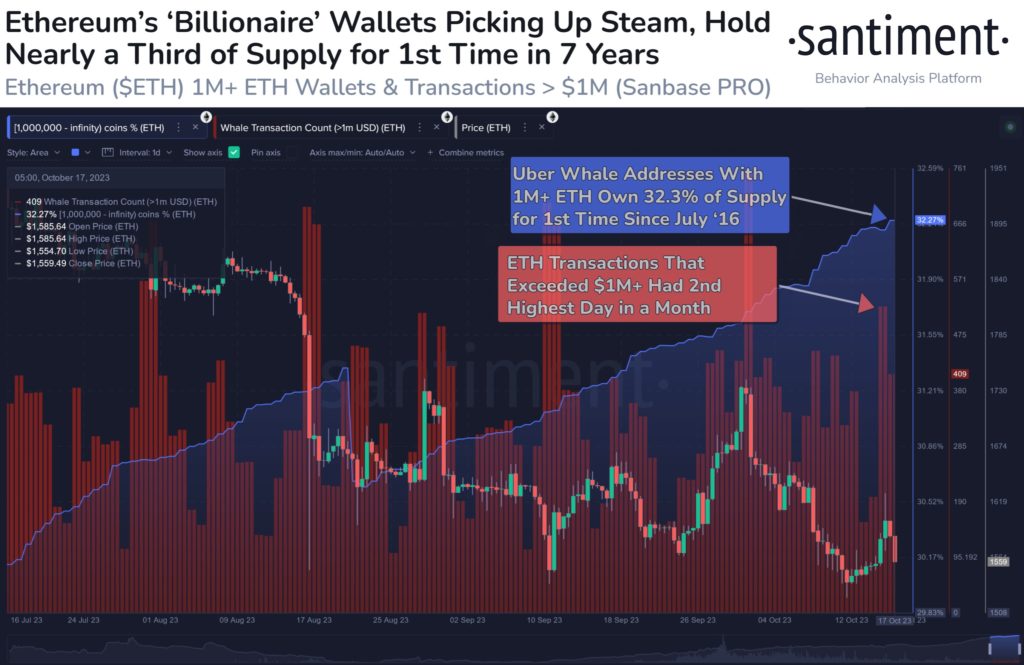

Ethereum, the world’s second-largest cryptocurrency by market capitalization, is witnessing a historic shift in wealth concentration among its top addresses. As billionaire-tier Ethereum addresses, those holding at least 1 million ETH, continue to accumulate, they now collectively control a staggering 32.3% of the available supply. This marks the first time such a high concentration of wealth has been seen since 2016.

Source: Santiment

Wealth Accumulation at Unprecedented Levels

Ethereum’s billionaire whales are amassing their holdings at an unprecedented pace. Their continued accumulation of ETH tokens showcases their confidence in the long-term potential and value of the Ethereum network. As these addresses consistently add to their holdings, they further solidify their status as some of the most influential players in the cryptocurrency space.

High-Value Transactions Surge

Another intriguing aspect of this Ethereum wealth accumulation is the surge in high-value transactions. Yesterday, Ethereum recorded its second-highest day of transactions valued at $1 million or more in the past five weeks. These large transactions often signify significant movements of capital within the Ethereum ecosystem.

Implications for Ethereum’s Future

The increasing concentration of wealth among Ethereum’s billionaire addresses has implications for the cryptocurrency’s future. It may impact market dynamics, trading patterns, and governance decisions. As these addresses grow in influence, they could play a pivotal role in shaping the development and direction of the Ethereum network.

Historic Significance

The current wealth concentration levels among Ethereum’s billionaire whales are indeed historic. Such a high concentration of supply in the hands of a few addresses has not been witnessed for several years. This milestone underscores the evolving dynamics within the cryptocurrency market, where influential players are seizing opportunities to accumulate significant portions of valuable assets.

In summary, Ethereum’s billionaire whale addresses holding 1 million ETH or more are rewriting history with their growing concentration of wealth. As they continue to accumulate, the impact on Ethereum’s market and governance could be profound. This milestone reflects the shifting landscape of wealth distribution within the cryptocurrency space and may have far-reaching implications for Ethereum’s future.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any projects.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: nexusplexus/123RF // Image Effects by Colorcinch