Ethereum, the second-largest cryptocurrency by market capitalization, has witnessed a significant shift in its supply dynamics recently, with approximately 110,000 ETH (equivalent to $181 million) moving off of exchanges on a single day. This remarkable outflow marks the most substantial movement away from exchanges since August 21st, reflecting a growing trend among Ethereum holders.

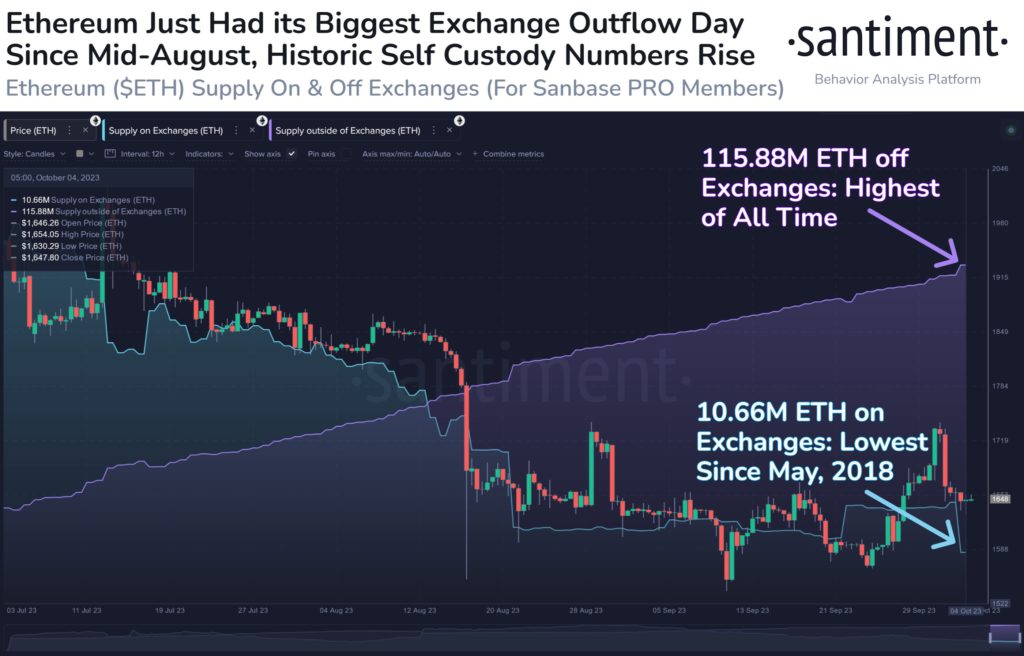

Ethereum Off Exchanges Hits 115.88M ETH

Currently, the amount of Ethereum held outside of cryptocurrency exchanges has reached an all-time high, totaling approximately 115.88 million ETH. In contrast, the supply of Ethereum available on exchanges has dwindled to its lowest level in approximately 5.5 years. These supply dynamics carry important implications for the Ethereum market.

- Strong HODLer Sentiment: The increasing number of Ethereum being withdrawn from exchanges suggests that a significant portion of holders has a long-term perspective. This “HODLer” sentiment indicates confidence in Ethereum’s future potential, as individuals opt to store their assets securely in private wallets rather than keeping them readily available for trading.

- Reduced Selling Pressure: A decrease in Ethereum’s exchange supply typically translates to reduced selling pressure in the short term. With fewer tokens available for trading, price fluctuations may become more pronounced, as market participants become cautious about parting with their holdings.

- Fundamental Demand: This trend aligns with Ethereum’s expanding role in decentralized finance (DeFi), non-fungible tokens (NFTs), and various blockchain-based applications. Increasingly, Ethereum is being utilized as a foundational asset within these ecosystems, leading to greater demand and reduced availability on exchanges.

While lower exchange supply can be seen as a positive indicator for Ethereum’s long-term prospects, it’s important to acknowledge the potential for market volatility.

Final Thoughts

In conclusion, Ethereum’s shrinking exchange supply and record high levels of non-exchange holdings underscore the strong belief in the cryptocurrency’s potential. As Ethereum continues to play a central role in the evolving landscape of blockchain technology and decentralized applications, its supply dynamics will remain a key indicator to watch, impacting both market sentiment and short-term price trends.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any service.

Follow us on Twitter @thevrsoldier to stay updated with the latest Crypto, NFT, and Metaverse news!

Image Source: rastudio/123RF// Image Effects by Colorcinch