Kaiko Research recently announced that the approval of spot Ethereum ETFs by regulatory bodies signals a bullish future for the digital asset, despite some immediate market challenges. The firm emphasizes that this development dispels much regulatory uncertainty surrounding ETH’s classification, thereby fostering its long-term growth.

Ethereum ETFs Await Final SEC Greenlight

Will Cai, Head of Indices at Kaiko, remarked on the implications of the SEC’s decision, indicating a pivotal shift in how Ethereum is perceived by regulatory entities. “The SEC’s approval is a clear indication that ETH is treated as a commodity rather than a security,” he stated. This perception is critical as it likely sets a precedent for the treatment of similar digital tokens in the U.S. market.

Moreover, Cai highlighted that while the approval is a significant step forward, the complete regulatory process requires further developments. The SEC has approved the ETFs’ 19b-4 filings but still needs to approve S-1 orders. The anticipation is that spot Ethereum ETFs could launch within weeks or months, marking a significant moment in cryptocurrency investment avenues.

Grayscale Ethereum Fund Braces for Outflows

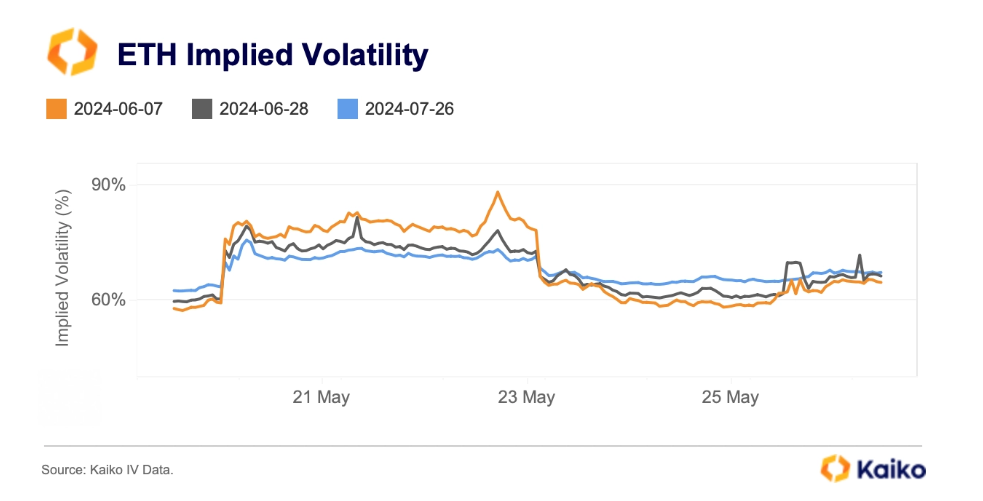

Despite the optimism, Kaiko predicts some potential short-term volatility, especially concerning Grayscale’s Ethereum fund, ETHE. With $11 billion in assets under management, the fund might see significant outflows, which could exert downward pressure on Ethereum prices. Kaiko estimates about $110 million in average daily outflows from ETHE once it transitions to an ETF.

This scenario mirrors the experience of Grayscale’s Bitcoin fund, GBTC, which witnessed outflows amounting to 23% of its AUM during its first month of ETF trading. However, it is noteworthy that other ETFs eventually offset these outflows, indicating a possible balance that could emerge with Ethereum as well.

Hong Kong ETH ETFs See Net Outflows

Kaiko also turned its focus to the global scene, particularly the underwhelming performance of Ethereum ETFs in Hong Kong. Since their inception in early May, these ETFs have recorded $4.4 million in net outflows, contributing to the uncertainty about how U.S. market developments might unfold.

Additionally, the analysis of centralized exchange data reveals that ETH market depth is currently about 42% below its average levels before the FTX collapse, and the U.S. market concentration has decreased from 50% to 40% since early 2023. These figures highlight the shifting landscape of ETH trading and the broader implications of regulatory and market changes on its accessibility and stability.