Whales, large cryptocurrency investors, are stocking up on Ethereum (ETH). In April, they bought and withdrew coins worth hundreds of millions of dollars from exchanges. Lookonchain analysts drew attention to the activity of investors, and members of the crypto community voiced possible reasons for this behavior of whales.

Whales are Stocking More Ethereum

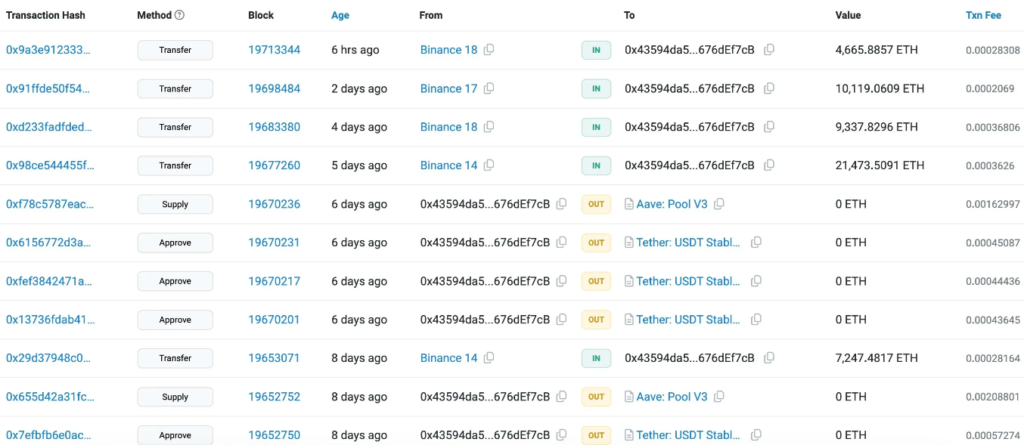

Analysts have paid attention to the activity of whales stocking ETH. For example, an anonymous person withdrew 7,182 ETH ($23.06 million) from Binance, and another user transferred 11,892 ETH from the exchange for $37.77 million. The Lookonchain team tracked these and other transactions through blockchain explorers.

According to analysts, Justin Sun, the founder of the Tron crypto project, may be among the whales that are actively stocking Ethereum. The activity of the wallet (0x4359), which presumably belongs to the businessman, indicates the active accumulation of ETH. However, and according to analysts, the owner of the wallet has bought $420 million worth of Ethereum since April 8, 2024.

Why whales are interested in ETH?

Members of the crypto community have speculated that whales are purchasing ETH in anticipation of the possible approval of spot Ethereum ETFs in the US. Moreover, the tool can democratize investments in the second largest cryptocurrency by capitalization. The deadline for applications from a number of market participants to launch spot Etheruem-ETFs will come in May 2024.

The main obstacle to the launch of the tool is pressure from the US Securities and Exchange Commission (SEC). The regulator sees signs of an illegally issued security in ETH. Unfortunately, in the United States there is no full-fledged legal framework that could clearly answer the question of whether a particular digital asset is a security. Moreover, to determine the status of an asset, American regulators still use the outdated Howey test, which appeared long before the launch of the first cryptocurrency.

Ripple Case Outcome Hinges on SEC Dispute with Ethereum Team

The SEC’s dispute with the Ethereum team could decide the outcome of California’s Ripple case against the Commission. In December 2020, the regulator accused the project of illegally issuing and selling securities in the form of tokens (XRP). Over the years of the showdown, the SEC was never able to prove Ripple’s guilt, while the court still doubted the legality of institutional sales of the coin.

As of April 2024, the confrontation between the parties was reduced to a discussion of the amount of the fine that the project would pay to the Commission to resolve the conflict.

Ripple’s victory over the SEC could give the green light to the launch of spot Ethereum-ETFs, since the triumph of the Californian project will prove the unfoundedness of similar claims by the regulator against other companies, and therefore will remove regulatory pressure from ETH. Therefore, many market participants see the parties’ bidding for the fine amount as a positive signal for Ether ETFs.

However, many market participants doubt that the Commission will allow the launch of the instrument. For example, crypto lawyer Jake Czerwinski believes that the difficult political situation in Washington is playing against the launch of spot Ethereum-ETFs in May. While the US is still discussing the viability of spot Ethereum ETFs, Hong Kong regulators have approved several applications to launch the instrument.

However, many market participants doubt that the Commission will allow the launch of the instrument. For example, crypto lawyer Jake Czerwinski believes that the difficult political situation in Washington is playing against the launch of spot Ethereum-ETFs in May. While the US is still discussing the viability of spot Ethereum ETFs, Hong Kong regulators have approved several applications to launch the instrument.