Introduction

With Bitcoin finally cooling off from its turbo-charged rally, the crypto spotlight has shifted to two surprising co-stars: Ethereum and PEPE. And while ETH is calmly strutting higher like a professional, PEPE’s been acting more like a sugar-rushed frog on a trampoline—chaotic, unpredictable, and strangely exciting.

Ethereum has pulled off a graceful 3%+ weekly gain streak, slow and steady like it’s running a marathon. PEPE, on the other hand, is bouncing around in tight ranges, teasing traders with possible breakout energy but delivering mostly sideways action… for now.

So the question becomes: is Ethereum the quiet winner of this rotation cycle, or is PEPE just stretching before launching into a face-melting breakout?

ETH Looks Mature, PEPE Looks Mischievous

Zooming out, Ethereum’s price action is looking impressively composed. Institutional players are treating $2,500 like the Costco of crypto—stocking up every time it dips. With momentum indicators like MACD staying bullish, ETH seems poised for another leg higher as long as Bitcoin keeps behaving.

But don’t write off PEPE just yet. While Ethereum’s playing the polished long-game, PEPE is that high-risk, high-reward player who turns up late but still walks away with the biggest gains. After a 60% rally in just 10 days and a breakout above January’s resistance, PEPE reminded everyone it can sprint when it wants to.

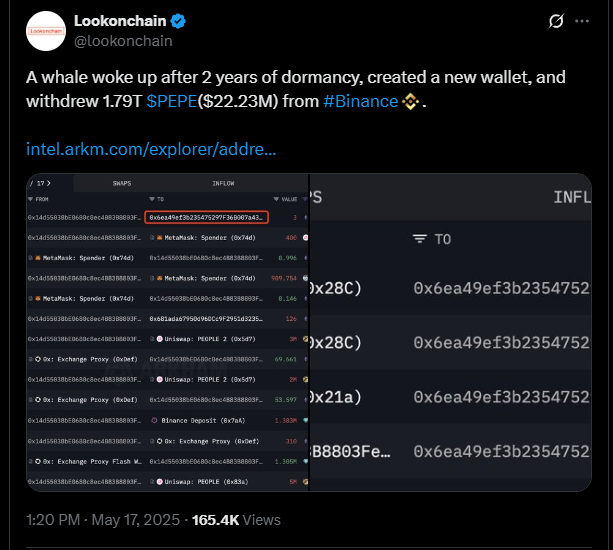

Of course, the party cooled this week with a 4.5% pullback—probably from profit-hungry traders jumping ship. Still, on-chain whispers suggest whales aren’t worried. In fact, Lookonchain spotted a wallet that had been snoozing for two years suddenly moving 1.79 trillion PEPE (worth over $22M) off Binance. Translation? Big players might be getting ready to reload.

PEPE vs Ethereum: Capital Rotation Gets Spicy

In the great rotation of crypto capital, both ETH/BTC and PEPE/BTC are showing strong support bases. Smart money appears to be shuffling funds between these two, looking for that sweet volatility edge. And surprise—PEPE just posted a red-hot 72% monthly gain, outpacing Ethereum’s already-solid 50%.

But let’s be clear: PEPE’s volatility is no joke. Its pair dumped nearly 15% in five days, compared to ETH/BTC’s gentle 5% slide. That kind of whiplash isn’t for the faint of heart.

Still, with BTC grinding sideways and altcoin hunger back in the air, PEPE might be setting up for another explosive leg up—especially if that $0.000012 support shelf holds strong.

Steady Steps or Rocket Jumps—Who Wins This Round?

The crypto battlefield right now is less about who moves first and more about who moves best. Ethereum is your trusted tank—slow, steady, strong. PEPE is the wild card—chaotic, unpredictable, but potentially game-changing.

If the current trend holds, PEPE could retest $0.000015 and maybe even leapfrog Ethereum in short-term gains. But ETH, with its solid fundamentals and whale-friendly price zones, remains the heavyweight in the room.

So, are you betting on the disciplined runner… or the frog with a jetpack?

Either way, grab popcorn. This altcoin standoff is just getting started.