The price of Fantom (FTM) has not yet confirmed the bullish pattern that was first noted on the charts in late February. However, given the support of whales, this could happen in the coming days.

Fantom Whales Accumulation Continues

FTM price bounces off key range support, after which the token may attempt to break through resistance at $1.0. However, this desire is supported by whales, who have been vigorously accumulating assets recently. Addresses holding between 100,000 and 10 million FTM have increased their holdings by 19+ million coins over the past seven days, worth almost $19 million.

Whales can significantly influence the price due to their dominance over the circulating supply of the coin. If they continue to accumulate, this will likely cause the FTM price to rise. Moreover, there are also bullish signals on the daily Fantom chart. However, these are supplied by the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change in price movement.

RSI readings range from 0 to 100, indicating overbought conditions above 70 and oversold conditions below 30. The index is currently above the neutral level of 50.0, in the bullish zone. This suggests that the token retains growth potential.

FTM forecast: The Most Important Thing is to Cross the $1 Mark

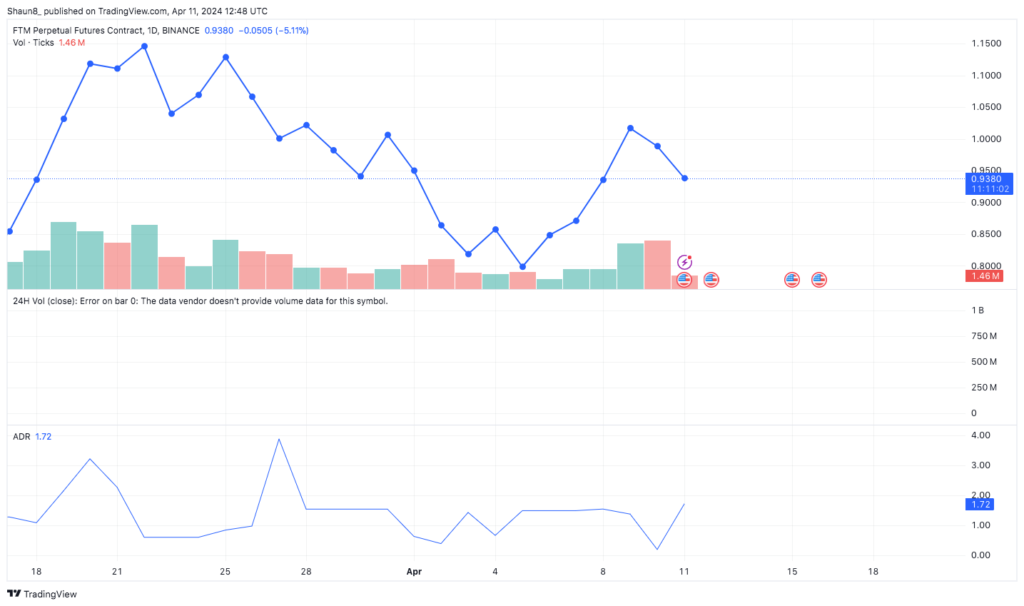

FTM is trading at $0.938 at the time of writing, approaching $1.00. On the other hand, breaking this level and turning it into support will allow the token to reach the target barrier of $1.61, which would represent a 55% increase in price.

This target was set using the Parabolic Curve pattern, which was noted back in mid-February. Although the altcoin successfully corrected and tested the support zone of the base 3rd price level, it failed to launch growth. Meanwhile, if the price fails to break through the $1 mark and pulls back, it will likely test the support zone again. If Fantom makes a breakout of this zone, it will invalidate the bullish forecasts and the price will likely retest $0.80 as support.