A whale transaction involving the movement of 2,000 ETH from Binance has captured the attention of the cryptocurrency community, sparking widespread speculation about its potential impact on Ethereum’s value. Whale movements often indicate upcoming market shifts, and this latest transfer has analysts and investors closely monitoring the market for possible price fluctuations. As the Ethereum network continues to evolve and adapt, this large-scale transaction raises questions about what might come next for ETH in an ever-fluctuating market.

ETH Whale Transfer Details and Strategic Implications

The Data Guru monitoring service observed in a notable development that has set the cryptocurrency community abuzz, a large-scale transfer of 2,000 ETH from Binance. However, this transaction, executed by Whale 0x2C4, involved moving Ethereum valued at approximately $7.84 million to the Manta Network, a privacy-focused blockchain platform. Such whale movements often trigger speculations about market trends and potential price impacts, and this latest activity is no exception.

Whale 0x2C4 executed this transfer just an hour ago. Meanwhile, the whale’s decision to pledge these 2,000 ETH to the Manta Network signifies a substantial commitment to this privacy-centric project. In addition, this move raises questions about the strategic reasons behind such a transfer and its implications for the broader cryptocurrency market.

A closer look at Whale 0x2C4’s portfolio reveals significant holdings across multiple assets, indicating a sophisticated investment strategy. With the recent addition, the whale’s total pledged assets in the Manta Network include 10,535 ETH, valued at approximately $41.4 million. Meanwhile, this substantial ETH holding shows the whale’s strong confidence in both Ethereum and the Manta Network. Besides Ethereum, Whale 0x2C4 holds 248 BTCB, a version of Bitcoin on the Binance Chain, worth about $17 million. Moreover, the whale also possesses a significant amount of Tether, with holdings amounting to 3 million USDT.

Ethereum Current Market Dynamics and Future Speculations

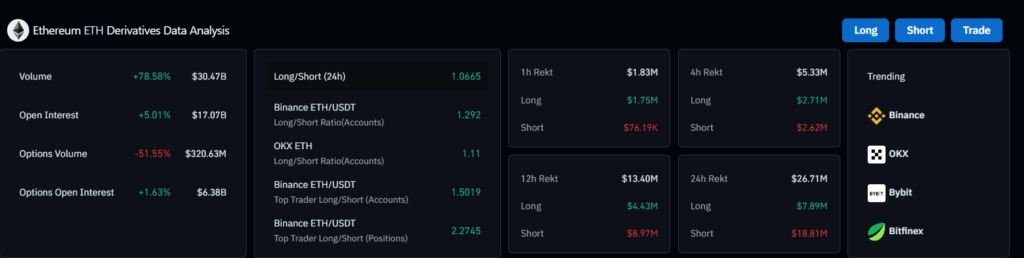

As of today, the live value of Ethereum (ETH) is $3,923.99, with the cryptocurrency’s 24-hour trading volume being $13.8 billion. The coin has surged 4.58% in the past 24 hours and is currently trading between $3,933.31 and $3,828.27. Ethereum’s live market cap stands at $471.4 billion, indicating a robust market presence despite recent fluctuations. Ethereums open interest is currently at +9.92% with a valuation of $13.2 Billion, also the RSI is at the 66.32 Level reflecting potential bullish presence.

Marking a landmark event within the United States’ crypto landscape, the SEC gave 8 spot ETH ETFs a green light via an omnibus order this week. These ETH ETFs included VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK 21Shares, Invesco Galaxy, and Bitwise. The approval of ETH ETFs is a significant development, suggesting increased institutional interest and potential for wider adoption. However, the immediate impact on ETH’s value has been less straightforward than that observed with Bitcoin.