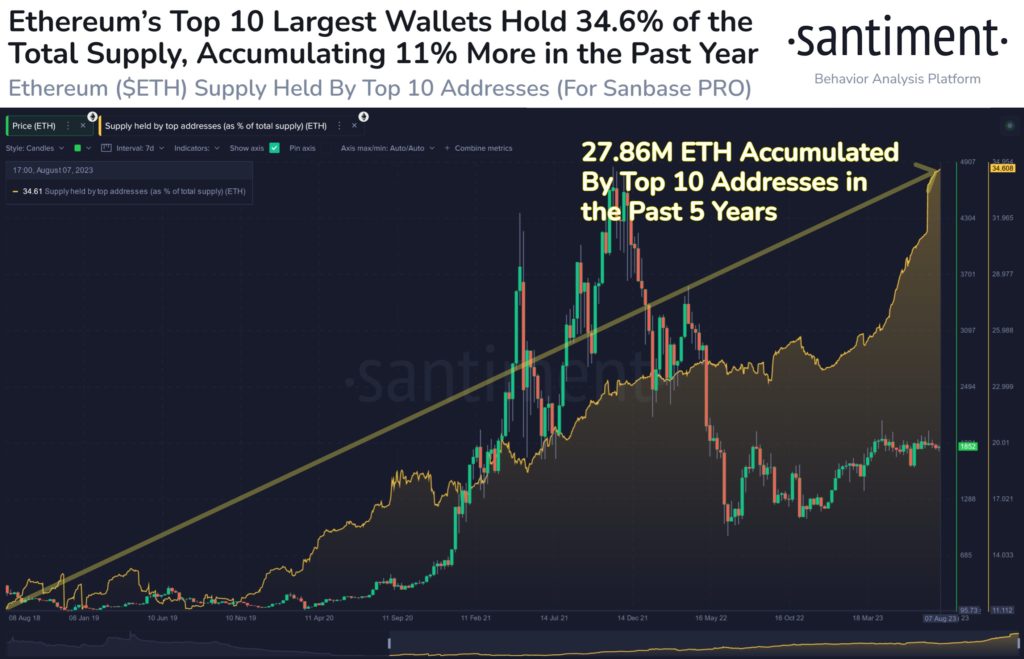

The recent trend of accumulation among Ethereum’s top addresses mirrors a similar pattern observed in the Bitcoin ecosystem. Over the past five years, the concentration of Ethereum within the top 10 addresses has risen significantly, expanding from 11.2% to a substantial 34.6% of the total coin supply. This accumulation of Ether by major holders suggests several implications.

Distribution Of Ethereum Supply

Firstly, it underscores the role of wealthy entities, often referred to as “whales,” in shaping the distribution dynamics of cryptocurrencies. Their ability to amass substantial portions of the coin supply can influence market sentiment and potentially impact price movements. This concentration of ownership can introduce a degree of centralization and raise concerns about potential market manipulation.

Increased Interest In Ethereum

Secondly, the accumulation might reflect increased interest and confidence in Ethereum’s long-term prospects. Major holders are potentially positioning themselves for the upcoming bull market run and while some are still waiting on the much talked-about flippening.

27.86 Million ETH Addition

Lastly, the addition of 27.86 million ETH worth $51.6 billion to these top addresses underscores the growing monetary value associated with these holdings. This accumulation could provide these entities with increased influence over network governance decisions, contributing to the ongoing debate about decentralization within the Ethereum ecosystem.

Final Thoughts

Lastly, Ethereum’s top address accumulation trend carries implications for market dynamics, network development, and governance. It highlights the evolving landscape of cryptocurrency ownership and underscores the need for a balanced distribution to ensure the network’s stability and decentralization.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: rastudio/123RF// Image Effects by Colorcinch