Last week’s sell-off signaled a correction for ETH and dragged the price to a low of $1470 earlier this week. Surprisingly, this low held as solid support for a fresh bullish wave. This rebound came earlier than expected!

Things have changed so quickly, as Ethereum witnessed a fast recovery over the last 24 hours of trading. It took many by surprise with the current surge in volatility across the crypto space.

This volatility inflow was led by the sudden upswing in Bitcoin’s price, which puts the second-largest crypto by market cap above $200 billion.

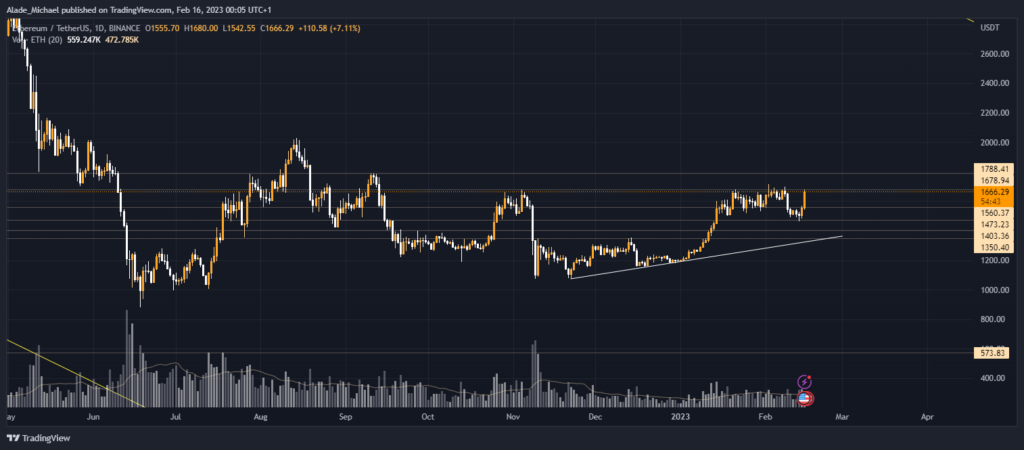

A daily 7.3% recovery has bought ETH back to around its previous multi-month resistance level. It trades at $1,666 and is now on the verge of breaking out. Undoubtedly, it is important to note that the bulls are back at full speed.

Meanwhile, the expected correction level was the $1350 – $1400 price range, where the diagonal support line is drawn. But unexpectedly, Ethereum found solid support nearby and rebounded far above those price ranges.

The newly initiated leg-up is expected to hit $2k with a big price movement in the coming days. However, it may face some hurdles around the $1.7k level before soaring higher.

As of now, buy orders are getting filled faster than sell. If ETH continues to experience a high bid, more volumes will keep the price rising in the near term.

Ethereum Key Level To Watch

The price is currently facing a resistance level of $1,678. If it flips this holding resistance, the next stop would be $1,788 and $1,950. The resistance to watch above the $2k lies at $2,170 and $2350.

Ethereum has left some crucial support untested. But if the asset attempts a pullback, the level to consider for support is $1,473, followed by $1,403. There’s also support at $1,350, which remains a key untested level.

Key Resistance Levels: $1,678, $1,788, $1,950

Key Support Levels: $1,560, $1,473, $1,403

- Spot Price: $1,666

- Trend: Bullish

- Volatility: High

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Image Source: forplayday/123RF // Image Effects by Colorcinch