Ethereum saw a significant decline in price after it fell below $3000. Nevertheless, the recovery of the market pointed out the volatility of the market and how cryptocurrencies are having a hard time coping with the challenges that are being thrown at them. At the time of writing, Ethereum is trading at $3,002 and is bouncing off the lower boundary of a falling wedge . The asset has been in this pattern for the past two months, and the fall below $3,000 only confirmed the bullish reversal pattern.

The likely movement from here will be an impulse to break the upper trend line. If it is successful, ETH will rise to $4,000. On the other hand, Bitbot emerges as a game-changer in the cryptocurrency world, boasting AI-powered trading and non-custodial solutions. Surpassing $3 million in its presale, Bitbot’s innovative approach and strategic focus promise a revolutionary trading experience.

Ethereum Rebounding Amidst Resistance

The price of ETH dropped after the test of the $2,820 support zone, and then the recovery started, surpassing significant resistance levels at $2,880 and $2,950. Meanwhile, this was especially significant because it also involved a decisive breakout of a bearish trend line at $3,000 on the hourly chart of ETH/USD. Yet, the upward trend faced a barrier at 100-hourly SMA, placing Ethereum below $3,030 and above the 100-hourly SMA.

On the other hand, increasing bearish sentiment among investors could jeopardize the rally’s potential. Failure to hold the $3,000 level will result in a collapse to $2,800, which will invalidate the bullish thesis and send the altcoin towards $2,740.

Market to Realized Value Ratio (MVRV) supports growth opportunity. However, Ethereum’s 30-day MVRV is at -8%. Historically, recoveries have occurred in the range of -4% to -10%, so the current situation looks like a great opportunity for accumulation.

Ethereum: Key Resistance and Support Levels

The Ethereum next resistance level is seen around the $3,030 mark, and the first major resistance lies at $3,050. Up the hill, the next barrier of the support is the 50% Fibonacci retracement level at $3,085, which is the high of $3,355 and the low of $2,813. In addition, a breakthrough in these resistance zones could potentially be the first step toward a steady rise towards $3,150.

On the contrary, a market downturn could be the result of an outcome that is below the $3,050 level. It is supported initially at $2,940, followed by the vital $2,880 zone. The primary support still holds at $2,820, and a clear break below this level might trigger further selling and push the price to $2,740 and the $2,650 mark in the short term.

Bitbot Success and Enhanced Product Offering

Bitbot, the AI-powered Telegram trading bot, has made waves in the crypto world by surpassing the $3 million mark in its presale. This achievement comes on the heels of Bitbot’s updated product offering, which now includes a layer of AI development integrated into its blockchain analysis tool, Gem Scanner.

As the project enters stage 12 of its 15-stage presale, anticipation is high for the upcoming launch of the BITBOT token in the open market later this quarter. Bitbot’s community has grown significantly, with over 140,000 members and strong engagement on platforms like X and Telegram. The team is banking on this growing community to translate into a substantial customer base upon the product’s official launch, slated for later this year.

Bitbot Strategic Focus on AI and Non-Custodial Trading

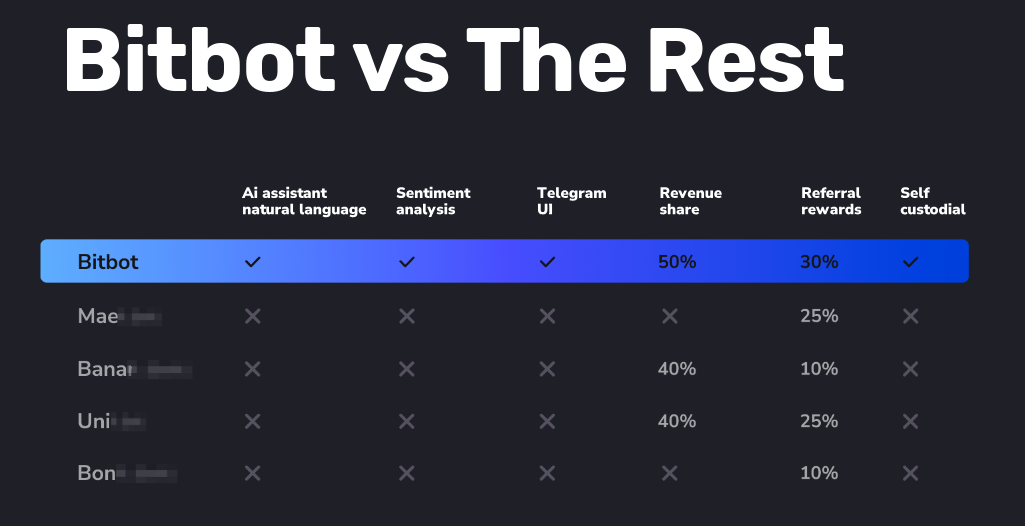

Bitbot’s success isn’t just about numbers; it’s about innovation. By introducing AI capabilities into its trading engine and offering the world’s first non-custodial Telegram trading platform, Bitbot is positioning itself as a game-changer in the industry. This approach ensures that users’ funds remain secure, transferring only upon completion of trades.

The recent rebranding efforts, including a revamped website and a spotlight on Bitbot’s AI features, have played a crucial role in attracting investor interest during the presale. With a strategic partnership in place and a focus on enhanced security measures, Bitbot is poised for an exciting market outlook, aiming to outperform its competitors and deliver a cutting-edge trading experience to retail investors.