JPMorgan is confident that the US Securities and Exchange Commission (SEC) will eventually give the green light to exchange-traded funds (ETFs) on Ethereum. Despite the fact that other analysts estimate the chances of approval at 50%, the company remains optimistic about the final decision of the regulator.

JPMorgan: Chances of ETH-ETF Approval are Increasing

Nikolaos Panigirtzoglou, managing director and global markets strategist at JPMorgan, said a delay beyond May could lead to a lawsuit similar to previous battles involving Grayscale. In his opinion, this time the SEC may suffer a defeat, which will pave the way for the final approval of Ethereum ETFs, albeit at a later date.

JPMorgan remains positive even amid reports that the SEC is scrutinizing the Ethereum Foundation and is trying to classify Ethereum as a security. However, easing centralization concerns, particularly Lido Finance’s decline in market share, increases ETH’s prospects of avoiding this category.

The JPMorgan team emphasizes network decentralization as a critical factor, based on Hinman’s SEC filings.

“Lido’s share of ETH staking has dropped from about a third a year ago to a quarter now. This should reduce concerns about network centralization, thereby increasing the chances that Ethereum will avoid listing as a security in the future,” says Panigirtzoglou.

However, not everyone shares such sentiments. Thus, Bloomberg senior ETF analyst Eric Balchunas recently adjusted the chances of Ethereum ETF approval to 25%. Cryptocurrency lawyer Jake Chervinski also believes that the difficult political situation in Washington will prevent the approval of spot ETFs on ETH in May.

Ethereum indicators predict a correction

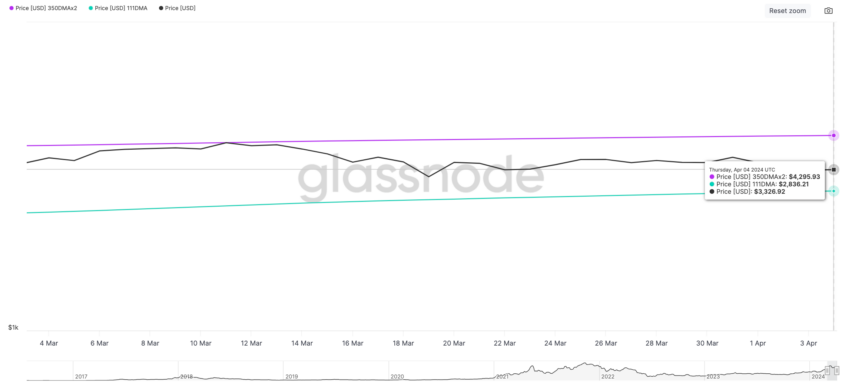

The Pi Cycle Top indicator signals a possible short-term correction. This is indicated by the gap between the 111-day moving average and the 350-day moving average multiplied by 2.

Currently, the upper and lower limits of the indicator are approximately $4295 and $2836, respectively. While this range may indicate market stability, Ethereum’s current position suggests a downturn may be imminent.

ETH active addresses have shown a steady decline since March 30, confirming bearish sentiment. This indicator is very important as it reflects the activity of network participants, and a downward trend indicates a decrease in interest and use of the network. Accordingly, this may negatively impact the price due to a perceived decline in demand or waning investor confidence.