Ethereum’s much-anticipated Dencun upgrade is poised to be deployed on the Ethereum mainnet at epoch 269568, following the successful activation of the Dencun network upgrade on all testnets. The Dencum upgrade is projected to occur around 2 pm UTC, according to the ETH Foundation. The sentiment surrounding the Dencun hard fork has propelled ETH price to exceed $2500 and even $4,000. Traders are now anticipating ETH price to reach $5000 post the upgrade.

Ethereum Price to $5000

The Ethereum Dencun upgrade represents a significant advancement that will have a broader impact on the ETH ecosystem. The upgrade will finally implement EIP-4844, also known as “protodanksharding”, which will markedly reduce L2 transaction costs.

While a decrease in transaction fees itself is a major factor for an uptick in prices, derivatives data provides crucial signals for upcoming ETH price trends.

The Ethereum futures OI reaches an all-time high of $14 billion, marking a 3% increase in 24 hours and 1% in the past 4 hours. Binance, Bybit, OKX emerge as the top three exchanges with a 2-3% surge. Meanwhile, CME and Deribit record a 5-6% surge in ETH OI, indicating significant buying from institutional investors.

Furthermore, Ethereum options OI has also attained a new all-time high of $14.77 billion. Call options open interest stands at 65.87% and put options open interest at 34.13%, bolstered by substantial volumes for calls.

Deribit data demonstrates a put-call ratio of 0.65 in the last 24 hours, with 112,304 put volume and 172,958 call volume. Additionally, options traders are becoming more active amid the ETH Dencun upgrade. Traders initiated 44.8K calls for a strike price of $4500 and 50.9K calls for $5000 before March 29.

Analysts Predictions on ETH Price

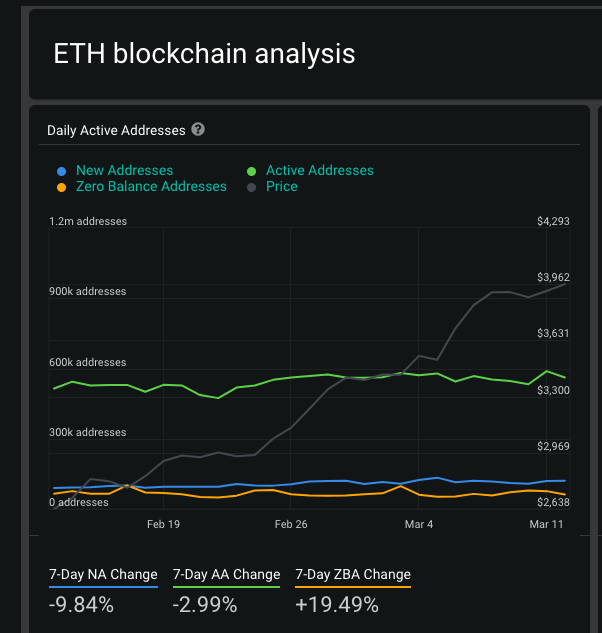

Prominent crypto analyst Ali Martinez disclosed that the crypto market is experiencing a massive influx of approximately $83 billion. Notably, Bitcoin and Ethereum account for $75 billion of the total money inflow, as per Glassnode. Furthermore, the impending Ethereum ETF remains a significant factor for the recent surge in adoption despite a decline in odds of Ethereum ETF to 30% by Bloomberg ETF analysts.

#Ethereum path to $5,000 looks increasingly clear, as resistance thins. The key hurdle? A supply zone at $4,522-$4,646, where 600,000 addresses hold 1.63 million $ETH. It’s not a matter of if, but when! pic.twitter.com/LMvw3kjrEW

— Ali (@ali_charts) March 11, 2024

Renowned trader and analyst Michael van de Poppe remarked, “It’s only a matter of time until ETH begins to pick up.” He advises traders to monitor the ETH/BTC pair chart for further confirmation of another rally in altcoins as BTC price cools down. If ETH price breaches the supply zone near $4550, it could easily reach $5000.

ETH price surged by 1% in the past 24 hours, with the price currently hovering at $4,056. The 24-hour low and high are $3,831 and $4,083, respectively. Moreover, trading volume has surged by 20% in the last 24 hours, indicating a rise in interest among traders.