Introduction

Ethereum’s price has been uncertain, and investors are trying to figure out what happens next. Some data suggests that people are buying more ETH, while other signs show that Ethereum is struggling to break past key resistance levels. If ETH can hold support and push higher, it might reach $2,000 soon. But if it loses momentum, it could drop to $1,500.

Are More People Buying Ethereum?

Ethereum’s exchange netflows give clues about investor behavior. This data tracks how much ETH is moving in and out of exchanges.

- In May 2021, Ethereum’s netflows peaked at 1.28K, and ETH’s price was $4,000.

- By September 2022, more ETH was flowing into exchanges, and the price dropped to $1,200.

- In May 2024, netflows balanced out, and ETH stayed around $3,800.

- By early 2025, Ethereum saw 250K more outflows, meaning investors were taking ETH off exchanges, which usually signals accumulation.

When more ETH is taken off exchanges, it often means investors expect the price to go up. If this trend continues, ETH might reach $2,000 soon. But if ETH starts flowing back into exchanges, it could mean people are selling, which might push the price down to $1,500.

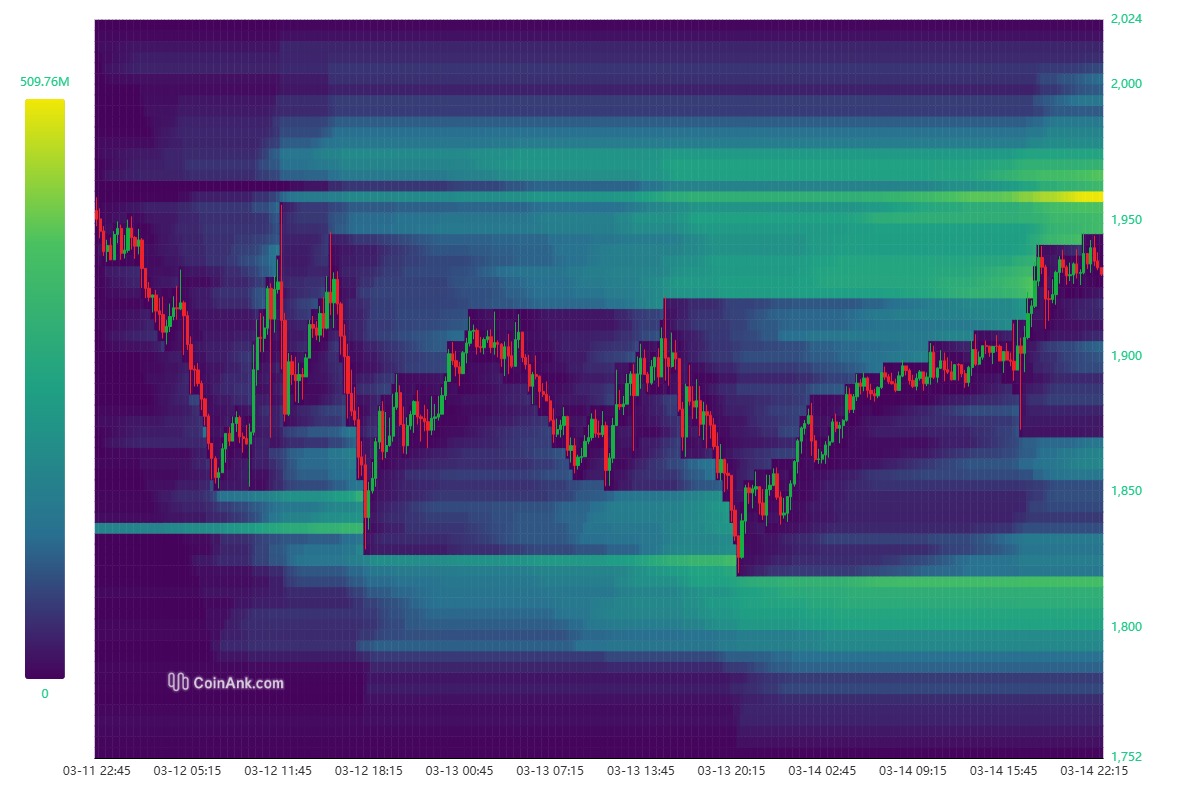

Where Is Ethereum Facing Resistance?

Ethereum’s liquidation heatmap shows key price levels where traders could get forced out of their positions. Right now, there are big liquidation levels at:

- $1,850 – $1,900 → This is a tough resistance zone, with traders holding $87.62M in leveraged positions.

- $1,800 → Another major level with $64.54M at risk.

- $1,750 → A lower zone with $45.4M in liquidations.

ETH is currently trading at $1,894, which means it’s right under a major resistance level at $1,900. If ETH pushes past this, it could hit $2,000. But if it fails to stay above $1,850, it might drop to $1,700 or lower, triggering more selling pressure.

Are Most Ethereum Investors Making or Losing Money?

A break-even price analysis helps us see how many people are in profit or at a loss.

- 33.6% of ETH holders are making money because they bought at a price lower than $1,803.

- 64.54% of ETH holders are at a loss because they bought ETH above $1,985.

- 1.86% of ETH holders are at break-even, meaning they bought ETH at $1,894.

Ethereum’s price is right in between these two ranges. If it stays above $1,850, there’s a chance it could break out toward $2,000. But if buyers can’t hold the price, ETH could fall toward $1,800 or even lower.

What Will Happen Next?

Ethereum’s price is at a critical point. Right now, ETH is seeing accumulation, with investors pulling 250K ETH off exchanges. But $1,900 is a tough resistance level, and many traders might sell if ETH doesn’t break through. If ETH holds support at $1,850, it could move toward $2,000. But if selling pressure increases, forced liquidations might push the price down to $1,500. The next few days will be important in deciding where Ethereum goes next.

Conclusion

Ethereum’s price is stuck between key levels, with investors buying but strong resistance at $1,900. If ETH breaks through resistance, it could reach $2,000 or higher. But if it fails to hold support, it could drop to $1,500. Investors should watch closely to see which way the market moves next.