Hyperliquid Strategies has completed its merger with Sonnet BioTherapeutics, creating what is now the largest HYPE-focused corporate treasury.

The merger, first proposed in July, positions the unified entity to operate under the name Hyperliquid Strategies.

According to CEO David Schamis, the move allows traditional public-market investors to gain direct exposure to the Hyperliquid chain and its decentralized exchange.

He stated that the new structure gives U.S. investors a liquid and accessible way to participate in the Hyperliquid ecosystem.

Until now, most major digital asset treasuries have been concentrated in Bitcoin, Ethereum, and Solana. Beyond these, only Binance and HYPE have drawn notable participation from corporate treasuries.

How digital asset treasuries are influencing HYPE

Hyperliquid Strategies and Hyperion DeFi lead the accumulation of HYPE among treasury entities.

Hyperliquid Strategies holds 16.89 million HYPE, valued at about 583 million dollars at current prices.

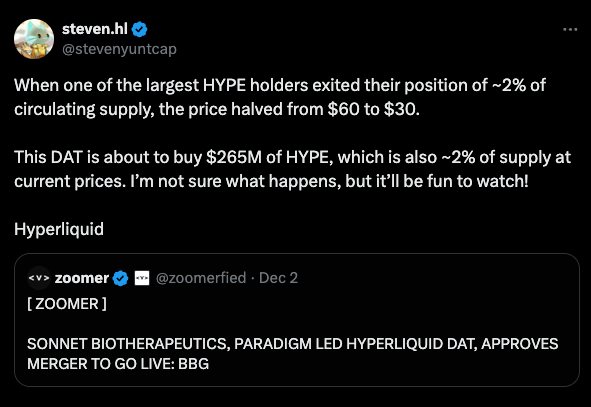

On-chain analyst Steven noted that the merger followed an earlier 265 million dollar bid for HYPE.

Hyperion DeFi holds 1.7 million HYPE, while Lion Group Holdings recently added 194,700 HYPE.

Together, treasury holdings now represent more than six percent of the circulating supply.

HYPE price overview

Following the merger update, HYPE gained nine percent and briefly extended towards a seventeen percent rebound before meeting resistance at 35 dollars.

The price has since eased to around 34.4 dollars.

A decisive break above 35 dollars may open the path toward 40 dollars, while renewed selling could push the token toward 30 dollars or the broader support region near 25 to 27 dollars.

Funding rates for HYPE have remained positive for six consecutive days, reflecting sustained bullish sentiment in the futures market.

Price charts also show a forming “W” bottom pattern, which historically aligns with early recovery phases.

Overall, treasury demand may help stabilize downside risk for HYPE and support its recovery.

However, a stronger move above resistance could depend on whether Bitcoin reclaims the 96,000 dollar level and continues higher.