In May 2024, Ethereum faced a host of challenges ranging from inflation to regulatory pressure that could threaten the launch of spot cryptocurrency exchange-traded funds (ETFs) in the US. On the other hand, WienerAI emerges as a revolutionary force in the realm of artificial intelligence, blending the charm of a sausage dog with the power of cutting-edge technology. As the universe’s most potent cybernetic being, WienerAI is poised to dominate the charts and redefine the landscape of AI-driven trading.

What’s happening with Ethereum?

The second largest cryptocurrency by capitalization, Ethereum, continues to fall. On March 12, 2024, ETH set a high price $4090, after which it entered a correction. At the time of writing, Ether is trading at $2,913..

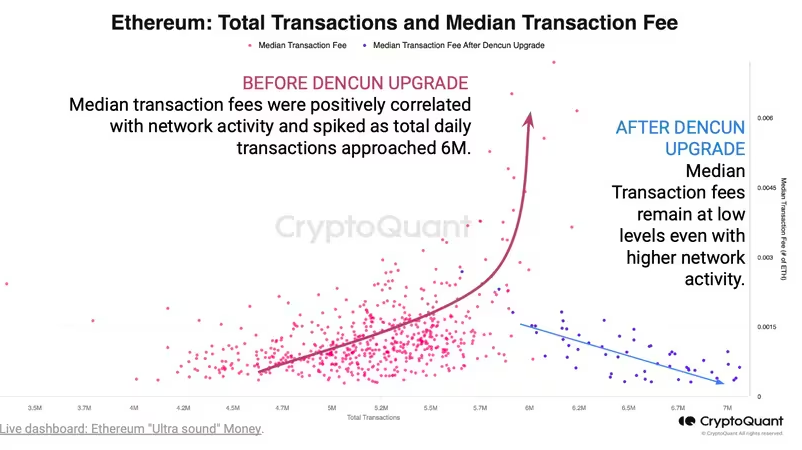

Against the backdrop of the Dencun update implemented in March 2024, the main goal of which was to reduce commissions in the cryptocurrency network, Ethereum again became an inflationary asset. The upgrade helped reduce the cost of operations on the ETH network by an average of four times. A side effect of the update was a drop in Ethereum burning rates. Therefore, ETH again got on the “rails of inflation” due to an increase in the supply of coins on the market.

Such changes, according to analysts at CryptoQuant, may offset the positive effect of The Merge upgrade, as a result of which Ethereum switched to the PoS algorithm. Meanwhile, Inflation may reduce the value of Ethereum. The changes, in turn, will hit the investment attractiveness of ETH. Despite rising inflation, the number of users of the Ethereum ecosystem continues to grow.

Chances of Spot Ethereum ETFs Launching in May

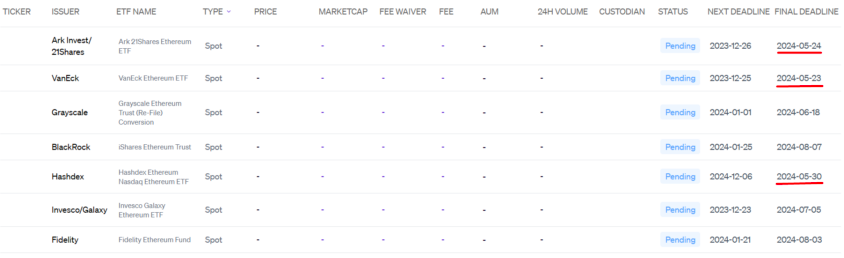

Late spring is a busy time for Ethereum investors. The fact is that in May there is a deadline for three applications for the launch of spot Ethereum-ETFs in the USA. The emergence of the tool, according to members of the crypto community, can support the growth of the cryptocurrency rate. Let us recall that against the backdrop of the approval of spot Bitcoin ETFs in the United States at the beginning of 2024, BTC for the first time in history updated its absolute maximum value before halving.

Many members of the crypto community believe that the SEC will not approve spot Ethereum ETFs in May. The fact is that in 2024, Ethereum came under the radar of the US Securities and Exchange Commission (SEC). The regulator sees in the coin signs of an illegally issued security.

What investors expect from Ethereum

Analyst and trader Peter Brandt, popular in the crypto community, believes that a downward channel has formed on the ETH chart, in the body of which the cryptocurrency may continue to decline. In his opinion, the prolonged movement of the coin in the body of the channel cancels the assumption that a bullish flag is forming on the chart – a technical analysis figure that may be a harbinger of the asset’s imminent transition to growth.

However, there are also supporters of positive scenarios. For example, a Nebraskangooner trader sees a “bowl and handle” technical analysis pattern on the ETH chart. His Ethereum forecast does not exclude a decline to lows during 2024, but implies a transition to active growth in 2025.

More Than Just a Memecoin: The Power of $WAI

WienerAI ($WAI) stands as the first sausage/dog/artificial intelligence ever created, representing a convergence of creativity, innovation, and canine-inspired charm. With aspirations to claim the title of “top dog” on the charts, WienerAI embarks on a journey to revolutionize the world of trading.

Currently in the private presale stage, WienerAI offers buyers a unique opportunity to secure $WAI tokens at a substantially lower price than the listing price. This exclusive window allows investors to capitalize on the potential of WienerAI before its public launch, when the listing price is expected to soar. Moreover, the WienerAI is more than just a meme coin—it’s a gateway to enhanced trading experiences and the backbone of the first AI-powered trading bot of its kind. By harnessing the power of artificial intelligence, WienerAI empowers traders with advanced insights, real-time analysis, and unparalleled efficiency.

The Sausage Army: A Community of Loyal Supporters

WienerAI is building a legion of fans, affectionately known as the Sausage Army, who rally behind this charismatic canine AI. With WienerAI at the helm, traders gain access to a new dimension of trading possibilities, where innovation meets reliability and success knows no bounds. For those who have joined the WienerAI journey, tracking token balances is simple. Whether through the Staking Menu or the Buy Widget on the WienerAI Homepage, investors can easily monitor their $WAI holdings and stay informed about their investment.

In essence, WienerAI represents a paradigm shift in the world of trading—a convergence of AI sophistication, canine charm, and investor potential. With WienerAI leading the charge, traders can expect a future where trading is not only smarter but also more delightful.