

Dogecoin (DOGE) is under pressure after a big rally. Its price hit $0.48 recently but fell to $0.39, dropping 3.49% in 24 hours. Market trends and whale activity now suggest more risks for memecoin.

Bearish Trends and Key Levels for DOGECOIN

Dogecoin shows weakness on charts. It trades below the 20-day, 50-day, and 100-day Exponential Moving Averages (EMAs). This points to a bearish short-term trend. The key support lies at the 200-day EMA of $0.34. If DOGE falls below this level, the long-term trend could also turn bearish. A sell signal is forming. The 20-day EMA is nearing the 100-day EMA. If it drops below $0.41 and crosses the 100-day EMA, it will confirm the signal. This could lead to a deeper price drop. The Chaikin Money Flow (CMF) shows a value of -0.02, meaning sellers are active.

If sellers dominate, DOGE could fall to $0.29, near the 1.618 Fibonacci level. On the upside, the $0.42 resistance level, which matches the 50-day EMA, is crucial. If buyers step in, DOGE could retest this level and move higher.

Whale Activity Raises Concerns

Whale Alert data shows two whale addresses moved 146 million DOGE, worth $56.42 million, to Robinhood on December 10. This move might signal plans to sell, as large transfers to exchanges often do. Last month, Dogecoin whales bought large amounts of DOGE. This helped drive its price higher. Now, if these whales start selling, DOGE could lose its recent gains. Whale activity suggests possible profit-taking, which could push prices lower.

Declining Speculative Interest In DOGECOIN

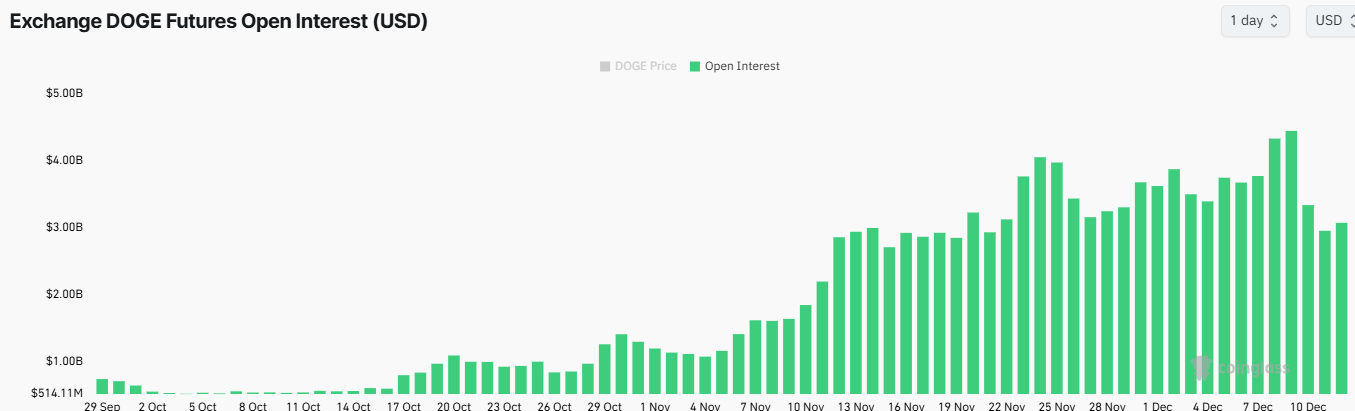

Speculative interest in Dogecoin is fading. Open Interest (OI) reached a high of $4.45 billion on December 9, tripling in one month. But in the last two days, OI fell to $2.95 billion, a $1.5 billion drop.

This decline shows traders are closing positions. Derivative trading volumes also dropped by 34% to $14.23 billion, per Coinglass. Lower trading activity may reduce price volatility. This could lead to a consolidation phase for DOGE.

Market Sentiment Turns Bearish

Market sentiment for Dogecoin has turned negative. Data from Market Prophit shows both crowd and smart money sentiment are bearish. Traders now expect further price drops. Speculative enthusiasm, which previously boosted DOGE, has faded. This shift highlights weaker confidence in its short-term performance.

What’s Next for DOGECOIN?

Dogecoin faces key challenges. If the sell signal confirms and whale activity increases, DOGE might test $0.34 support or drop to $0.29. But if buyers push prices above $0.42, a recovery could follow. With declining speculative interest and trading activity, DOGE might enter a period of low volatility. Consolidation at current levels could give a clearer direction in the coming days.

Conclusion

Dogecoin’s recent price action and whale moves highlight risks ahead. Its short-term trend remains bearish, with key support and resistance levels in focus. As traders close positions and market activity slows, DOGE’s future depends on whether buyers or sellers take charge.