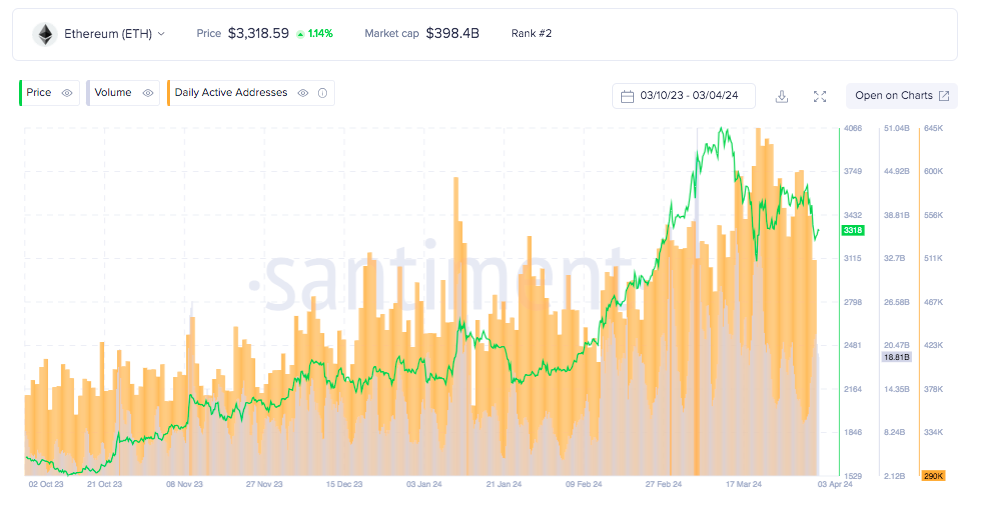

Let’s figure out why there may be an increase in bearish activity regarding Ethereum (ETH) in the very near future. Ethereum price is trading below two major support levels after a sustained decline over the past week. At the same time, bearish activity is likely to increase in the coming days, since ETH is currently forming a market top.

Ethereum may fall below $3,000

Despite the recent drawdown, Ethereum price tried to recover above the $3,500 mark but failed. As on-chain data shows, more than 96% of the entire token supply is currently in the profit zone. This situation confirms the thesis about the formation of a market top.

A market top is the highest point reached by the price of an asset before the start of a downtrend. It marks the peak of investor optimism and often precedes a correction or downturn in the market. This is confirmed when more than 95% of the supply of an asset is in profit. Thus, the likelihood that ETH will continue to decline is very high.

In addition, ETH remains under sustained selling pressure, with supply of the token on exchanges increasing over the past couple of months. This resulted in more than 2.31 million ETH entering exchanges, worth over $7.6 billion. If the selling continues amid bearish sentiment, the price will find it difficult to recover, causing ETH to fall further.

ETH Price Forecast

Ethereum price is currently hovering around $3,300. It has already lost support from the 50 and 100-day exponential moving averages (EMA) and is also below the $3,336 support line. This makes ETH highly vulnerable to testing the next critical price point at $3,031.

A fall to this level seems likely, and if the above conditions persist, ETH could fall below $3k. However, if Ethereum rebounds from $3,031, it could very well begin to recover or slow its decline. This will give the price the opportunity to regain the $3,336 level and refute the bearish scenario.