New data from Grayscale Investments unveils a compelling correlation between the exponential growth of crypto market capitalization and the ascending trajectory of Canadian stock markets. However, as crypto assets soar to unprecedented heights, paralleling the expansion of traditional equity markets in Canada, intriguing insights emerge into the interconnectedness of global financial landscapes.

Crypto Market Cap Soars: Data Shows Link to Canadian Equities

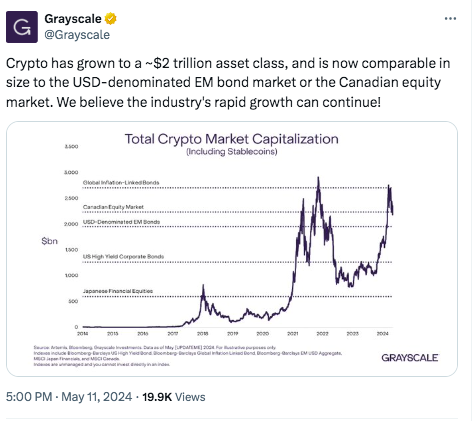

In a captivating plot twist, Grayscale Investments, one of the world’s largest crypto asset management companies, has recently posted on X, drawing parallels between the burgeoning expansion of crypto and the Canadian equity market. In addition, In its statement shared yesterday, May 11, the crypto asset management firm also put crypto and USD-denominated EM (Emerging markets) bonds in the same league, triggering ripples across the broader crypto industry. Grayscale and Bloomberg appear to have exchanged an index comparing crypto market capitalization to that of various other bonds and markets over the past years. Let’s plunge deeper into this index.

Crypto Market Capitalization Spikes To Unprecedented Levels

According to the chart shared by Grayscale Investments, the crypto market capitalization, including stablecoins, has surged to unprecedented levels over the past few years. In addition, Initially surpassing the Japanese financial equities as of 2018, evaluating over $500 billion, the market cap has continued to rise gradually. Zooming into 2021, the crypto market capitalization exceeded U.S. high-yield corporate bonds, assessing over $1,500 billion.

Subsequently, in 2022 and 2024, the total crypto market capitalization outstripped USD-denominated EM bonds, Canadian equity markets, and even global inflation-linked bonds, surpassing the $2,500 billion mark. This data, collectively, has instilled immense optimism in the crypto community, underscoring the worldwide rising adoption of digital assets. Moreover, It’s worth noting that the surge in the digital asset market capitalization coincides with this year’s much-touted ‘bull cycle.’ Bitcoin, Ethereum, and numerous altcoins surged in sync as this year commenced, primarily aligning with the BTC halving frenzy.

Grayscale Index

Meanwhile, providing disclosure, Grayscale stated that the Bloomberg Global Inflation Linked Index gauges the investment-grade, government inflation-linked debt from 12 other developed market countries. On the contrary, the MSCI Canada Index is designed to measure the performance of the Canadian market’s large and mid-cap segments. However, with 87 constituents, the index wraps approximately 85% of Canada’s free float-adjusted market capitalization.