The first day of trading in spot ETFs on the second-largest cryptocurrency by market cap, Ethereum, took place in the US. As with Bitcoin funds earlier this year, Grayscale spoiled the picture. In this article, we’ll tell you how the first day of trading in spot Ethereum ETFs went and what market participants expect from the instrument.

The Road to Ethereum ETFs in the US

The first step toward approving spot Ethereum ETFs trading in the U.S. is the launch of a similar Bitcoin-based instrument in January 2024. Meanwhile, the crypto community members have been pushing for its emergence since 2013.

In 2024, the US Securities and Exchange Commission (SEC) stood in the way of launching spot ETH ETFs in America. In March, information appeared online that the regulator saw signs of an illegally issued security in Ether. Due to regulatory pressure, the launch of spot ETH ETFs in the US was in question. Meanwhile, the situation was resolved in June. On the other hand, the SEC dropped its claims against ETH, thereby confirming the legal status of the cryptocurrency. The “green light” from the Commission made it possible to launch spot Ethereum ETFs in the US.

How did the first day of trading go?

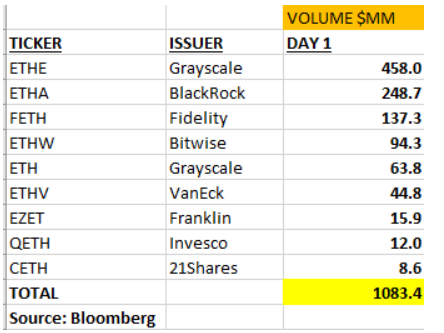

Spot Ethereum ETFs trading volume in the US exceeded $1 billion on the first day, according to Bloomberg analyst Eric Balchunas. Grayscale’s Ethereum fund was the leader.

Balchunas observed that spot Ethereum ETFs trading volume was 23% of spot Bitcoin ETFs trading volume on launch day.

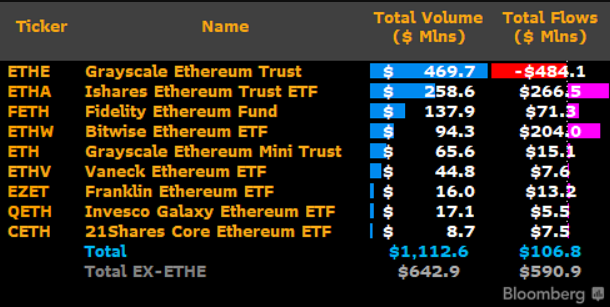

According to Bloomberg analyst James Seyffarth, the net inflow into spot ETH -ETFs exceeded $106 million at the end of the first day. In his opinion, the result was decent. The best result (+$266.5 million) was demonstrated by ETHA from BlackRock.

The picture was spoiled by the new Grayscale crypto fund. Meanwhile, the company transformed its ETH trust into a spot fund. Against the backdrop of the changes, investors were able to fix profits. As a result, the new ETH fund faced an outflow, which harmed the overall statistics. In addition, over $484 million was withdrawn from the instrument on the first day.

Grayscale previously similarly transformed its Bitcoin trust into a spot Bitcoin ETF. The transformation triggered a massive outflow of funds from the instrument, putting BTC under pressure.

“Damn. That’s a lot. About 5% of the fund. Not sure if the ‘newbies’ will be able to offset that kind of outflow with their own capital inflow. On the other hand, maybe it’s better to get it over with [Grayscale’s Ethereum fund sell-off] as quickly as possible, like ripping off a band-aid,” said Eric Balchunas on the Grayscale Ethereum fund sell-off on the first day.

ETH Reaction

Ethereum has shown negative dynamics amid the launch of spot ETH-ETFs trading in the US. One of the reasons for the decline in Ether could be the pressure that the cryptocurrency came under amid the sell-off from the Grayscale Ethereum fund.

Also, against the backdrop of the launch of the instrument, many participants in the crypto community, remembering the correction of Bitcoin against the backdrop of the start of trading in the spot BTC-ETFs in the US, rushed to fix the profit. Moreover, such behavior of representatives of the crypto industry could put additional pressure on Ether.

What’s next for Ethereum?

Many crypto community members believe that ETH will be able to overcome Grayscale pressure and please its investors in 2024. For example, the positive forecast for ETH was supported by trader Doctor Profit. Also, he expects ETH to enter parabolic growth. In his opinion, Ethereum’s small capitalization compared to Bitcoin will allow the cryptocurrency to surpass BTC’s results.

Doctor Profit believes that within a year after the launch of spot ETH-ETFs in the US, Ether will be able to reach $10-14 thousand. The trader’s opinion was supported by many other crypto bloggers. For example, technical analyst Yoddha also expects an ETH rally. However, unlike Doctor Profit, he believes that the positive momentum can take Ether to higher levels. His Ethereum forecast does not exclude ETH at $17,000 by the end of the year.