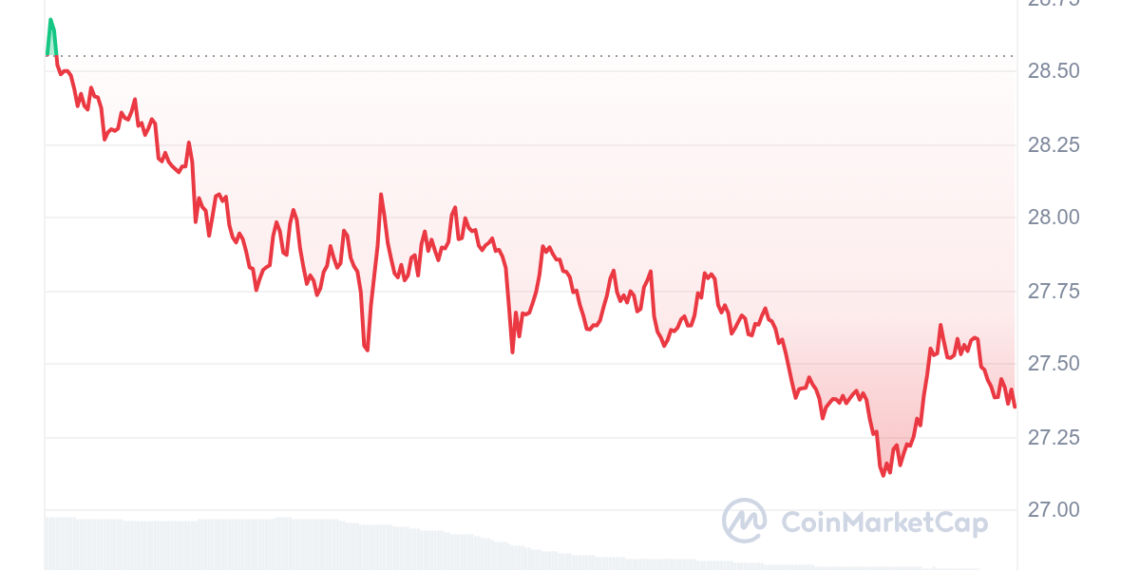

Injective (INJ) price has demonstrated impressive performance, rising 17% in the last 24 hours. However, by using technical indicators and on-chain metrics, we will figure out whether the token will be able to recover after a 65% drawdown from the historical high.

Injective tests key levels

The price of Injective approached the daily Ichimoku cloud. In addition, Key resistance levels in the medium to long term will be $29.5, $34, $38.4 and $43.

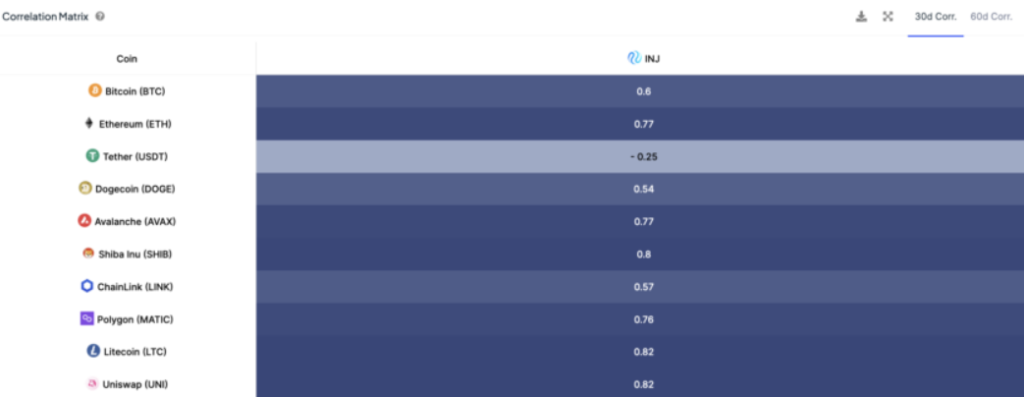

Additionally, the token shows a significant correlation with Bitcoin. Moreover, this suggests that if the main cryptocurrency continues its upward movement and updates its next all-time high, the altcoin will follow.

On-chain metrics confirm growth

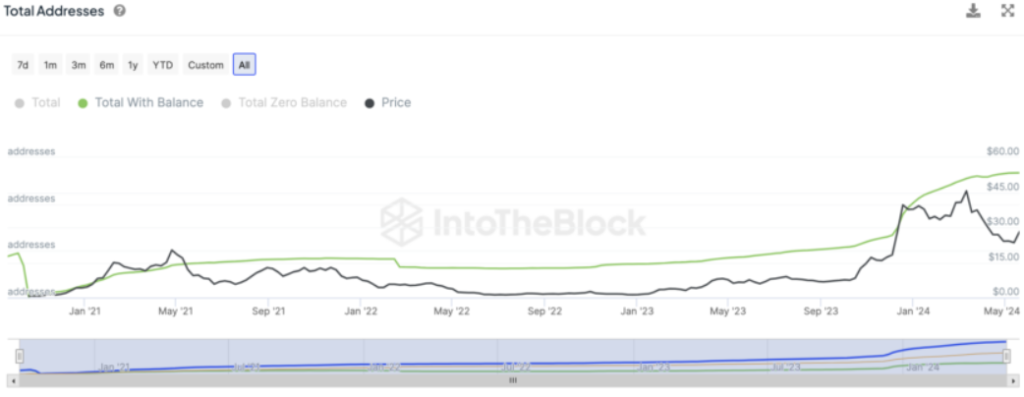

Key on-chain metrics indicate that INJ price growth is sustainable. However, the total number of addresses holding the altcoin is at its peak, indicating high interest.

The number of wallets actively transacting is also growing. However, the number of large transactions is noticeably reduced, which can reduce volatility and lead to price stabilization, making the asset less susceptible to sudden large-scale sales.

Injective price forecast: Continued growth coming?

Target level is $29.5 If the price enters the daily Ichimoku cloud, the initial target will be located at $29.5. In addition, this level serves as significant resistance.

A break and consolidation above $29.5 could trigger a rally with potential targets of $34, $38.4 and $40. However, If the price tests the lower boundary of the Ichimoku cloud and fails to hold it, Injective may go into a protracted correction, which will negate the bullish scenario.

Injective Burn: Auctions Signal Higher Activity

Each Injective burn auction is based on the project’s weekly fees. The fees, denominated in ETH and WBTC, are the object of the auction. INJ owners bet to buy the pool at the highest possible price, but potentially at a discount to the market price. Meanwhile, the pool can only be acquired for INJ tokens.

After the auction, the sum of INJ paid is taken out of the pool by burning to a non-recoverable address. Thus, the Injective event has a double goal – to encourage user activity and reward participants, while also limiting the INJ supply. INJ has a supply of 100M, of which more than 93M are in circulation. Moreover, all the INJ tokens are unlocked, and have completed their vesting periods in the past few years. Currently, Injective is limiting the token supply, with no more big unlocking events left.