Ethereum giant players made a bold move: unloading more than 430,000 ETH in just two weeks, valued at around $1.8 billion. This sharp reduction in whale balances dragged holdings to multi-week lows, sparking concerns about liquidity and resilience.

Historically, when whales offload in bulk, markets often cool down. Liquidity gets thinner, and smaller investors are left holding the bag. Yet, this time, something different is brewing: retail wallets have quietly stepped up activity, cushioning some of the sell pressure.

The clash between deep-pocketed whales and persistent retail investors may very well decide whether Ethereum sinks further—or stages an unexpected rebound.

Spot trading: heating up or boiling over?

Data from CryptoQuant’s Spot Volume Bubble Map showed Ethereum’s trading activity entering what analysts dubbed a “heating phase.” Large trades lit up the charts across multiple exchanges, proving that ETH isn’t being ignored—it’s being fought over.

But higher spot activity can be a double-edged sword. On the one hand, it strengthens liquidity, allowing markets to absorb whale sell-offs without collapsing. On the other, it raises volatility, as both sides of the trade push harder to dominate short-term price action.

The key mystery here: are these inflows a signal of strong accumulation—or are whales simply unloading into eager retail buyers?

The sell-side story

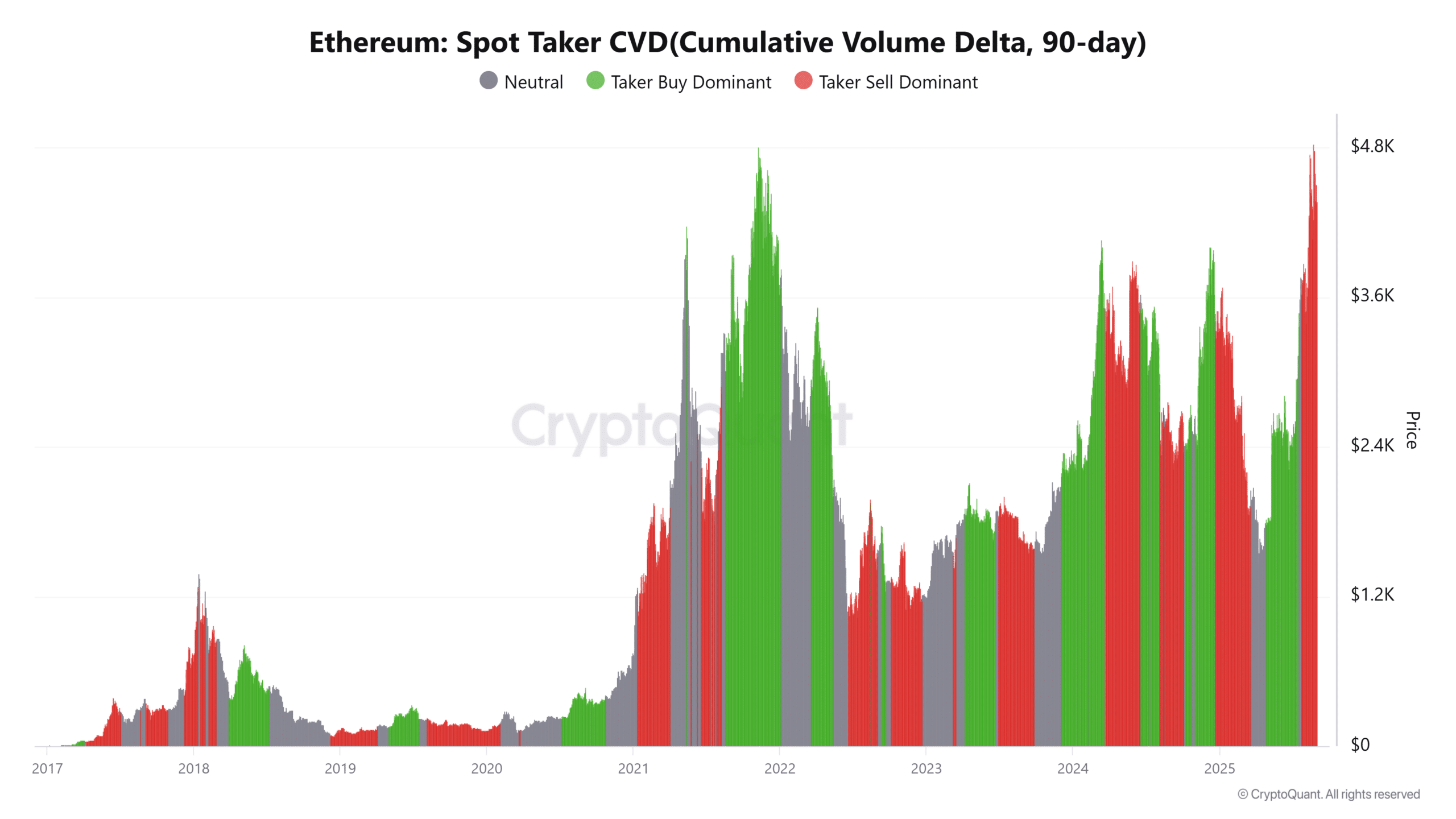

The Spot Taker Cumulative Volume Delta (CVD) over 90 days made one thing very clear: sellers are still steering the ship. Aggressive sell orders continue to outweigh buy demand, reinforcing the narrative that whales hold the upper hand.

That said, history shows that relentless selling doesn’t last forever. Once sellers burn through momentum, exhausted markets often flip sharply, giving buyers the chance to take control.

For now, ETH remains caught in this tug-of-war—bears hold momentum, but bulls are waiting for their chance to pounce.

Leverage: the real powder keg

Ethereum’s leveraged markets have been anything but calm. In the past 24 hours, short sellers got stung the hardest, taking $23 million in liquidations compared to just $2.4 million for longs.

This imbalance revealed that bearish bets have been dangerously overextended. Every time ETH steadies near $4,472, shorts feel the pain. Yet, constant liquidations on both sides suggest the market is hypersensitive, ready to punish any trader who strays too far into leverage.

The message is simple: Ethereum’s price swings are being magnified by leverage, making every move riskier than the last.

Where does ETH go from here?

Ethereum’s current setup looks like a high-stakes poker game. Whales are offloading, retail is trying to fill the gap, and leverage is fueling volatility. On paper, bears appear to hold the upper hand.

Yet, the vulnerability of short sellers signals that one surprise move could flip sentiment entirely. If retail conviction holds strong—and leverage continues to punish overzealous shorts—Ethereum might just stabilize before aiming higher.

The real question: will ETH bend to whale exits, or will the broader market flip the script?