Gyroscope, a project advised by Galaxy Ventures, is making a splash with a new strategy for yield farming with its Amplify liquidity pools and SPIN (Staking, Providing, Incentivizing, and Networking) program in the DeFi landscape. However, the project team expect these pools to bring returns as high as 15%, which is substantially higher than what you would normally get from regular financial products.

Yield Farming Pools: Supercharging Returns

The Amplify liquidity pools, based on the idea of rehypothecation (the process of lending out the collateral that backs a loan), intend to increase income for participants. In addition, Lewis Gudgeon, one of the two co-founders of FTL Labs, the company which is behind the creation of Gyroscope, gives his view on the advantages accrued to those depositors who contribute assets to the pool. Moreover, the depositors will at least have three yield sources at their disposal. The press release is implying that the pool’s actual performance could be around 15% very often.

This product can be considered as the latest innovation of the DeFi (Decentralized Finance) world. Yield Farmers, the ones who are looking for higher returns on their crypto holdings, are now turning to DeFi as these give superior returns compared to traditional banks which are offering APY below 4%. It is even true for stablecoins, which are the most stable cryptos, DeFi, as it offers the opportunity for huge gains.

Stablecoin with Built-in Yield

Gyroscope’s GYD is a stablecoin which will act as a hedge against volatility, pegged to the dollar through a basket of other stablecoins. The protocol’s documentation will show how a “sizeable fraction of its reserve backing” will be used to trade in these stablecoins in trading pools where they can earn extra fees. However, the amplify pools are designed to guarantee liquidity for stablecoin traders. Meanwhile, these pools act as a set of machines that automatically serve as market makers, making buying and selling smooth and taking a cut from each transaction. Depositors who make assets available to this pool will receive a portion of the fees. Gudgeon says pools will be for the stablecoins like USDC and USDT.

An interesting aspect of Amplify pools is the automatic expansion and conversion of deposited assets into specific tokens depending on the chosen pool. However, this expansion process, according to Gudgeon, generates additional yield for depositors.

Gamifying DeFi with SPIN

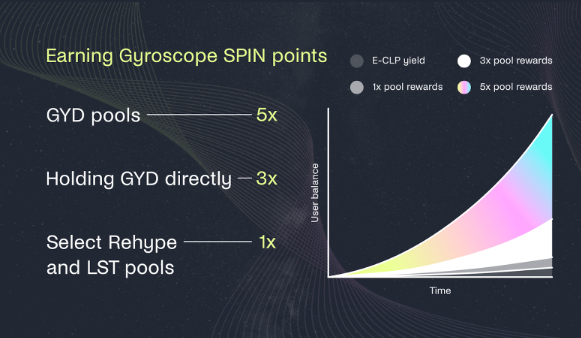

The final layer of the yield-generating strategy comes from Gyroscope’s new SPIN program, a loyalty points system. Users who participate in the Amplify pools will earn points based on their activity. Similar to other points programs, this could be a precursor to a future distribution of governance tokens.

Points programs have become a popular tool in the crypto space. Protocols leverage them to gamify the user experience in anticipation of a token airdrop, while maintaining some secrecy about the token’s release date. Regardless, these programs have proven successful, with many protocols significantly boosting their user base by incentivizing specific actions that earn points, such as borrowing, lending, and trading.

Early Days for Gyroscope

Since launching on the Ethereum mainnet in early December, Gyroscope’s stablecoin, GYD, has seen its total supply decrease from highs above $3 million to its current levels near $1.7 million. Data from Dune Dashboard suggests that only a little over 30 people currently hold more than $100 worth of GYD. With the introduction of Amplify pools and the SPIN program, Gyroscope is making a strong push to attract yield farmers seeking to maximize their returns on stablecoins. Whether this strategy will propel Gyroscope’s growth remains to be seen, but it certainly positions the project as a player to watch in the ever-evolving DeFi landscape.